Ct706ntext Form

What is the CT706NT Ext?

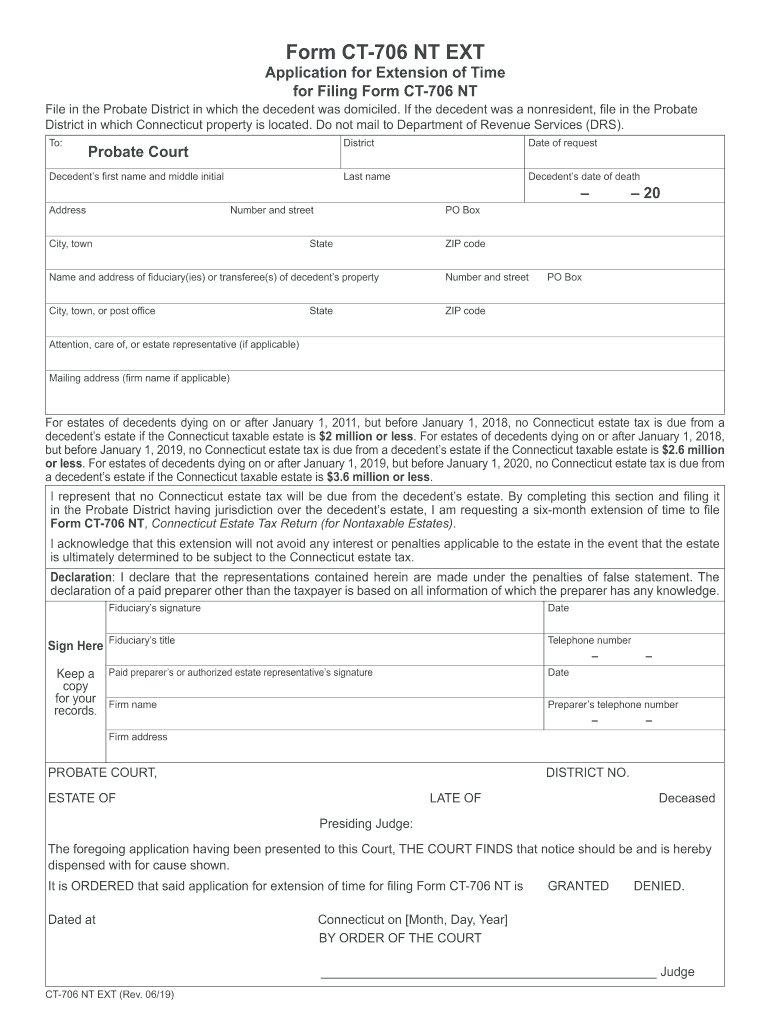

The CT706NT Ext, or the Connecticut Estate and Gift Tax Return Extension, is a form used by individuals and entities in Connecticut to request an extension for filing their estate or gift tax returns. This form is particularly relevant for estates exceeding specific thresholds, as it allows taxpayers additional time to gather necessary documentation and complete their tax filings accurately. The CT706NT Ext is essential for ensuring compliance with state tax laws while providing flexibility in the filing process.

How to Use the CT706NT Ext

Using the CT706NT Ext involves several straightforward steps. First, ensure that you meet the eligibility criteria for requesting an extension. Next, fill out the form with accurate information, including the estate's details and the reason for the extension request. After completing the form, submit it to the Connecticut Department of Revenue Services by the specified deadline. This process ensures that you can file your estate or gift tax return without incurring penalties for late submission.

Steps to Complete the CT706NT Ext

Completing the CT706NT Ext requires careful attention to detail. Start by downloading the fillable form from the appropriate state website. Provide your name, address, and the estate identification number. Clearly indicate the type of extension you are requesting and the reasons for the extension. Review all entries for accuracy, as errors can lead to delays or complications. Once completed, submit the form electronically or by mail, ensuring it is sent before the deadline to avoid penalties.

Legal Use of the CT706NT Ext

The CT706NT Ext is legally binding when submitted according to state regulations. It allows taxpayers to comply with Connecticut’s estate and gift tax laws while providing a legitimate means to request additional time for filing. To ensure the extension is recognized, it is crucial to follow all instructions carefully and submit the form within the designated timeframe. Failure to do so may result in penalties or denial of the extension request.

Filing Deadlines / Important Dates

Filing deadlines for the CT706NT Ext are critical to avoid penalties. The extension request must typically be submitted by the original due date of the estate or gift tax return. It is essential to check the specific deadlines each year, as they may vary based on the date of death of the decedent or other factors. Keeping track of these dates ensures compliance and helps manage the estate's tax obligations effectively.

Required Documents

When completing the CT706NT Ext, certain documents may be required to support your extension request. These may include the decedent's death certificate, prior tax returns, and any relevant financial documents related to the estate. Having these documents on hand can facilitate the completion of the form and ensure that all necessary information is accurately reported, which is vital for a successful extension request.

Quick guide on how to complete form ct 706 nt estate tax return for nontaxable estates

Complete Ct706ntext seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly and without interruptions. Handle Ct706ntext on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Ct706ntext effortlessly

- Find Ct706ntext and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to store your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs with just a few clicks from any device you prefer. Modify and eSign Ct706ntext and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 706 nt estate tax return for nontaxable estates

How to generate an eSignature for your Form Ct 706 Nt Estate Tax Return For Nontaxable Estates in the online mode

How to create an eSignature for the Form Ct 706 Nt Estate Tax Return For Nontaxable Estates in Google Chrome

How to make an eSignature for putting it on the Form Ct 706 Nt Estate Tax Return For Nontaxable Estates in Gmail

How to make an eSignature for the Form Ct 706 Nt Estate Tax Return For Nontaxable Estates right from your smartphone

How to create an electronic signature for the Form Ct 706 Nt Estate Tax Return For Nontaxable Estates on iOS

How to create an electronic signature for the Form Ct 706 Nt Estate Tax Return For Nontaxable Estates on Android

People also ask

-

What is the form ct 706 nt ext fillable used for?

The form ct 706 nt ext fillable is utilized primarily for reporting the estate tax for Connecticut residents. This form allows individuals to declare their estate's value and applicable deductions in a convenient, fillable format, ensuring accurate and timely submissions.

-

How do I access the form ct 706 nt ext fillable on airSlate SignNow?

Accessing the form ct 706 nt ext fillable on airSlate SignNow is simple. You can start by creating an account, then select the form from our template library or upload your own document to start filling it out electronically.

-

Is there a cost associated with using the form ct 706 nt ext fillable?

Using the form ct 706 nt ext fillable via airSlate SignNow can be very cost-effective. While we offer a variety of pricing plans, many features are accessible for free or at a low monthly rate, providing great value for your eSigning needs.

-

Can I integrate the form ct 706 nt ext fillable with my current software?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, allowing you to incorporate the form ct 706 nt ext fillable into your existing workflows. This integration improves efficiency and keeps your document management streamlined.

-

What are the benefits of using the airSlate SignNow platform for the form ct 706 nt ext fillable?

Using airSlate SignNow for the form ct 706 nt ext fillable offers numerous benefits, including enhanced document security and the ability to easily share, sign, and store your documents. Our user-friendly interface ensures that you can complete your forms quickly and efficiently.

-

Is the form ct 706 nt ext fillable compatible with mobile devices?

Yes, the form ct 706 nt ext fillable is fully compatible with mobile devices on the airSlate SignNow platform. This means you can fill out and eSign your documents on the go, making it easier to manage your paperwork wherever you are.

-

How does airSlate SignNow ensure the security of the form ct 706 nt ext fillable?

AirSlate SignNow takes security seriously by implementing advanced encryption protocols for the form ct 706 nt ext fillable. This protects your sensitive information and ensures that only authorized users can access the documents.

Get more for Ct706ntext

- Mpc 630 mass gov mass form

- Community pharmacy medication safety incident pha form

- Affidavit of residency form for school

- Waterproofing certificate of compliance form

- A tax exempt 501c3 organization form

- Exosomes for hair restoration aftercare consent form

- Review checklist contract template form

- Review checklist manufactur contract template form

Find out other Ct706ntext

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document