Form it 248 Claim for Empire State Film Production Credit Tax Year 2023-2026

What is the Form IT 248 Claim For Empire State Film Production Credit Tax Year

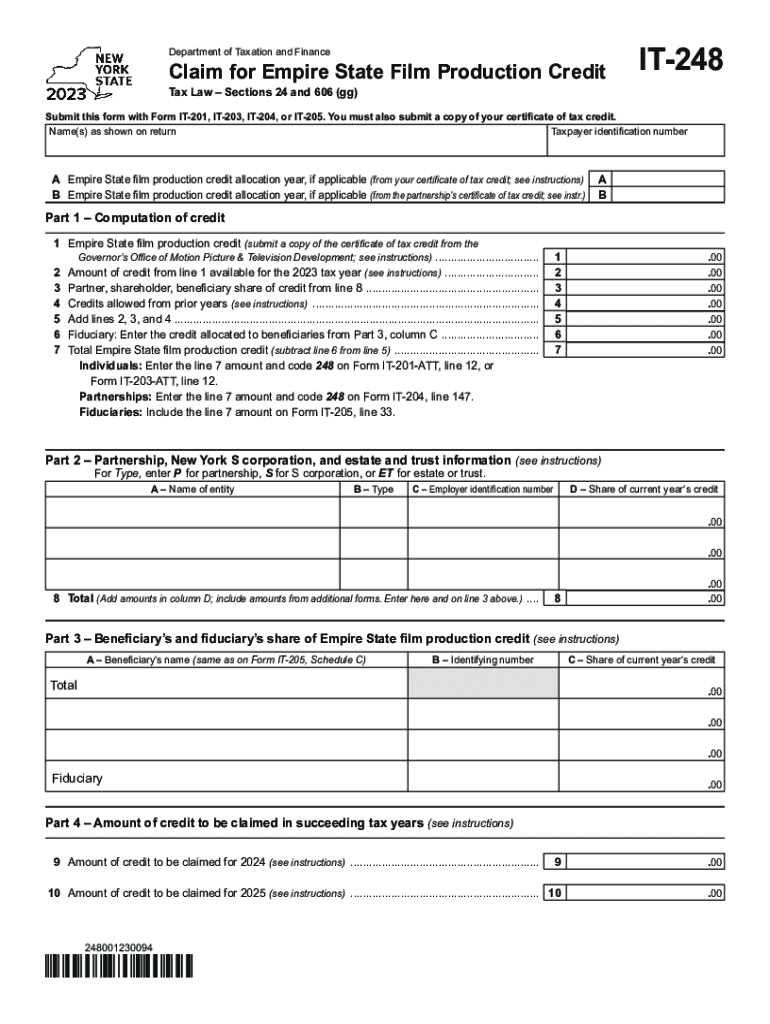

The Form IT 248 is a tax form used by film and television production companies to claim the Empire State Film Production Credit in New York. This credit is designed to incentivize film and television production within the state, offering significant tax benefits to eligible productions. The form requires detailed information about the production, including costs incurred, production locations, and the nature of the project. By completing this form, production companies can reduce their tax liability, making it a valuable resource for those in the film industry.

Steps to complete the Form IT 248 Claim For Empire State Film Production Credit Tax Year

Completing the Form IT 248 involves several key steps:

- Gather Required Information: Collect all necessary documentation, including production budgets, invoices, and proof of expenses.

- Fill Out the Form: Provide accurate details about the production, including the title, production company information, and the total amount of qualified expenses.

- Calculate the Credit: Determine the amount of credit being claimed based on the eligible expenses outlined in the form instructions.

- Attach Supporting Documents: Include all relevant documentation that supports the claim, such as receipts and contracts.

- Review and Submit: Carefully review the completed form for accuracy before submitting it to the appropriate tax authority.

Eligibility Criteria

To qualify for the Empire State Film Production Credit, productions must meet specific eligibility criteria. These include:

- The production must be filmed in New York State.

- Eligible expenses must exceed a minimum threshold, typically set at a specific dollar amount.

- The project must be a feature film, television series, or other qualifying production types as defined by the state.

- Production companies must provide proof of their New York State residency or business operations.

Required Documents

When submitting Form IT 248, several documents are required to substantiate the claim. These may include:

- Production budget and financial statements.

- Invoices for all qualified production expenses.

- Proof of employment for cast and crew, including contracts and payroll records.

- Documentation of filming locations within New York State.

Filing Deadlines / Important Dates

Timely submission of Form IT 248 is crucial to ensure eligibility for the tax credit. Key dates to remember include:

- The form must be filed within a specified period following the end of the tax year in which the production expenses were incurred.

- Extensions may be available, but they must be requested ahead of the original deadline.

Form Submission Methods

Form IT 248 can be submitted through various methods, including:

- Online Submission: Some tax authorities may allow electronic filing through their designated platforms.

- Mail: The completed form and supporting documents can be mailed to the appropriate tax office.

- In-Person: In certain cases, submissions may be made in person at designated tax offices.

Quick guide on how to complete form it 248 claim for empire state film production credit tax year

Complete Form IT 248 Claim For Empire State Film Production Credit Tax Year seamlessly on any device

Digital document management has become increasingly favored by businesses and users alike. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Form IT 248 Claim For Empire State Film Production Credit Tax Year on any device with airSlate SignNow Android or iOS applications and simplify any document-based task today.

How to modify and eSign Form IT 248 Claim For Empire State Film Production Credit Tax Year effortlessly

- Find Form IT 248 Claim For Empire State Film Production Credit Tax Year and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or an invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from your device of choice. Edit and eSign Form IT 248 Claim For Empire State Film Production Credit Tax Year and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 248 claim for empire state film production credit tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 248 claim for empire state film production credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form IT 248 Claim For Empire State Film Production Credit Tax Year?

The Form IT 248 Claim For Empire State Film Production Credit Tax Year is a tax form designed for film productions in New York State to claim production credits. This form allows filmmakers to leverage tax incentives and recover a portion of their production costs, making it easier to produce films in the state.

-

How can airSlate SignNow help with the Form IT 248 Claim For Empire State Film Production Credit Tax Year?

AirSlate SignNow provides a streamlined solution for completing and eSigning the Form IT 248 Claim For Empire State Film Production Credit Tax Year. Our platform makes it simple to gather necessary signatures and document approvals, ensuring compliance and efficiency in your film production tax credit application.

-

What are the pricing options for using airSlate SignNow for the Form IT 248 Claim?

AirSlate SignNow offers several pricing tiers to accommodate different business needs, including plans specifically for individuals, teams, and enterprises. With competitively priced options, users can choose a plan that suits their requirements for eSigning documents like the Form IT 248 Claim For Empire State Film Production Credit Tax Year.

-

What features does airSlate SignNow offer for managing the Form IT 248 Claim?

With airSlate SignNow, users have access to features such as customizable templates, real-time tracking, and secure cloud storage to manage the Form IT 248 Claim For Empire State Film Production Credit Tax Year. These tools enhance the efficiency and security of your document handling process.

-

Are there any benefits to using airSlate SignNow for the Form IT 248 Claim?

Using airSlate SignNow provides numerous benefits including faster processing times, reduced paperwork, and enhanced collaboration among team members. By simplifying the submission of the Form IT 248 Claim For Empire State Film Production Credit Tax Year, you can focus more on your creative projects.

-

Can airSlate SignNow integrate with other tools for managing the Form IT 248 Claim?

Yes, airSlate SignNow offers integrations with a variety of popular applications that are commonly used in film production and project management. This capability allows for seamless workflow management as you handle the Form IT 248 Claim For Empire State Film Production Credit Tax Year alongside your other tools.

-

Is it easy to track the status of the Form IT 248 Claim with airSlate SignNow?

Absolutely! AirSlate SignNow enables users to track the status of their documents, including the Form IT 248 Claim For Empire State Film Production Credit Tax Year, in real-time. This transparency ensures that you are always up-to-date on the progress of your tax credit application.

Get more for Form IT 248 Claim For Empire State Film Production Credit Tax Year

- Brick fundraiser order form

- Renew a blue badge in suffolk form

- Honorarium invoice template form

- Story sum form

- At2059 alberta finance and enterprise government of alberta finance alberta form

- Fieldtrip pdf form

- Between two individuals contract template form

- Between two companies contract template form

Find out other Form IT 248 Claim For Empire State Film Production Credit Tax Year

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF