Tr 579 Ct Fillable Form

What is the TR-579 CT Fillable?

The TR-579 CT Fillable form is a critical document used for requesting withholding exemptions for entertainers and athletes in Connecticut. This form is essential for individuals who perform in the state and need to manage their tax obligations effectively. By completing the TR-579, entertainers can ensure that the correct amount of state tax is withheld from their earnings, aligning with Connecticut's tax regulations.

Steps to Complete the TR-579 CT Fillable

Completing the TR-579 CT Fillable involves several key steps to ensure accuracy and compliance with state requirements. First, gather all necessary personal information, including your Social Security number and details about your performances. Next, accurately fill in the sections regarding your withholding exemption status. It is crucial to double-check all entries for correctness. Finally, sign and date the form before submission.

Legal Use of the TR-579 CT Fillable

The TR-579 CT Fillable form is legally recognized in Connecticut for managing withholding tax for entertainers and athletes. To ensure its validity, the form must be completed accurately and submitted in accordance with state guidelines. This legal framework protects both the taxpayer and the state, ensuring that tax obligations are met without unnecessary complications.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the TR-579 CT Fillable is essential for compliance. Typically, forms should be submitted before the start of a performance or event to ensure the correct withholding amounts are applied. It is advisable to check the Connecticut Department of Revenue Services for any updates on deadlines and specific dates relevant to your situation.

Required Documents

When completing the TR-579 CT Fillable, certain documents may be required to support your request. These documents can include proof of residency, identification, and any prior tax filings relevant to your performances. Having these documents ready can streamline the process and help avoid delays in processing your withholding request.

Who Issues the Form

The TR-579 CT Fillable form is issued by the Connecticut Department of Revenue Services. This agency is responsible for overseeing tax regulations and ensuring compliance among entertainers and athletes performing within the state. For any questions regarding the form or its requirements, reaching out to the department can provide clarity and assistance.

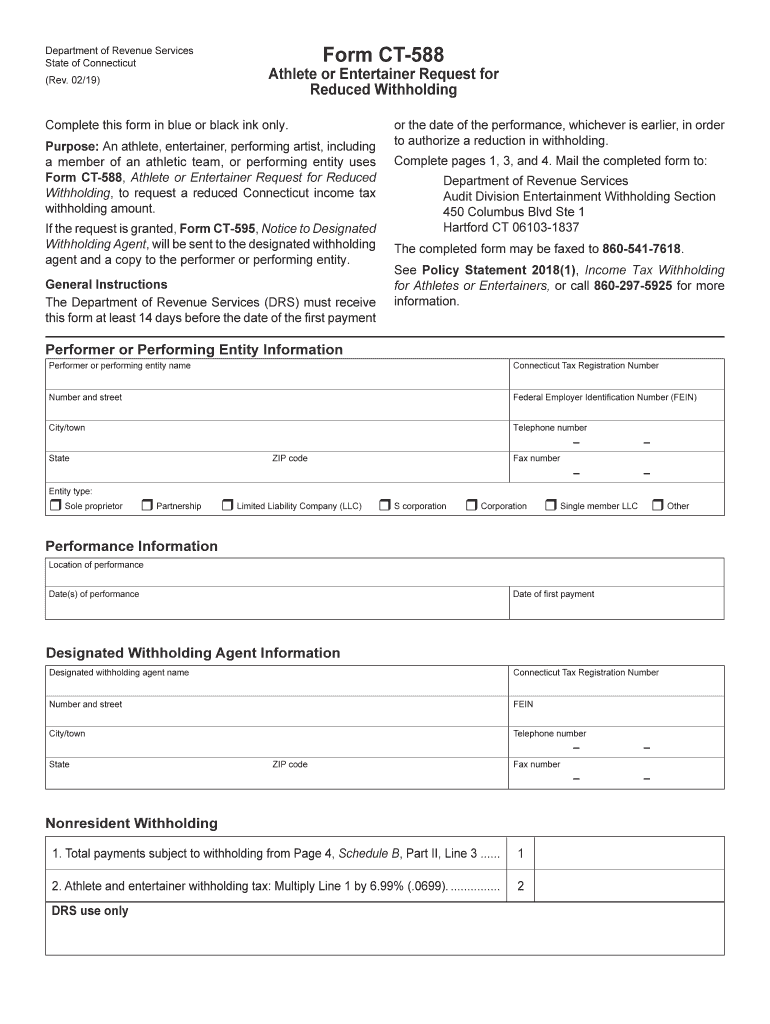

Quick guide on how to complete form ct588

Complete Tr 579 Ct Fillable effortlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely preserve it online. airSlate SignNow provides you with all the tools necessary to generate, modify, and electronically sign your documents quickly without unnecessary delays. Handle Tr 579 Ct Fillable on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest method to modify and electronically sign Tr 579 Ct Fillable without difficulty

- Obtain Tr 579 Ct Fillable and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to secure your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow takes care of all your needs in document management in just a few clicks from any device you prefer. Adjust and eSign Tr 579 Ct Fillable and guarantee excellent communication throughout any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct588

How to generate an electronic signature for the Form Ct588 online

How to generate an eSignature for your Form Ct588 in Chrome

How to make an eSignature for putting it on the Form Ct588 in Gmail

How to create an eSignature for the Form Ct588 right from your smart phone

How to make an eSignature for the Form Ct588 on iOS

How to create an electronic signature for the Form Ct588 on Android OS

People also ask

-

What is a Tr 579 Ct Fillable form?

The Tr 579 Ct Fillable form is a customizable document that allows users to input information electronically, making it easier to complete and submit official forms. With airSlate SignNow, you can easily create and manage Tr 579 Ct Fillable forms, streamlining your workflow and ensuring accuracy.

-

How can I create a Tr 579 Ct Fillable form using airSlate SignNow?

Creating a Tr 579 Ct Fillable form with airSlate SignNow is simple and user-friendly. You can start by selecting a template or designing your form from scratch using our intuitive drag-and-drop editor, allowing you to add fields, text, and other elements to suit your needs.

-

What are the benefits of using the Tr 579 Ct Fillable form?

Using the Tr 579 Ct Fillable form offers numerous benefits, including improved data accuracy, reduced processing time, and enhanced collaboration among team members. By utilizing airSlate SignNow, businesses can take advantage of electronic signatures and secure document storage, making the process more efficient.

-

Is there a cost associated with using Tr 579 Ct Fillable forms in airSlate SignNow?

Yes, airSlate SignNow provides various pricing plans to accommodate different business needs, including options for using Tr 579 Ct Fillable forms. You can choose a plan that fits your budget while gaining access to essential features for document management and eSignatures.

-

Can I integrate Tr 579 Ct Fillable with other applications?

Absolutely! airSlate SignNow allows seamless integration with a variety of applications, enabling you to use Tr 579 Ct Fillable forms alongside your existing tools. This integration enhances your workflow by automating processes and reducing manual data entry.

-

How secure are Tr 579 Ct Fillable forms created with airSlate SignNow?

Security is a top priority for airSlate SignNow, especially when handling Tr 579 Ct Fillable forms. Our platform employs advanced encryption and compliance measures to ensure your documents are protected, giving you peace of mind when managing sensitive information.

-

Can multiple users collaborate on a Tr 579 Ct Fillable form?

Yes, airSlate SignNow supports collaboration on Tr 579 Ct Fillable forms, allowing multiple users to access, edit, and sign the document. This feature ensures that all stakeholders can contribute in real-time, enhancing productivity and reducing turnaround times.

Get more for Tr 579 Ct Fillable

- Form it 248 claim for empire state film production credit tax year

- Form it 223 innovation hot spot deduction tax year

- Oxygen therapy request for prior authorization and form

- Roofing contract template 787755104 form

- Room and board contract template form

- Room contract template form

- Room for rent contract template form

- Room block contract template form

Find out other Tr 579 Ct Fillable

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile