Ct 3a Form

What is the Ct 3a

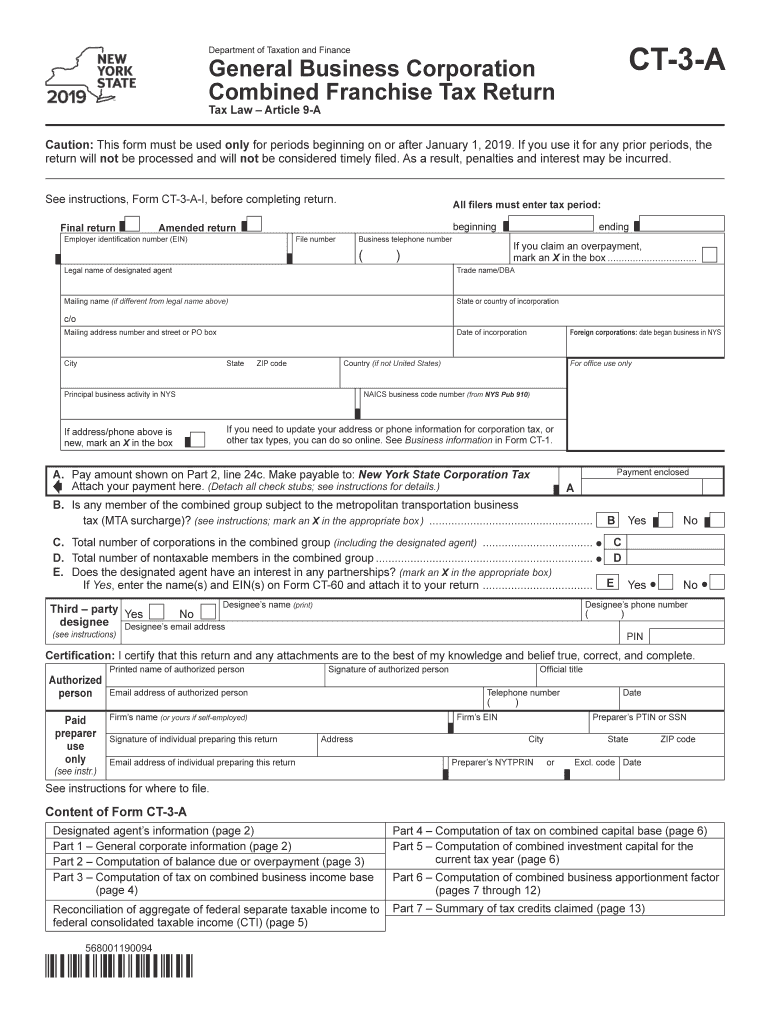

The Ct 3a, also known as the New York Combined Franchise Tax Return, is a form used by corporations and partnerships operating in New York to report their income and calculate their franchise tax liability. This form is essential for businesses that are subject to New York State taxation, ensuring compliance with state tax laws. The Ct 3a consolidates various tax obligations into a single document, simplifying the filing process for entities with multiple business activities.

How to use the Ct 3a

Using the Ct 3a involves several steps, including gathering necessary financial information, completing the form accurately, and submitting it to the New York State Department of Taxation and Finance. Businesses must report their total income, deductions, and credits, which will determine their tax liability. It is crucial to follow the specific instructions provided with the form to ensure all required information is included and correctly formatted.

Steps to complete the Ct 3a

Completing the Ct 3a requires attention to detail. Here are the key steps:

- Gather financial records, including income statements and expense reports.

- Fill out the form by entering your business's total income, allowable deductions, and any credits.

- Ensure all calculations are accurate to avoid discrepancies.

- Review the form for completeness and correctness.

- Sign and date the form to certify its accuracy.

Legal use of the Ct 3a

The Ct 3a is legally binding when completed and submitted according to New York State tax regulations. It is important for businesses to understand that failure to file or inaccuracies in the form can lead to penalties and interest charges. By utilizing a reliable electronic signature solution, businesses can ensure that their submission is secure and compliant with legal standards, such as the ESIGN Act and UETA.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 3a vary depending on the business type and fiscal year. Generally, corporations must file their returns by the 15th day of the fourth month following the end of their fiscal year. It is essential for businesses to stay informed about these deadlines to avoid late filing penalties. Keeping track of important dates ensures that your business remains compliant with state tax obligations.

Required Documents

When completing the Ct 3a, businesses must prepare several documents to support their financial reporting. These may include:

- Income statements showing total revenue.

- Expense documentation to substantiate deductions.

- Previous tax returns for reference.

- Any applicable schedules or additional forms required for specific deductions or credits.

Form Submission Methods (Online / Mail / In-Person)

The Ct 3a can be submitted through various methods, including online filing via the New York State Department of Taxation and Finance website, mailing a paper form, or delivering it in person to a local tax office. Online submission is often the most efficient method, allowing for quicker processing and confirmation of receipt. Businesses should choose the method that best suits their needs while ensuring compliance with submission guidelines.

Quick guide on how to complete form ct 3 a2019general business corporation combined franchise tax returnct3a

Effortlessly Prepare Ct 3a on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Ct 3a on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The Easiest Way to Modify and Electronically Sign Ct 3a Seamlessly

- Find Ct 3a and click on Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and has the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, and errors that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Ct 3a while ensuring excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 3 a2019general business corporation combined franchise tax returnct3a

How to make an eSignature for your Form Ct 3 A2019general Business Corporation Combined Franchise Tax Returnct3a online

How to generate an eSignature for the Form Ct 3 A2019general Business Corporation Combined Franchise Tax Returnct3a in Google Chrome

How to create an electronic signature for putting it on the Form Ct 3 A2019general Business Corporation Combined Franchise Tax Returnct3a in Gmail

How to create an electronic signature for the Form Ct 3 A2019general Business Corporation Combined Franchise Tax Returnct3a from your smartphone

How to make an eSignature for the Form Ct 3 A2019general Business Corporation Combined Franchise Tax Returnct3a on iOS devices

How to make an eSignature for the Form Ct 3 A2019general Business Corporation Combined Franchise Tax Returnct3a on Android

People also ask

-

What is the ct3a feature in airSlate SignNow?

The ct3a feature in airSlate SignNow helps users streamline their document signing process. It provides an intuitive interface for sending, signing, and managing documents efficiently, reducing time for approvals and enhancing productivity.

-

How much does airSlate SignNow cost for using the ct3a feature?

Pricing for airSlate SignNow with ct3a is competitive and tailored for businesses of all sizes. To obtain the most accurate pricing details, visit our website and explore the plans that include this feature, ensuring you choose the best fit for your needs.

-

What are the main benefits of using ct3a in airSlate SignNow?

Using ct3a in airSlate SignNow offers several benefits, including improved efficiency in document handling and enhanced security for sensitive information. These features contribute to faster transactions and a better user experience overall.

-

Is it easy to integrate ct3a with existing software?

Yes, airSlate SignNow is designed to seamlessly integrate ct3a with various applications and systems you may already use. Our platform supports popular tools and provides robust API capabilities for smooth integration into your workflow.

-

Can I customize document templates using ct3a in airSlate SignNow?

Absolutely! With the ct3a feature in airSlate SignNow, users can easily create and customize document templates. This functionality allows for quick personalization while maintaining a professional appearance for all your business documents.

-

What types of documents can be signed with ct3a?

You can use ct3a in airSlate SignNow to sign a wide range of documents, including contracts, agreements, and forms. The platform supports various file formats, ensuring comprehensive solutions for all your signing needs.

-

How does ct3a ensure the security of signed documents?

ct3a in airSlate SignNow prioritizes document security by implementing encryption and rigorous authentication protocols. These measures help safeguard your sensitive information throughout the entire signing process.

Get more for Ct 3a

Find out other Ct 3a

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document