Form 200 01 Division of Revenue Taxhow

What is the Form 200 01 Division Of Revenue Taxhow

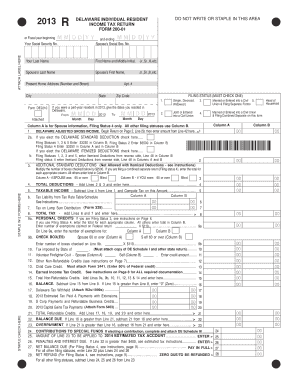

The Form 200 01 Division Of Revenue Taxhow is a specific tax form used in the United States for reporting certain financial information to state revenue departments. This form is essential for individuals and businesses to ensure compliance with state tax regulations. It typically includes details about income, deductions, and tax liabilities, which help the state assess the appropriate tax obligations for the filer.

How to use the Form 200 01 Division Of Revenue Taxhow

Using the Form 200 01 Division Of Revenue Taxhow involves several steps. First, gather all necessary financial documents, including income statements and previous tax returns. Next, download the form from the appropriate state revenue department's website or obtain a physical copy. Carefully fill out the form, ensuring all information is accurate and complete. After completing the form, review it for any errors before submitting it to the state revenue department by the specified deadline.

Steps to complete the Form 200 01 Division Of Revenue Taxhow

Completing the Form 200 01 Division Of Revenue Taxhow requires attention to detail. Follow these steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Report your total income for the tax year, including wages, interest, and other earnings.

- List any deductions you are eligible for, such as business expenses or educational costs.

- Calculate your total tax liability based on the provided instructions.

- Sign and date the form to certify that the information is accurate.

Filing Deadlines / Important Dates

It is crucial to be aware of filing deadlines associated with the Form 200 01 Division Of Revenue Taxhow. Typically, the form must be submitted by April 15th of the following tax year. However, specific states may have different deadlines, so it is advisable to check with your local revenue department for the exact date. Late submissions may incur penalties or interest on unpaid taxes.

Required Documents

When preparing to file the Form 200 01 Division Of Revenue Taxhow, certain documents are necessary to ensure accurate reporting. These may include:

- W-2 forms or 1099 forms for reporting income.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

- Any relevant schedules or additional forms required by your state.

Who Issues the Form

The Form 200 01 Division Of Revenue Taxhow is issued by the state’s revenue department. Each state has its own specific revenue agency responsible for the administration of tax laws and the distribution of tax forms. It is important to ensure you are using the correct version of the form specific to your state to avoid any compliance issues.

Quick guide on how to complete form 200 01 division of revenue taxhow

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly replacement for conventional printed and signed documents, as you can easily access the appropriate form and securely archive it online. airSlate SignNow equips you with all the necessary tools to swiftly create, alter, and electronically sign your documents without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

The Easiest Way to Modify and Electronically Sign [SKS] Effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the resources we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign feature, which takes seconds and carries the same legal authority as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method to submit your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] while ensuring outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 200 01 Division Of Revenue Taxhow

Create this form in 5 minutes!

How to create an eSignature for the form 200 01 division of revenue taxhow

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 200 01 Division Of Revenue Taxhow?

Form 200 01 Division Of Revenue Taxhow is a document required for tax reporting and compliance. It helps businesses accurately report their revenue to the Division of Revenue, ensuring they meet state tax obligations. Using airSlate SignNow, you can easily eSign and send this form securely.

-

How can airSlate SignNow help with Form 200 01 Division Of Revenue Taxhow?

airSlate SignNow streamlines the process of completing and submitting Form 200 01 Division Of Revenue Taxhow. Our platform allows you to fill out the form digitally, eSign it, and send it directly to the relevant authorities, saving you time and reducing errors.

-

What are the pricing options for using airSlate SignNow for Form 200 01 Division Of Revenue Taxhow?

airSlate SignNow offers flexible pricing plans to accommodate different business needs. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while ensuring you can efficiently manage documents like Form 200 01 Division Of Revenue Taxhow.

-

Are there any features specifically for managing Form 200 01 Division Of Revenue Taxhow?

Yes, airSlate SignNow includes features tailored for managing Form 200 01 Division Of Revenue Taxhow. You can utilize templates, automated workflows, and reminders to ensure timely submission and compliance with tax regulations.

-

What benefits does airSlate SignNow provide for eSigning Form 200 01 Division Of Revenue Taxhow?

Using airSlate SignNow for eSigning Form 200 01 Division Of Revenue Taxhow offers numerous benefits, including enhanced security, reduced turnaround time, and improved accuracy. Our platform ensures that your documents are legally binding and securely stored.

-

Can I integrate airSlate SignNow with other software for Form 200 01 Division Of Revenue Taxhow?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage Form 200 01 Division Of Revenue Taxhow alongside your existing tools. This integration enhances your workflow and ensures all your documents are in one place.

-

Is airSlate SignNow user-friendly for completing Form 200 01 Division Of Revenue Taxhow?

Yes, airSlate SignNow is designed with user experience in mind. Our intuitive interface makes it easy for anyone to complete and eSign Form 200 01 Division Of Revenue Taxhow without any technical expertise, ensuring a smooth process.

Get more for Form 200 01 Division Of Revenue Taxhow

Find out other Form 200 01 Division Of Revenue Taxhow

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement