Form a 6

What is the Form A 6

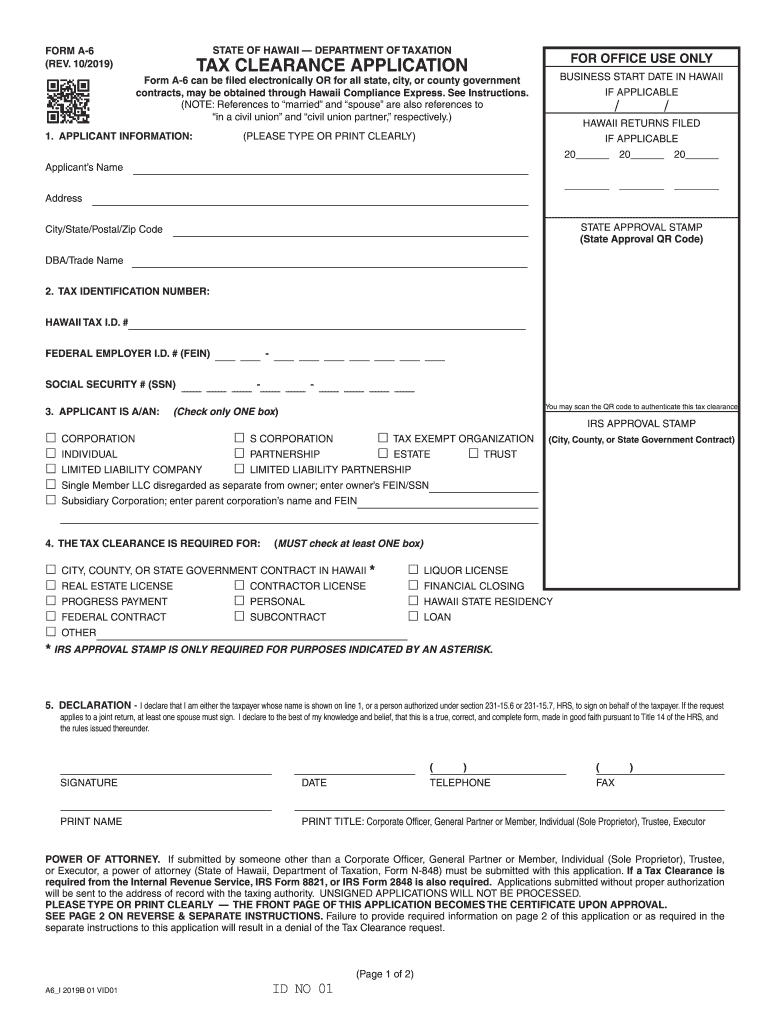

The Form A 6 is a crucial document used in Hawaii for tax clearance purposes. It is officially known as the 6 Hawaii tax form and serves as a declaration that an individual or business has fulfilled their tax obligations. This form is often required when applying for various licenses, permits, or contracts within the state. Understanding the purpose of the Form A 6 is essential for compliance with state regulations.

How to use the Form A 6

Using the Form A 6 involves several steps to ensure accurate completion and submission. First, gather all necessary information, including your tax identification number and details about your tax payments. Next, fill out the form carefully, ensuring all sections are complete and accurate. Once completed, you may submit the form electronically or by mail, depending on your preference and the requirements of the agency requesting it. It is important to retain a copy for your records.

Steps to complete the Form A 6

Completing the Form A 6 requires attention to detail. Follow these steps:

- Obtain the latest version of the Form A 6 from the appropriate state agency.

- Fill in your personal or business information accurately.

- Provide details regarding your tax status and any payments made.

- Review the form for any errors or omissions.

- Submit the form as instructed, either online or via mail.

Legal use of the Form A 6

The legal use of the Form A 6 is governed by specific regulations in Hawaii. This form must be completed accurately to be considered valid. It serves as proof that the filer has met their tax obligations and complies with state laws. Failure to use the form correctly may result in penalties or delays in obtaining necessary permits or licenses.

Required Documents

When completing the Form A 6, certain documents may be required to support your application. These typically include:

- Your most recent tax return.

- Documentation of any payments made to the state.

- Identification documents, such as a driver's license or business registration.

Having these documents ready will streamline the completion process and ensure compliance with state requirements.

Form Submission Methods

The Form A 6 can be submitted through various methods, depending on the preferences of the submitting party and the requirements of the receiving agency. Common submission methods include:

- Online submission through the state’s official portal.

- Mailing a physical copy to the designated office.

- In-person delivery at local tax offices or relevant agencies.

Each method has its own advantages, and filers should choose the one that best suits their needs.

Quick guide on how to complete form a 6 rev 102019 tax clearance application forms 2019 fillable

Complete Form A 6 seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly substitute for traditional printed and signed paperwork, enabling you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without interruptions. Manage Form A 6 on any device with airSlate SignNow Android or iOS applications and enhance any document-driven procedure today.

How to edit and eSign Form A 6 effortlessly

- Locate Form A 6 and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight important segments of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate producing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your preference. Modify and eSign Form A 6 to ensure effective communication at any point in your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form a 6 rev 102019 tax clearance application forms 2019 fillable

How to generate an eSignature for the Form A 6 Rev 102019 Tax Clearance Application Forms 2019 Fillable in the online mode

How to generate an eSignature for your Form A 6 Rev 102019 Tax Clearance Application Forms 2019 Fillable in Google Chrome

How to generate an eSignature for signing the Form A 6 Rev 102019 Tax Clearance Application Forms 2019 Fillable in Gmail

How to create an eSignature for the Form A 6 Rev 102019 Tax Clearance Application Forms 2019 Fillable from your mobile device

How to create an eSignature for the Form A 6 Rev 102019 Tax Clearance Application Forms 2019 Fillable on iOS

How to make an electronic signature for the Form A 6 Rev 102019 Tax Clearance Application Forms 2019 Fillable on Android

People also ask

-

What is clearance hawaii in the context of document signing?

Clearance hawaii refers to streamline processes for businesses in Hawaii needing to send and sign documents efficiently. With airSlate SignNow, you can manage your document workflows effortlessly, ensuring that all necessary clearances are obtained quickly and seamlessly.

-

How much does airSlate SignNow cost for businesses in Hawaii?

The pricing for clearance hawaii services through airSlate SignNow varies based on the plan you choose, with options to fit different business sizes. Our pricing is designed to be cost-effective while providing robust features that help streamline your eSignature processes.

-

What features does airSlate SignNow offer for clearance hawaii?

AirSlate SignNow provides various features tailored for clearance hawaii, including electronic signatures, document templates, and automated workflows. These tools help businesses simplify their document management and approval processes, making it easier to comply with local regulations.

-

What are the benefits of using airSlate SignNow for clearance hawaii?

Using airSlate SignNow for clearance hawaii can help increase your business's operational efficiency and reduce turnaround times for document signing. Plus, our secure platform ensures that all your sensitive information remains protected while allowing for easy accessibility.

-

Can airSlate SignNow integrate with other tools for clearance hawaii?

Yes, airSlate SignNow offers integrations with a range of applications commonly used for clearance hawaii, including CRM systems and cloud storage services. This connectivity enhances your workflow by allowing for a more cohesive experience across multiple platforms.

-

Is airSlate SignNow compliant with local laws in Hawaii for clearance hawaii?

Absolutely, airSlate SignNow is designed to comply with the legal requirements for electronic signatures in Hawaii. This ensures that your documents are legally binding and acceptable for clearance hawaii and other business processes.

-

How can I get started with airSlate SignNow for clearance hawaii?

Getting started with airSlate SignNow for clearance hawaii is simple! You can sign up for a free trial on our website to test out the features and see how it fits your business needs. Our user-friendly interface makes the onboarding process quick and efficient.

Get more for Form A 6

- Table of contents 162095 form

- Adult sports registration form quickscorescom

- The 23rd dia japan annual workshop for clinical data form

- Bcs 6000c burner control system docuthek form

- Repair service contract template form

- Repayment contract template form

- Repayment of money contract template form

- Repository contract template form

Find out other Form A 6

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document