Form Ct 706 Nt

What is the Form Ct 706 Nt

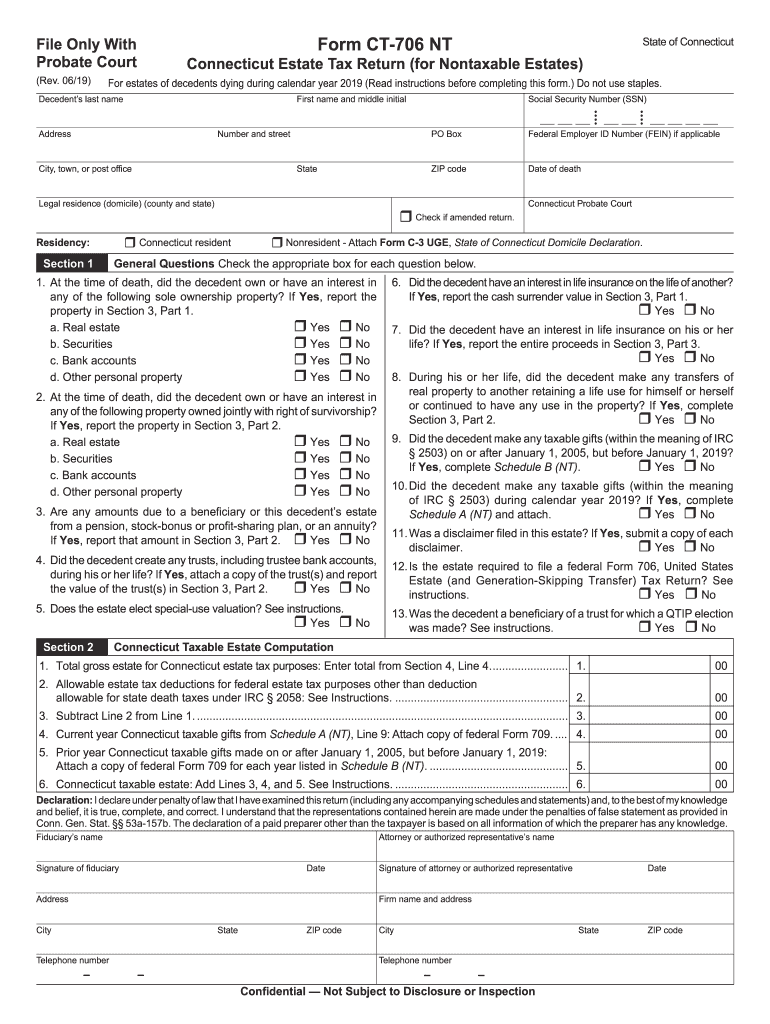

The Form Ct 706 Nt is a state-specific document used in Connecticut for reporting the estate tax for estates that exceed a certain threshold. This form is essential for the proper assessment and payment of estate taxes owed to the state. The form is typically required when a decedent's estate value surpasses the exemption limit set by Connecticut law. Understanding the purpose of this form is crucial for executors and administrators of estates to ensure compliance with state tax regulations.

How to use the Form Ct 706 Nt

Using the Form Ct 706 Nt involves several steps. First, gather all necessary financial documents related to the decedent's assets, liabilities, and any other relevant financial information. Next, complete the form accurately, ensuring that all values are reported correctly. It is important to follow the instructions provided with the form carefully, as any errors could lead to delays or penalties. Once completed, the form must be submitted to the Connecticut Department of Revenue Services along with any required payments.

Steps to complete the Form Ct 706 Nt

Completing the Form Ct 706 Nt requires a systematic approach. Begin by filling out the decedent's information, including name, date of death, and Social Security number. Next, list all assets, including real estate, bank accounts, and personal property, along with their fair market values. Deduct any allowable liabilities, such as debts and funeral expenses, to determine the net taxable estate. After verifying all entries for accuracy, sign and date the form before submitting it to the appropriate state authority.

Legal use of the Form Ct 706 Nt

The legal use of the Form Ct 706 Nt is governed by Connecticut estate tax laws. This form must be filed within a specific timeframe following the decedent's death to avoid penalties. The information provided on the form must be truthful and complete, as inaccuracies can result in legal repercussions, including fines or audits. It is advisable for individuals handling estates to consult with a legal professional or tax advisor to ensure compliance with all applicable laws and regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form Ct 706 Nt are critical for compliance. The form must typically be filed within six months of the decedent's date of death. However, extensions may be available under certain circumstances. It is important to be aware of these deadlines to avoid incurring penalties or interest on unpaid taxes. Keeping track of important dates related to the filing process can help ensure that all obligations are met in a timely manner.

Required Documents

When completing the Form Ct 706 Nt, several supporting documents are required. These may include a copy of the decedent's death certificate, documentation of all assets and liabilities, and any previous tax returns that may be relevant. Additionally, appraisals for real estate or valuable personal property may be necessary to substantiate the reported values. Gathering these documents in advance can streamline the process and help ensure that the form is completed accurately.

Quick guide on how to complete for estates of decedents dying during calendar year 2019 read instructions before completing this form

Accomplish Form Ct 706 Nt seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any hindrance. Manage Form Ct 706 Nt on any gadget using airSlate SignNow’s Android or iOS applications and enhance any document-centric task today.

How to modify and eSign Form Ct 706 Nt with ease

- Obtain Form Ct 706 Nt and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and possesses the same legal validity as a conventional ink signature.

- Review the details and then click the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about misplaced or lost documents, tedious form searching, or errors that require the printing of new document copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Modify and eSign Form Ct 706 Nt and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the for estates of decedents dying during calendar year 2019 read instructions before completing this form

How to make an electronic signature for the For Estates Of Decedents Dying During Calendar Year 2019 Read Instructions Before Completing This Form online

How to make an electronic signature for your For Estates Of Decedents Dying During Calendar Year 2019 Read Instructions Before Completing This Form in Chrome

How to generate an electronic signature for signing the For Estates Of Decedents Dying During Calendar Year 2019 Read Instructions Before Completing This Form in Gmail

How to make an electronic signature for the For Estates Of Decedents Dying During Calendar Year 2019 Read Instructions Before Completing This Form straight from your mobile device

How to generate an eSignature for the For Estates Of Decedents Dying During Calendar Year 2019 Read Instructions Before Completing This Form on iOS

How to create an eSignature for the For Estates Of Decedents Dying During Calendar Year 2019 Read Instructions Before Completing This Form on Android OS

People also ask

-

What are the main features of airSlate SignNow related to ct 706 nt instructions 2019?

airSlate SignNow offers a range of features that streamline the eSigning process, which includes customizable templates specifically designed for ct 706 nt instructions 2019. Users can easily upload, manage, and send documents for signature, ensuring that they meet all necessary compliance and legal requirements. Additionally, the platform provides secure storage and tracking capabilities to enhance document management.

-

How does airSlate SignNow simplify the process of completing ct 706 nt instructions 2019?

With airSlate SignNow, completing ct 706 nt instructions 2019 is made simple through an intuitive interface that allows users to fill out and sign documents easily. The platform also provides step-by-step guidance to ensure all required fields are accurately completed. This user-friendly approach helps reduce errors and enhances compliance with the necessary regulations.

-

Can I collaborate with others while filling out ct 706 nt instructions 2019 on airSlate SignNow?

Yes, airSlate SignNow facilitates collaboration by allowing multiple users to work on ct 706 nt instructions 2019 simultaneously. You can invite colleagues or clients to review and sign the documents in real-time, ensuring that everyone stays informed and engaged in the process. This collaborative feature signNowly speeds up the workflow and enhances productivity.

-

What pricing options are available for airSlate SignNow when using ct 706 nt instructions 2019?

airSlate SignNow offers flexible pricing plans tailored to various business needs while focusing on features like ct 706 nt instructions 2019. Plans range from basic to advanced packages, ensuring users can choose the level of functionality that suits them best. Each plan includes access to crucial features, making it a cost-effective solution for eSigning documents.

-

Is airSlate SignNow compliant with legal standards for ct 706 nt instructions 2019?

Absolutely. airSlate SignNow ensures compliance with legal standards required for ct 706 nt instructions 2019, including eSignature laws like ESIGN and UETA. The platform implements robust security measures and offers audit trails that provide clear evidence of consent and signature authenticity, ensuring that your documents are legally binding.

-

What integrations does airSlate SignNow offer to support ct 706 nt instructions 2019?

airSlate SignNow seamlessly integrates with various applications to enhance the experience of managing ct 706 nt instructions 2019. Popular integrations include Google Drive, Salesforce, and Microsoft Office, allowing users to easily import and export documents. These integrations enhance productivity by helping users manage their workflows more efficiently.

-

How can I access support for issues related to ct 706 nt instructions 2019 on airSlate SignNow?

airSlate SignNow provides extensive support for users encountering issues with ct 706 nt instructions 2019. You can access a dedicated support team via live chat, email, or phone for immediate assistance. Additionally, the platform offers a comprehensive knowledge base filled with resources and guides to help you navigate the system effectively.

Get more for Form Ct 706 Nt

- 5748 pdf missouri department of revenue mo gov form

- Residential property management contract template form

- Residential roof contract template form

- Residential snow plow contract template form

- Residential snow removal contract template form

- Residential sale contract template form

- Residential solar contract template form

- Residential solar installation contract template form

Find out other Form Ct 706 Nt

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer