Ia Form

What is the IA Form?

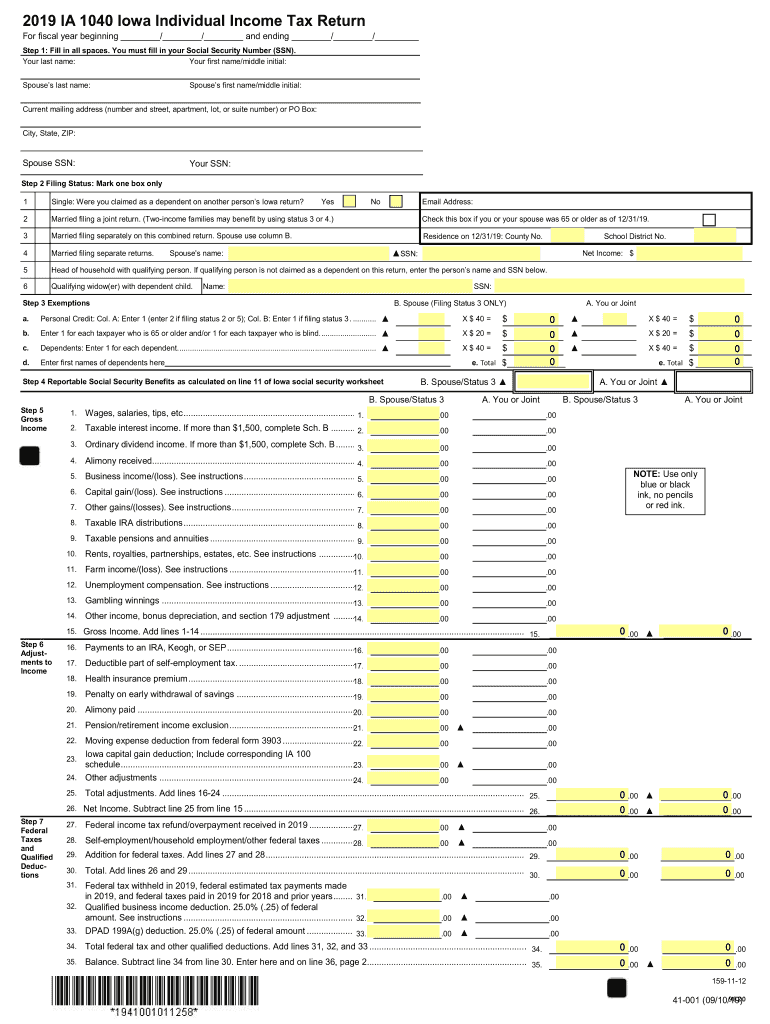

The IA Form, specifically the Iowa Individual Income Tax Return, is a crucial document for residents of Iowa to report their income and calculate their tax obligations. This form is essential for individuals who earn income in Iowa and need to comply with state tax laws. It encompasses various income sources, deductions, and credits that taxpayers can claim to reduce their taxable income. Understanding the IA Form is vital for accurate tax reporting and ensuring compliance with state regulations.

How to Obtain the IA Form

Obtaining the IA Form is straightforward. Taxpayers can access the form through the Iowa Department of Revenue's official website, where it is available for download in a printable format. Additionally, physical copies of the form can often be found at local libraries, post offices, or tax preparation offices. Ensuring you have the correct and most current version of the IA Form is essential for accurate filing.

Steps to Complete the IA Form

Completing the IA Form involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income, including wages, interest, and dividends.

- Claim deductions and credits applicable to your situation, such as education credits or standard deductions.

- Calculate your total tax liability and determine if you owe additional taxes or are due a refund.

- Sign and date the form before submitting it.

Legal Use of the IA Form

The IA Form must be used in accordance with Iowa state tax laws to ensure its legal validity. This includes accurately reporting income, claiming only eligible deductions and credits, and submitting the form by the designated deadlines. Failure to comply with these regulations can result in penalties or legal repercussions. Utilizing a reliable digital solution, like signNow, can help streamline the process and ensure compliance with eSignature laws.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the IA Form to avoid penalties. Typically, the deadline for filing the Iowa Individual Income Tax Return is April 30 of the year following the tax year. For example, the deadline for the 2014 tax year would be April 30, 2015. It is advisable to check for any extensions or changes to deadlines that may occur due to specific circumstances or state announcements.

Form Submission Methods

The IA Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the Iowa Department of Revenue's e-file system, which allows for quick processing.

- Mailing a printed copy of the form to the appropriate address specified by the Iowa Department of Revenue.

- In-person submission at designated tax offices, which may provide assistance if needed.

Quick guide on how to complete 2019 ia 1040 iowa individual income tax return

Complete Ia Form effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Ia Form on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Ia Form with ease

- Obtain Ia Form and click Get Form to commence.

- Leverage the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive details with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you would like to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device of your choosing. Edit and eSign Ia Form and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 ia 1040 iowa individual income tax return

How to make an eSignature for your 2019 Ia 1040 Iowa Individual Income Tax Return online

How to generate an eSignature for the 2019 Ia 1040 Iowa Individual Income Tax Return in Google Chrome

How to make an eSignature for signing the 2019 Ia 1040 Iowa Individual Income Tax Return in Gmail

How to generate an electronic signature for the 2019 Ia 1040 Iowa Individual Income Tax Return from your mobile device

How to generate an electronic signature for the 2019 Ia 1040 Iowa Individual Income Tax Return on iOS devices

How to make an electronic signature for the 2019 Ia 1040 Iowa Individual Income Tax Return on Android devices

People also ask

-

What is the printable Iowa 2014 document format?

The printable Iowa 2014 document format typically refers to official state forms or tax documents that can be filled out and printed. These documents are essential for various legal and administrative processes in Iowa. By using airSlate SignNow, you can easily manage and eSign your printable Iowa 2014 documents, ensuring a smooth workflow.

-

How can I access the printable Iowa 2014 documents through airSlate SignNow?

To access printable Iowa 2014 documents, simply sign up on the airSlate SignNow platform. You can upload your PDF files or choose from our extensive library of templates that include Iowa 2014 documents. The platform makes it easy to find and select the forms you need.

-

Is airSlate SignNow affordable for handling printable Iowa 2014 documents?

Yes, airSlate SignNow offers a cost-effective solution for managing your printable Iowa 2014 documents. With various pricing plans available, you can choose an option that suits your business needs without breaking the bank. This pricing flexibility makes airSlate SignNow a smart choice for any organization.

-

Can I eSign my printable Iowa 2014 documents using airSlate SignNow?

Absolutely! airSlate SignNow allows you to eSign printable Iowa 2014 documents with ease. Our user-friendly platform ensures that your signatures are legally binding and secure, so you can confidently complete your documents online.

-

Are there any integrations available for managing printable Iowa 2014 documents?

Yes, airSlate SignNow integrates with various applications to streamline the management of your printable Iowa 2014 documents. Whether you use Google Drive, Salesforce, or other tools, you can easily connect them to enhance your workflow. These integrations save you time and improve document management efficiency.

-

What features does airSlate SignNow offer for printable Iowa 2014 documents?

airSlate SignNow offers a variety of features for handling printable Iowa 2014 documents, including eSigning, document templates, and secure storage. These tools assist in simplifying your document processes, ensuring you can manage your forms effortlessly. Additionally, features like real-time tracking help keep you informed on the status of your documents.

-

Can I customize printable Iowa 2014 documents in airSlate SignNow?

Yes, you can customize your printable Iowa 2014 documents in airSlate SignNow. The platform allows you to edit fields, add signatures, and make notes to personalize your documents. This customization feature enables you to tailor your forms to meet your specific needs.

Get more for Ia Form

- Form it 203 tm att b schedule b

- Invoice sf expresscom form

- Application form for extension of aruba travelguide

- Synthes small frag inventory 214192613 form

- The grand lodge of the state of israel of ancient and form

- Report contract template form

- Request contract template form

- Repossession contract template 787755017 form

Find out other Ia Form

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free