S01THE INCOME TAX ACTEMPLOYER 'S MONTHLY STATUTORY 2020-2026

Understanding the Jamaica S01 Form

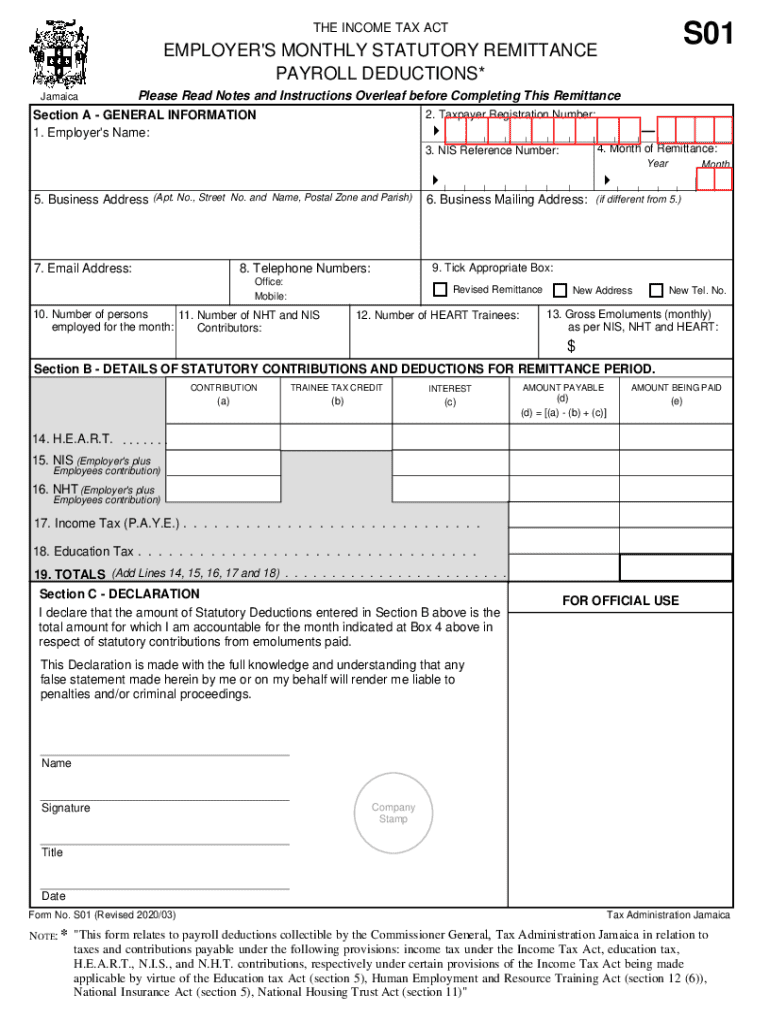

The Jamaica S01 form, officially known as the Employer's Monthly Statutory, is a critical document for employers in Jamaica. This form is primarily used to report and remit statutory deductions, including income tax and National Insurance contributions, on behalf of employees. Understanding its purpose is essential for compliance with Jamaican tax laws and regulations.

How to Obtain the Jamaica S01 Form

The Jamaica S01 form can be obtained through various channels. Employers can download the form directly from the official website of the Jamaican Tax Administration. Additionally, physical copies may be available at local tax offices. It is important to ensure that you are using the most current version of the form to avoid any compliance issues.

Steps to Complete the Jamaica S01 Form

Completing the Jamaica S01 form requires careful attention to detail. Here are the key steps:

- Gather necessary information, including employee details and the amounts to be reported.

- Fill in the employer's information, including the Taxpayer Registration Number (TRN).

- Report the total statutory deductions for each employee, ensuring accuracy.

- Review the form for any errors or omissions.

- Submit the completed form by the designated deadline.

Legal Use of the Jamaica S01 Form

The Jamaica S01 form is legally mandated for employers to report statutory deductions. Failure to submit this form accurately and on time can result in penalties and legal repercussions. Employers must understand their obligations under the Income Tax Act to ensure compliance and avoid potential fines.

Filing Deadlines and Important Dates

Employers should be aware of the filing deadlines associated with the Jamaica S01 form. Typically, the form must be submitted monthly, with specific due dates set by the Jamaican Tax Administration. Keeping track of these deadlines is crucial to maintain compliance and avoid late fees.

Required Documents for Submission

When completing the Jamaica S01 form, certain documents are required to ensure accurate reporting. These may include:

- Employee payroll records

- Taxpayer Registration Number (TRN)

- Details of statutory deductions for each employee

Having these documents on hand will facilitate a smoother completion process.

Penalties for Non-Compliance

Non-compliance with the Jamaica S01 form requirements can lead to significant penalties. Employers may face fines, interest on unpaid taxes, and potential legal action. Understanding these risks emphasizes the importance of timely and accurate submissions.

Handy tips for filling out S01THE INCOME TAX ACTEMPLOYER 'S MONTHLY STATUTORY online

Quick steps to complete and e-sign S01THE INCOME TAX ACTEMPLOYER 'S MONTHLY STATUTORY online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms could be. Get access to a HIPAA and GDPR compliant service for optimum efficiency. Use signNow to electronically sign and send out S01THE INCOME TAX ACTEMPLOYER 'S MONTHLY STATUTORY for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct s01the income tax actemployers monthly statutory

Create this form in 5 minutes!

How to create an eSignature for the s01the income tax actemployers monthly statutory

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the jamaica s01 form?

The jamaica s01 form is a specific document used for various administrative purposes in Jamaica. It is essential for businesses and individuals to understand its requirements to ensure compliance. airSlate SignNow simplifies the process of filling out and eSigning the jamaica s01 form, making it accessible and efficient.

-

How can airSlate SignNow help with the jamaica s01 form?

airSlate SignNow provides an intuitive platform for completing and eSigning the jamaica s01 form. With its user-friendly interface, you can easily upload, fill out, and send the form securely. This streamlines the process, saving you time and reducing errors.

-

Is there a cost associated with using airSlate SignNow for the jamaica s01 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost-effective solutions ensure that you can manage the jamaica s01 form and other documents without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for the jamaica s01 form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking for the jamaica s01 form. These features enhance the efficiency of document management and ensure that all parties can sign and access the form easily. Additionally, you can integrate it with other tools for a seamless workflow.

-

Can I integrate airSlate SignNow with other applications for the jamaica s01 form?

Absolutely! airSlate SignNow supports integration with various applications, allowing you to manage the jamaica s01 form alongside your existing tools. This integration capability enhances productivity and ensures that your document processes are streamlined across platforms.

-

What are the benefits of using airSlate SignNow for the jamaica s01 form?

Using airSlate SignNow for the jamaica s01 form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and easy document sharing, which can signNowly speed up your workflow. Additionally, it helps maintain compliance with legal standards.

-

Is airSlate SignNow secure for handling the jamaica s01 form?

Yes, airSlate SignNow prioritizes security and compliance when handling the jamaica s01 form. The platform employs advanced encryption and security protocols to protect your sensitive information. You can trust that your documents are safe and secure throughout the signing process.

Get more for S01THE INCOME TAX ACTEMPLOYER 'S MONTHLY STATUTORY

- Duplicate salon license request form nc cosmetic arts

- Application for minor subdivision plat city of morris form

- Mandannd govoffice com vertical sitescity of mandan development review application form

- Www glassdoor comreviewswaukesha countywaukesha county department of parks ampamp land use wi form

- Tennessee burn permit application form

- Child tennessee neglect form

- Bill lee state of tennessee penny schwinn governor tn form

- Maryville fire department 402 w broadway ave yp com form

Find out other S01THE INCOME TAX ACTEMPLOYER 'S MONTHLY STATUTORY

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer