Ia Schedule a Form

What is the Iowa Schedule A

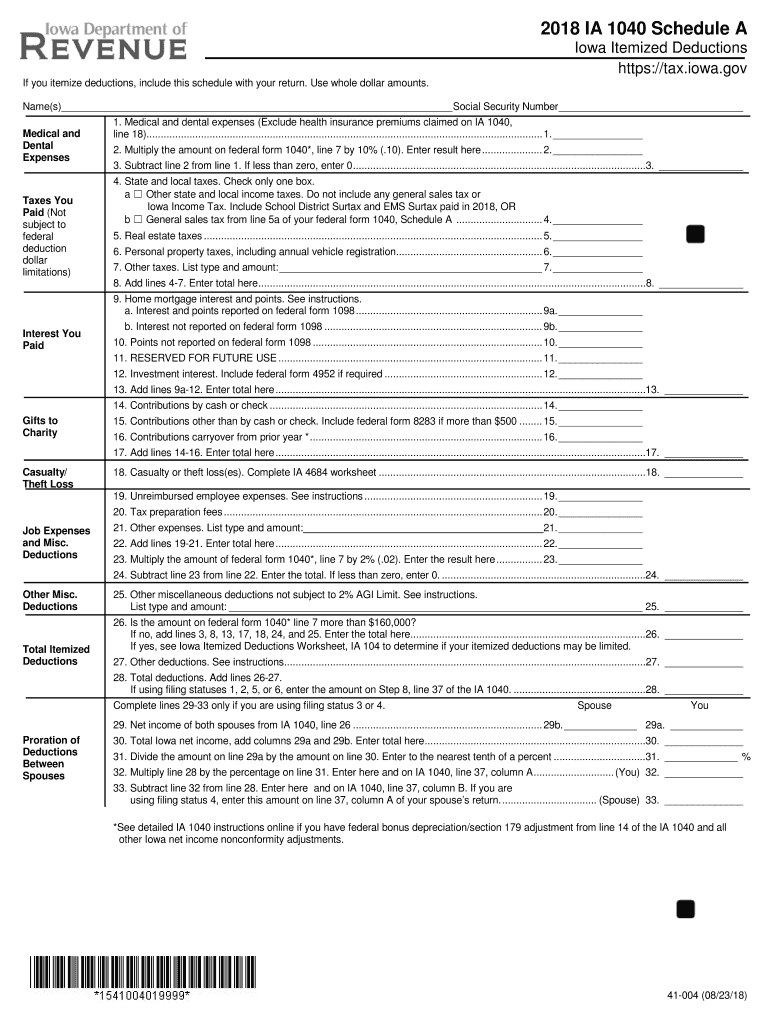

The Iowa Schedule A is a form used by taxpayers in Iowa to itemize deductions on their state income tax returns. This form allows individuals to report various deductible expenses, which can reduce their taxable income and, consequently, their overall tax liability. Common deductions include medical expenses, mortgage interest, property taxes, and charitable contributions. Understanding the purpose and function of the Iowa Schedule A is essential for taxpayers seeking to maximize their deductions and ensure compliance with state tax laws.

Steps to Complete the Iowa Schedule A

Completing the Iowa Schedule A involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to your deductible expenses. This may include receipts, bank statements, and tax documents. Next, fill out the form by entering your personal information and detailing each deductible expense in the appropriate sections. Be sure to follow the instructions carefully, as specific guidelines dictate how to report each type of deduction. Finally, review your completed form for accuracy and ensure that it aligns with your overall Iowa 1040 tax return before submission.

State-Specific Rules for the Iowa Schedule A

Iowa has specific rules regarding the deductions that can be claimed on the Schedule A. For instance, certain expenses may be subject to limitations or may not be deductible at all. It is important to familiarize yourself with Iowa's tax laws, as they can differ significantly from federal tax regulations. Additionally, some deductions may require additional documentation or forms to support your claims. Understanding these state-specific rules will help you navigate the completion of the Iowa Schedule A effectively.

Required Documents

When filling out the Iowa Schedule A, you will need to gather several key documents to substantiate your claims. These documents may include:

- Receipts for medical expenses

- Statements showing mortgage interest payments

- Property tax bills

- Charitable contribution receipts

- Any other relevant financial records

Having these documents on hand will facilitate the completion of the form and ensure you have the necessary evidence to support your deductions if required by the Iowa Department of Revenue.

Legal Use of the Iowa Schedule A

The Iowa Schedule A must be completed in accordance with state tax laws to ensure its legal validity. This means that all reported deductions must be legitimate and backed by appropriate documentation. Misrepresenting information on the Schedule A can lead to penalties, including fines or additional taxes owed. It is crucial to maintain accurate records and to only claim deductions that you are entitled to under Iowa law. Utilizing a reliable electronic signature tool can also help in securely submitting your forms, ensuring compliance with legal requirements.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Iowa Schedule A. The form can be filed online through the Iowa Department of Revenue's e-file system, which provides a convenient and efficient way to submit your tax return. Alternatively, you can mail a paper copy of the completed form to the appropriate address listed on the Iowa Department of Revenue's website. Some taxpayers may also choose to file in person at local tax offices, although this method may be less common. Regardless of the method chosen, ensure that all information is accurate and complete before submission.

Quick guide on how to complete ia 1040 schedule a iowagov

Effortlessly Prepare Ia Schedule A on Any Device

Digital document management has become increasingly favored by both organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents swiftly and without delays. Handle Ia Schedule A on any device using the airSlate SignNow applications for Android or iOS and enhance any document-focused process today.

The easiest way to modify and electronically sign Ia Schedule A effortlessly

- Locate Ia Schedule A and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select pertinent sections of the documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details thoroughly and click on the Done button to save your modifications.

- Choose your preferred method to submit your form: via email, text message (SMS), invitation link, or download it to your PC.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Ia Schedule A and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ia 1040 schedule a iowagov

How to create an eSignature for your Ia 1040 Schedule A Iowagov online

How to create an electronic signature for the Ia 1040 Schedule A Iowagov in Google Chrome

How to create an electronic signature for signing the Ia 1040 Schedule A Iowagov in Gmail

How to generate an eSignature for the Ia 1040 Schedule A Iowagov straight from your smartphone

How to create an eSignature for the Ia 1040 Schedule A Iowagov on iOS devices

How to create an eSignature for the Ia 1040 Schedule A Iowagov on Android

People also ask

-

What are the 2018 Iowa 1040 Schedule A instructions?

The 2018 Iowa 1040 Schedule A instructions provide a detailed guideline for taxpayers in Iowa to report their itemized deductions. These instructions include information on eligible expenses such as medical costs, mortgage interest, and charitable contributions. Understanding these instructions is crucial for accurate tax filing.

-

How can I access the 2018 Iowa 1040 Schedule A instructions online?

You can access the 2018 Iowa 1040 Schedule A instructions directly from the Iowa Department of Revenue's website. They offer downloadable PDF files that contain all the necessary information. This resource is essential for individuals looking to maximize their deductions.

-

What are the common mistakes to avoid when using the 2018 Iowa 1040 Schedule A instructions?

Common mistakes include miscalculating deductions or failing to include all relevant expenses. It's important to follow the 2018 Iowa 1040 Schedule A instructions carefully to ensure all eligible deductions are reported correctly. Missing information could result in delayed tax refunds or penalties.

-

How does airSlate SignNow help in the eSigning process for 2018 Iowa 1040 Schedule A?

airSlate SignNow streamlines the eSigning process for documents related to the 2018 Iowa 1040 Schedule A. With its user-friendly interface, users can easily send and sign tax documents securely online. This feature speeds up the filing process, ensuring you meet all deadlines.

-

Are there any fees associated with accessing the 2018 Iowa 1040 Schedule A instructions?

No, the 2018 Iowa 1040 Schedule A instructions are available for free from the Iowa Department of Revenue website. This allows taxpayers to access important tax information without incurring any fees. Utilizing these instructions correctly can help save money on taxes.

-

What benefits does using airSlate SignNow provide for filing taxes?

Using airSlate SignNow offers ease of use for eSigning and managing tax documents like the 2018 Iowa 1040 Schedule A. It enhances efficiency by allowing multiple signers and tracking status in real-time. These benefits ensure a smooth tax filing process, crucial during peak tax season.

-

Can I integrate airSlate SignNow with other software for tax filing?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software that can assist in the preparation of documents like the 2018 Iowa 1040 Schedule A. This interoperability enhances your workflow, making the tax preparation process much more efficient.

Get more for Ia Schedule A

- Meeting notice and agenda name of organization commission on leg state nv form

- Location stated above fid state nv form

- App electrical permit town of sebago 406 bridgton rd sebago me 04029 phone 2077872457 fax 2077872760 permit date map lot form

- Wholesale invoice form

- S01the income tax actemployers monthly statutory form

- Research assistant contract template form

- Residential clean contract template form

- Residential clean service contract template form

Find out other Ia Schedule A

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter