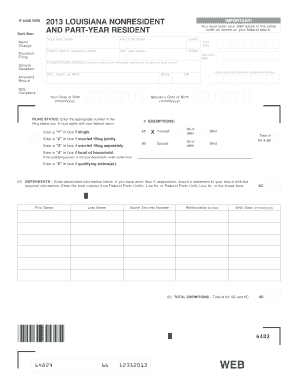

Louisiana Nonresident and Part Year Resident Taxhow Form

What is the Louisiana Nonresident And Part Year Resident Taxhow

The Louisiana Nonresident and Part Year Resident Taxhow is a tax form specifically designed for individuals who reside outside of Louisiana but earn income within the state, as well as those who have moved in or out of Louisiana during the tax year. This form allows these taxpayers to report their Louisiana-source income and calculate their tax liability accurately. Understanding this form is crucial for compliance with state tax laws and ensuring that individuals pay the correct amount of taxes based on their residency status.

How to use the Louisiana Nonresident And Part Year Resident Taxhow

Using the Louisiana Nonresident and Part Year Resident Taxhow involves several steps to ensure accurate completion. Taxpayers must first gather all relevant financial documents, including W-2s, 1099s, and any other income statements that reflect earnings sourced from Louisiana. Next, individuals should determine their residency status for the tax year, as this will affect the income that needs to be reported. After completing the form, it is essential to review all entries for accuracy before submission to avoid penalties or delays.

Steps to complete the Louisiana Nonresident And Part Year Resident Taxhow

Completing the Louisiana Nonresident and Part Year Resident Taxhow requires careful attention to detail. Follow these steps:

- Gather all necessary documents, such as income statements and previous tax returns.

- Determine your residency status for the tax year.

- Fill out the form, ensuring all Louisiana-source income is reported accurately.

- Calculate the tax liability based on the provided instructions.

- Review the completed form for any errors or omissions.

- Submit the form by the specified deadline, either electronically or via mail.

Required Documents

To successfully complete the Louisiana Nonresident and Part Year Resident Taxhow, several documents are required:

- W-2 forms from employers for income earned in Louisiana.

- 1099 forms for any freelance or contract work performed in the state.

- Records of any other income sourced from Louisiana.

- Previous tax returns, if applicable, to provide context for income levels.

- Proof of residency status, if needed, to clarify part-year residency.

Filing Deadlines / Important Dates

Filing deadlines for the Louisiana Nonresident and Part Year Resident Taxhow are crucial for compliance. Typically, the form must be submitted by May fifteenth of the tax year following the income earned. If May fifteenth falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to these dates to avoid late fees or penalties.

Penalties for Non-Compliance

Failing to comply with the requirements of the Louisiana Nonresident and Part Year Resident Taxhow can result in significant penalties. These may include:

- Late filing fees, which can accumulate over time.

- Interest on any unpaid taxes, which can increase the total amount owed.

- Potential legal action for severe cases of non-compliance.

To avoid these penalties, it is essential to file the form accurately and on time.

Quick guide on how to complete louisiana nonresident and part year resident taxhow

Access [SKS] effortlessly on any device

Digital document management has surged in popularity among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can find the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle [SKS] on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign [SKS] without difficulty

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal authority as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign [SKS] and ensure exceptional communication at every stage of the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Louisiana Nonresident And Part year Resident Taxhow

Create this form in 5 minutes!

How to create an eSignature for the louisiana nonresident and part year resident taxhow

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Louisiana Nonresident And Part year Resident Taxhow?

Louisiana Nonresident And Part year Resident Taxhow refers to the tax guidelines and regulations that apply to individuals who earn income in Louisiana but do not reside there full-time. Understanding these tax rules is crucial for compliance and to avoid penalties. Our platform provides resources to help you navigate these complexities effectively.

-

How can airSlate SignNow assist with Louisiana Nonresident And Part year Resident Taxhow?

airSlate SignNow offers a streamlined solution for managing documents related to Louisiana Nonresident And Part year Resident Taxhow. With our eSigning capabilities, you can easily sign and send tax forms securely. This simplifies the process, ensuring you meet all necessary deadlines without hassle.

-

What are the pricing options for using airSlate SignNow for tax documents?

Our pricing for airSlate SignNow is competitive and designed to fit various business needs. We offer flexible plans that cater to individuals and businesses dealing with Louisiana Nonresident And Part year Resident Taxhow. You can choose a plan that best suits your volume of document management and eSigning requirements.

-

Are there any features specifically beneficial for Louisiana Nonresident And Part year Resident Taxhow?

Yes, airSlate SignNow includes features that are particularly beneficial for handling Louisiana Nonresident And Part year Resident Taxhow. These features include customizable templates for tax forms, secure cloud storage, and automated reminders for important deadlines. This ensures you stay organized and compliant.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax management software. This integration is particularly useful for managing Louisiana Nonresident And Part year Resident Taxhow, allowing you to streamline your workflow and keep all your documents in one place.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents offers numerous benefits, including enhanced security, ease of use, and time savings. For those dealing with Louisiana Nonresident And Part year Resident Taxhow, our platform ensures that your documents are signed and stored securely, reducing the risk of errors and delays.

-

Is airSlate SignNow compliant with Louisiana tax regulations?

Yes, airSlate SignNow is designed to comply with various state regulations, including those pertaining to Louisiana Nonresident And Part year Resident Taxhow. We prioritize compliance and security, ensuring that your documents meet all necessary legal standards while being processed through our platform.

Get more for Louisiana Nonresident And Part year Resident Taxhow

- Copy of ph d proposal budget august xlsx louisville form

- Kk run for vegasjunior world finals homefacebook form

- Kk run for vegasjunior world finals form

- For his glory homeschool co op 2025 membership and form

- Registration form chattanooga

- Recommendation letters for studentskindergarten recommendation letter 5 samples examples ampamp formatskindergarten

- Mls listingreferral agreement form

- Contract carrier form

Find out other Louisiana Nonresident And Part year Resident Taxhow

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter