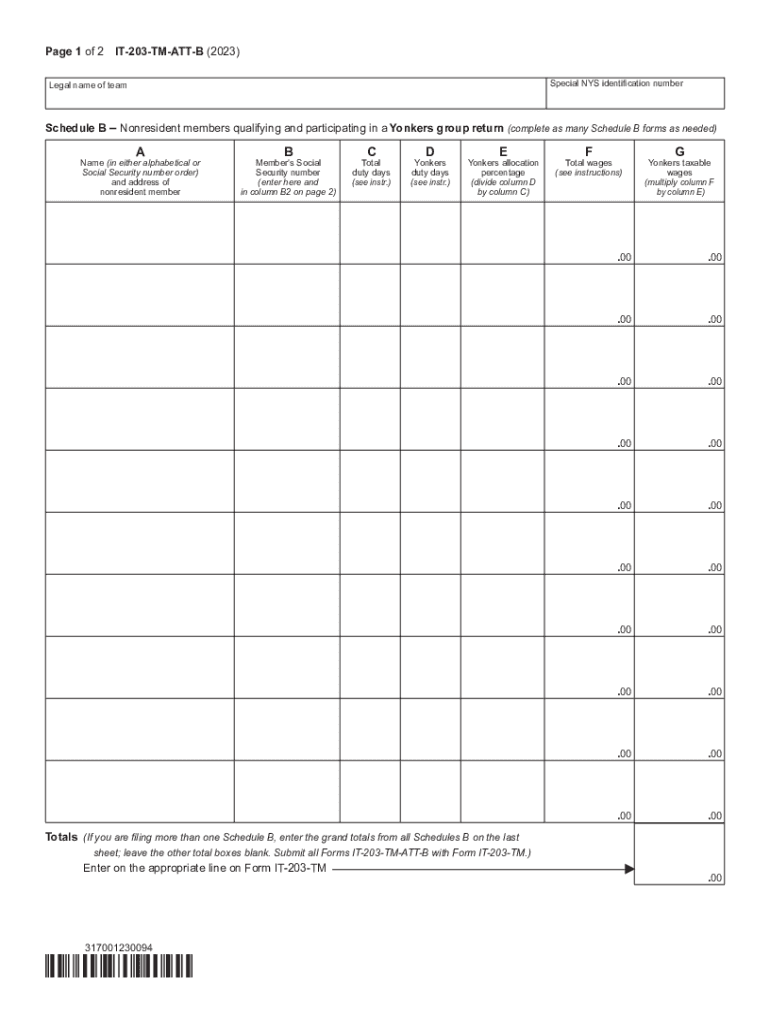

Form it 203 TM ATT B Schedule B 2023

What is the IT-201 Tax Form?

The IT-201 tax form is a New York State income tax return used by residents to report their income and calculate their tax liability. It is essential for individuals who earn income within the state, allowing them to claim various deductions and credits applicable to their financial situation. The form is designed for personal income tax and must be filed annually by April fifteenth, unless an extension is granted.

How to Use the IT-201 Tax Form

To effectively use the IT-201 tax form, taxpayers should gather all necessary documentation, including W-2 forms, 1099 forms, and any relevant receipts for deductions. The form consists of several sections, including personal information, income details, and deductions. Completing the form accurately is crucial for ensuring compliance with state tax laws and minimizing the risk of penalties.

Steps to Complete the IT-201 Tax Form

Completing the IT-201 tax form involves several key steps:

- Gather all relevant financial documents, including income statements and deduction receipts.

- Fill out your personal information at the top of the form, including your name, address, and Social Security number.

- Report your total income, including wages, interest, and dividends, in the appropriate sections.

- Claim any deductions you qualify for, such as standard deductions or itemized deductions.

- Calculate your total tax liability based on the information provided.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

The IT-201 tax form must be filed by April fifteenth each year for the previous tax year. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Taxpayers can request an extension to file, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents

When completing the IT-201 tax form, taxpayers should have the following documents ready:

- W-2 forms from employers

- 1099 forms for additional income sources

- Records of any tax credits or deductions claimed

- Previous year’s tax return for reference

Penalties for Non-Compliance

Failure to file the IT-201 tax form on time can result in penalties and interest on any unpaid taxes. The New York State Department of Taxation and Finance may impose a late filing penalty, which can be a percentage of the unpaid tax amount. Additionally, interest accrues on any outstanding balance from the original due date until the tax is paid in full.

Quick guide on how to complete form it 203 tm att b schedule b

Effortlessly Prepare Form IT 203 TM ATT B Schedule B on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools necessary to quickly create, edit, and electronically sign your documents without hassle. Manage Form IT 203 TM ATT B Schedule B on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

How to Edit and Electronically Sign Form IT 203 TM ATT B Schedule B with Ease

- Obtain Form IT 203 TM ATT B Schedule B and click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, whether via email, text message (SMS), or invitation link, or download it to your computer.

Forget about mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks on the device of your choice. Modify and electronically sign Form IT 203 TM ATT B Schedule B to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 203 tm att b schedule b

Create this form in 5 minutes!

How to create an eSignature for the form it 203 tm att b schedule b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is online fax att and how does it work?

Online fax att allows users to send and receive faxes via the internet without the need for a traditional fax machine. Utilizing airSlate SignNow, this service converts your documents into a digital format that can be easily transmitted. This efficient process saves time and reduces paper usage, making it an eco-friendly solution.

-

How much does online fax att cost?

The pricing for online fax att varies based on the plan you choose, with options designed to fit different business needs. airSlate SignNow offers flexible pricing tiers, allowing users to pay only for what they need. This ensures a cost-effective solution for businesses of all sizes.

-

What features are included with online fax att?

Online fax att with airSlate SignNow includes features such as easy document uploads, eSignature capabilities, and a user-friendly dashboard. Additionally, users can track the status of their faxes and receive notifications, ensuring all documents are being handled promptly and efficiently. These features enhance the overall user experience, making faxing convenient.

-

What are the benefits of using online fax att?

Using online fax att provides numerous benefits including increased productivity and reduced costs associated with physical fax machines. It streamlines document management and enhances accessibility, allowing users to send and receive faxes from anywhere. Moreover, online fax att helps improve security with encrypted document transmission.

-

Can online fax att integrate with other applications?

Yes, online fax att can integrate with a variety of applications, including cloud storage services and productivity tools. This integration enhances workflow efficiency, allowing users to easily access their documents from multiple platforms. airSlate SignNow supports seamless connectivity with many popular business applications to streamline your processes.

-

Is online fax att secure and compliant with regulations?

Absolutely, online fax att is designed with security in mind, utilizing encryption and secure transmission protocols. airSlate SignNow complies with industry standards and regulations, ensuring that your sensitive information is protected. This makes it a reliable choice for businesses that handle confidential documents.

-

How can I get started with online fax att?

Getting started with online fax att is easy; simply sign up for an airSlate SignNow account and choose a suitable plan. The user-friendly interface guides you through the setup process, making it accessible for everyone. Once registered, you can begin to send and receive faxes in just a few clicks.

Get more for Form IT 203 TM ATT B Schedule B

- Forms ampamp instructions virginia tax

- Schedule of tax payments form

- Licensing nebraska department of health ampamp human services form

- Form 1045 application for tentative refund what it is

- Annual 1042 s form

- Solved change my mailing address on the account form

- Publication 4695 pr vitatce puerto rico volunteer test form

- Schedule d form

Find out other Form IT 203 TM ATT B Schedule B

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile