5748 PDF Missouri Department of Revenue MO Gov 2022-2026

What is the form 5748?

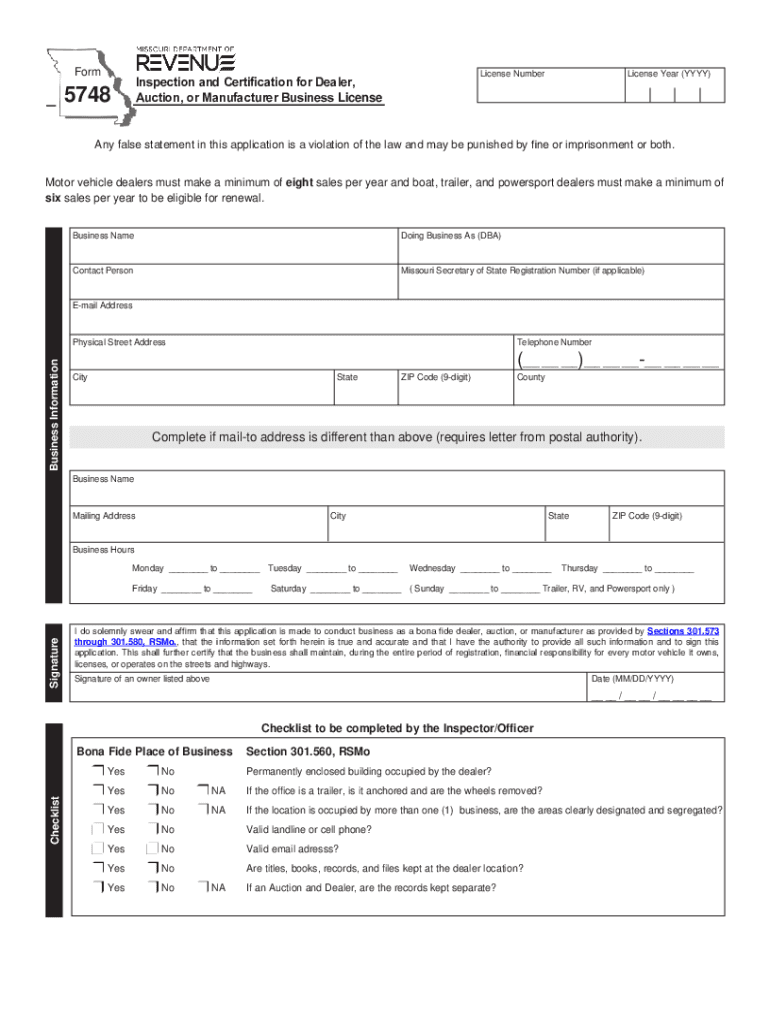

The form 5748 is a document issued by the Missouri Department of Revenue. It is primarily used for reporting certain tax-related information. This form is essential for individuals and businesses in Missouri who need to comply with state tax regulations. Understanding the purpose of form 5748 is crucial for ensuring accurate reporting and compliance with state laws.

Steps to complete the form 5748

Completing form 5748 involves several key steps to ensure accurate submission. First, gather all necessary information, including personal identification details and financial data relevant to the tax year. Next, carefully fill out each section of the form, ensuring that all entries are accurate and complete. Pay close attention to any specific instructions provided with the form. After completing the form, review it for any errors before submission.

How to obtain the form 5748

To obtain the form 5748, individuals can visit the Missouri Department of Revenue's official website. The form is available for download in PDF format, making it easily accessible for users. Alternatively, individuals may request a physical copy by contacting the department directly. It is important to ensure that you have the most current version of the form to comply with the latest regulations.

Legal use of the form 5748

The legal use of form 5748 is essential for compliance with Missouri tax laws. This form must be filled out accurately and submitted by the designated deadlines to avoid penalties. It serves as an official record for the state, detailing important tax information that may be subject to review. Understanding the legal implications of submitting this form is vital for both individuals and businesses.

Key elements of the form 5748

Key elements of form 5748 include the identification of the taxpayer, the reporting of income or deductions, and any relevant tax credits. Each section of the form is designed to capture specific information required by the Missouri Department of Revenue. Ensuring that all key elements are completed accurately is crucial for the successful processing of the form.

Form submission methods

Form 5748 can be submitted through various methods, including online submission, mailing, or in-person delivery. For online submission, users may need to create an account on the Missouri Department of Revenue's website. Alternatively, completed forms can be mailed to the appropriate address provided by the department. In-person submissions may be made at designated office locations. Understanding these methods ensures timely and efficient processing of the form.

Quick guide on how to complete 5748 pdf missouri department of revenue mo gov

Effortlessly Prepare 5748 pdf Missouri Department Of Revenue MO gov on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers a commendable environmentally-friendly option to traditional printed and signed papers, as you can easily locate the appropriate template and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents swiftly and without interruptions. Manage 5748 pdf Missouri Department Of Revenue MO gov on any device with airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to Edit and Electronically Sign 5748 pdf Missouri Department Of Revenue MO gov with Ease

- Find 5748 pdf Missouri Department Of Revenue MO gov and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or anonymize sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes just moments and holds the same legal validity as a conventional ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you want to send your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign 5748 pdf Missouri Department Of Revenue MO gov while ensuring seamless communication at every stage of the document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 5748 pdf missouri department of revenue mo gov

Create this form in 5 minutes!

How to create an eSignature for the 5748 pdf missouri department of revenue mo gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 5748 and how does it work with airSlate SignNow?

Form 5748 is a document used for specific tax-related purposes. With airSlate SignNow, you can easily create, send, and eSign form 5748, streamlining your workflow and ensuring compliance. Our platform simplifies the process, allowing you to manage your documents efficiently.

-

Is there a cost associated with using airSlate SignNow for form 5748?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost of using our platform for form 5748 depends on the features you require. We provide a cost-effective solution that ensures you get the best value for your investment.

-

What features does airSlate SignNow offer for managing form 5748?

airSlate SignNow provides a range of features for managing form 5748, including customizable templates, secure eSigning, and real-time tracking. These features enhance your document management process, making it easier to handle form 5748 efficiently. Our user-friendly interface ensures a smooth experience.

-

How can airSlate SignNow benefit my business when using form 5748?

Using airSlate SignNow for form 5748 can signNowly improve your business operations. It reduces the time spent on paperwork, enhances collaboration, and ensures that your documents are securely signed and stored. This efficiency allows you to focus on more critical aspects of your business.

-

Can I integrate airSlate SignNow with other applications for form 5748?

Absolutely! airSlate SignNow offers seamless integrations with various applications, making it easy to manage form 5748 alongside your existing tools. Whether you use CRM systems, cloud storage, or other software, our platform can enhance your workflow and improve productivity.

-

Is it easy to eSign form 5748 using airSlate SignNow?

Yes, eSigning form 5748 with airSlate SignNow is incredibly easy. Our platform allows users to sign documents electronically with just a few clicks, ensuring a quick and hassle-free process. This convenience helps you complete transactions faster and more efficiently.

-

What security measures does airSlate SignNow have for form 5748?

airSlate SignNow prioritizes the security of your documents, including form 5748. We implement advanced encryption and secure storage solutions to protect your sensitive information. You can trust that your documents are safe while using our platform.

Get more for 5748 pdf Missouri Department Of Revenue MO gov

- Printreset2021 ticket sale and resale registration form

- Maine dept of inland fisheries and maine gov form

- Tax return for a non resident company liable to income tax use sa700 to file a tax return for a non resident company for the form

- End of year certificate p60 revenue form

- Ac2122 application for modification relating to b2 durability form

- Www pagibigfund gov ph document pdfhqp pff 226 modified pag ibig ii enrollment form

- Sa900man use form sa900 to file a tax return for a trust or estate for the tax year ended 5 april

- Motor vehicle excise tax phase out proposal form

Find out other 5748 pdf Missouri Department Of Revenue MO gov

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement