Form ST 100 10 I919Quarterly Schedule FR Instructions Sales and Use Tax on Quailifed Motor Fuel and Diesel Motor Fuelst100

What is the Form ST 100 10 I919Quarterly Schedule FR Instructions Sales And Use Tax On Qualified Motor Fuel And Diesel Motor Fuel

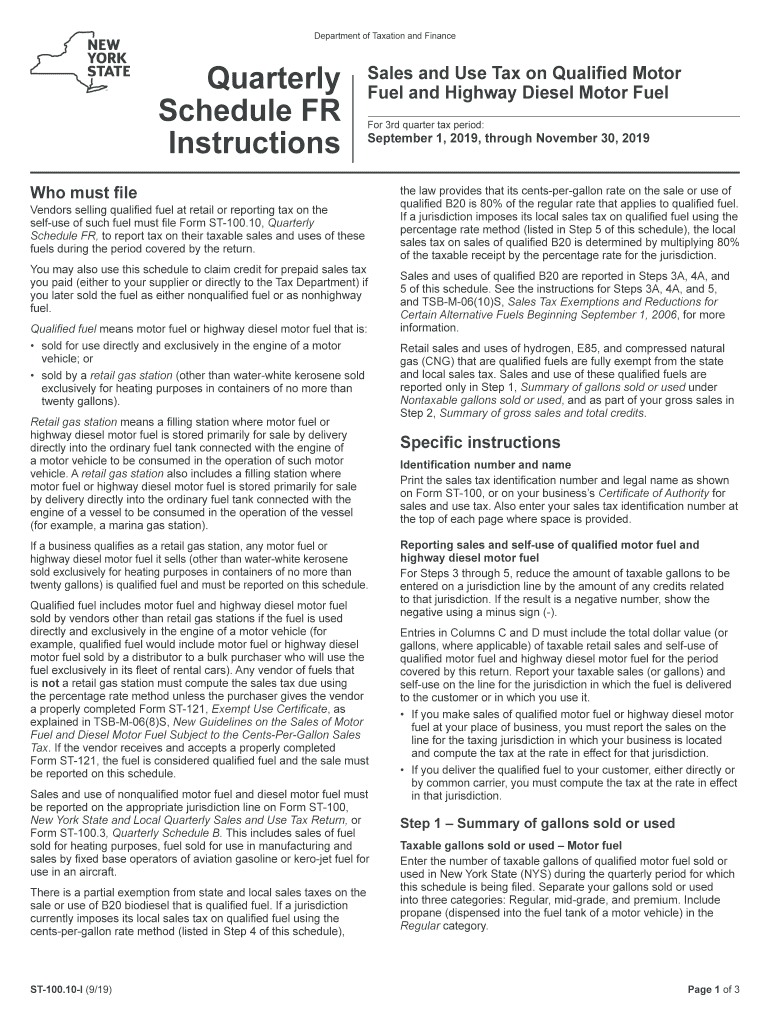

The Form ST 100 10 I919 is a crucial document used for reporting sales and use tax on qualified motor fuel and diesel motor fuel in the United States. This form is specifically designed for businesses that engage in the sale or use of these types of fuel. It helps ensure compliance with state tax regulations and provides a structured way to report taxable sales. The instructions accompanying the form guide users through the necessary steps to accurately complete and submit their tax obligations.

How to Use the Form ST 100 10 I919

Using the Form ST 100 10 I919 involves several steps to ensure accurate reporting. First, gather all necessary financial records related to fuel sales. This includes invoices, receipts, and any relevant documentation that supports the reported figures. Next, follow the instructions provided with the form carefully, filling out each section as required. Ensure that all calculations are accurate to avoid discrepancies. Once completed, the form can be submitted according to the specified methods, which may include online submission or mailing it to the appropriate tax authority.

Steps to Complete the Form ST 100 10 I919

Completing the Form ST 100 10 I919 requires attention to detail. Begin by entering your business information at the top of the form. Then, proceed to report the total gallons of qualified motor fuel and diesel motor fuel sold during the reporting period. Include the corresponding sales tax collected on these sales. Ensure each section is filled out completely, as missing information can lead to processing delays. After reviewing the form for accuracy, sign and date it before submission.

Legal Use of the Form ST 100 10 I919

The legal use of the Form ST 100 10 I919 is essential for compliance with state tax laws. This form must be filed accurately and on time to avoid penalties. It serves as a formal declaration of the sales and use tax obligations related to qualified motor fuel and diesel motor fuel. Proper use of the form helps protect businesses from legal repercussions and ensures that they fulfill their tax responsibilities in accordance with applicable regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form ST 100 10 I919 are critical to avoid late fees and penalties. Typically, this form is due on a quarterly basis, with specific dates set by state tax authorities. It is important for businesses to stay informed about these deadlines and plan accordingly to ensure timely submission. Marking these dates on a calendar can help maintain compliance and avoid any last-minute rush to complete the form.

Form Submission Methods (Online / Mail / In-Person)

The Form ST 100 10 I919 can be submitted through various methods, providing flexibility for businesses. Online submission is often the quickest and most efficient option, allowing for immediate processing. Alternatively, businesses may choose to mail the completed form to the designated tax office. In some cases, in-person submission may also be available, depending on local regulations. It is advisable to verify the preferred submission method with the appropriate tax authority to ensure compliance.

Quick guide on how to complete form st 10010 i919quarterly schedule fr instructions sales and use tax on quailifed motor fuel and diesel motor fuelst10010i

Complete Form ST 100 10 I919Quarterly Schedule FR Instructions Sales And Use Tax On Quailifed Motor Fuel And Diesel Motor Fuelst100 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed papers, as you can obtain the correct form and safely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without interruptions. Manage Form ST 100 10 I919Quarterly Schedule FR Instructions Sales And Use Tax On Quailifed Motor Fuel And Diesel Motor Fuelst100 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to alter and eSign Form ST 100 10 I919Quarterly Schedule FR Instructions Sales And Use Tax On Quailifed Motor Fuel And Diesel Motor Fuelst100 with ease

- Find Form ST 100 10 I919Quarterly Schedule FR Instructions Sales And Use Tax On Quailifed Motor Fuel And Diesel Motor Fuelst100 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, whether via email, text message (SMS), an invitation link, or download it to your computer.

Forget about missing or misplaced documents, frustrating form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Form ST 100 10 I919Quarterly Schedule FR Instructions Sales And Use Tax On Quailifed Motor Fuel And Diesel Motor Fuelst100 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form st 10010 i919quarterly schedule fr instructions sales and use tax on quailifed motor fuel and diesel motor fuelst10010i

How to generate an electronic signature for the Form St 10010 I919quarterly Schedule Fr Instructions Sales And Use Tax On Quailifed Motor Fuel And Diesel Motor Fuelst10010i in the online mode

How to generate an electronic signature for the Form St 10010 I919quarterly Schedule Fr Instructions Sales And Use Tax On Quailifed Motor Fuel And Diesel Motor Fuelst10010i in Google Chrome

How to generate an eSignature for putting it on the Form St 10010 I919quarterly Schedule Fr Instructions Sales And Use Tax On Quailifed Motor Fuel And Diesel Motor Fuelst10010i in Gmail

How to generate an eSignature for the Form St 10010 I919quarterly Schedule Fr Instructions Sales And Use Tax On Quailifed Motor Fuel And Diesel Motor Fuelst10010i from your mobile device

How to create an electronic signature for the Form St 10010 I919quarterly Schedule Fr Instructions Sales And Use Tax On Quailifed Motor Fuel And Diesel Motor Fuelst10010i on iOS devices

How to create an eSignature for the Form St 10010 I919quarterly Schedule Fr Instructions Sales And Use Tax On Quailifed Motor Fuel And Diesel Motor Fuelst10010i on Android

People also ask

-

What is the 'Form ST 100 10 I919Quarterly Schedule FR Instructions Sales And Use Tax On Qualified Motor Fuel And Diesel Motor Fuelst100'?

The 'Form ST 100 10 I919Quarterly Schedule FR Instructions Sales And Use Tax On Qualified Motor Fuel And Diesel Motor Fuelst100' is a state-mandated document used to report sales and use tax on qualified motor fuels. It provides detailed instructions for businesses to accurately calculate and remit taxes on these fuels. Understanding this form is crucial for compliance and to avoid potential penalties.

-

How can airSlate SignNow assist with completing the 'Form ST 100 10 I919Quarterly Schedule FR Instructions Sales And Use Tax On Qualified Motor Fuel And Diesel Motor Fuelst100'?

airSlate SignNow simplifies the process of completing the 'Form ST 100 10 I919Quarterly Schedule FR Instructions Sales And Use Tax On Qualified Motor Fuel And Diesel Motor Fuelst100' by providing eSigning capabilities and document management. You can easily fill out, sign, and send the form online, ensuring accuracy and speed. This eliminates the need for manual paperwork and enhances compliance.

-

What are the pricing options for airSlate SignNow related to the 'Form ST 100 10 I919Quarterly Schedule FR Instructions Sales And Use Tax On Qualified Motor Fuel And Diesel Motor Fuelst100'?

airSlate SignNow offers flexible pricing plans that cater to different business sizes and needs. Each plan includes features that support the completion of essential forms like the 'Form ST 100 10 I919Quarterly Schedule FR Instructions Sales And Use Tax On Qualified Motor Fuel And Diesel Motor Fuelst100.' You can choose a plan that fits your budget while gaining access to robust eSignature solutions.

-

What features of airSlate SignNow make it ideal for handling tax-related documents like the 'Form ST 100 10 I919Quarterly Schedule FR Instructions Sales And Use Tax On Qualified Motor Fuel And Diesel Motor Fuelst100'?

airSlate SignNow includes features such as templating, document tracking, and secure eSignature capabilities that are paramount for handling tax-related documents like the 'Form ST 100 10 I919Quarterly Schedule FR Instructions Sales And Use Tax On Qualified Motor Fuel And Diesel Motor Fuelst100.' These features ensure that your documents are signed quickly while remaining compliant with tax regulations.

-

Can I integrate airSlate SignNow with other software to assist with the 'Form ST 100 10 I919Quarterly Schedule FR Instructions Sales And Use Tax On Qualified Motor Fuel And Diesel Motor Fuelst100'?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your workflow when dealing with documents like the 'Form ST 100 10 I919Quarterly Schedule FR Instructions Sales And Use Tax On Qualified Motor Fuel And Diesel Motor Fuelst100.' By integrating with your existing systems, you can streamline the documentation and tax submission processes.

-

What benefits does using airSlate SignNow provide when submitting the 'Form ST 100 10 I919Quarterly Schedule FR Instructions Sales And Use Tax On Qualified Motor Fuel And Diesel Motor Fuelst100'?

Using airSlate SignNow for submitting the 'Form ST 100 10 I919Quarterly Schedule FR Instructions Sales And Use Tax On Qualified Motor Fuel And Diesel Motor Fuelst100' offers benefits such as enhanced speed, security, and compliance. The eSigning process is user-friendly, reducing turnaround time for document approvals. Additionally, cloud storage provides easy access for audits and tax reviews.

-

Is airSlate SignNow compliant with regulations for handling tax documents like the 'Form ST 100 10 I919Quarterly Schedule FR Instructions Sales And Use Tax On Qualified Motor Fuel And Diesel Motor Fuelst100'?

Absolutely, airSlate SignNow is designed to meet all regulatory requirements for eSigning, making it compliant for handling tax documents such as the 'Form ST 100 10 I919Quarterly Schedule FR Instructions Sales And Use Tax On Qualified Motor Fuel And Diesel Motor Fuelst100.' This compliance ensures that your signed documents are legally valid and recognized by tax authorities.

Get more for Form ST 100 10 I919Quarterly Schedule FR Instructions Sales And Use Tax On Quailifed Motor Fuel And Diesel Motor Fuelst100

Find out other Form ST 100 10 I919Quarterly Schedule FR Instructions Sales And Use Tax On Quailifed Motor Fuel And Diesel Motor Fuelst100

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure