Annual Wage Reconciliation 2023-2026

What is the Annual Wage Reconciliation

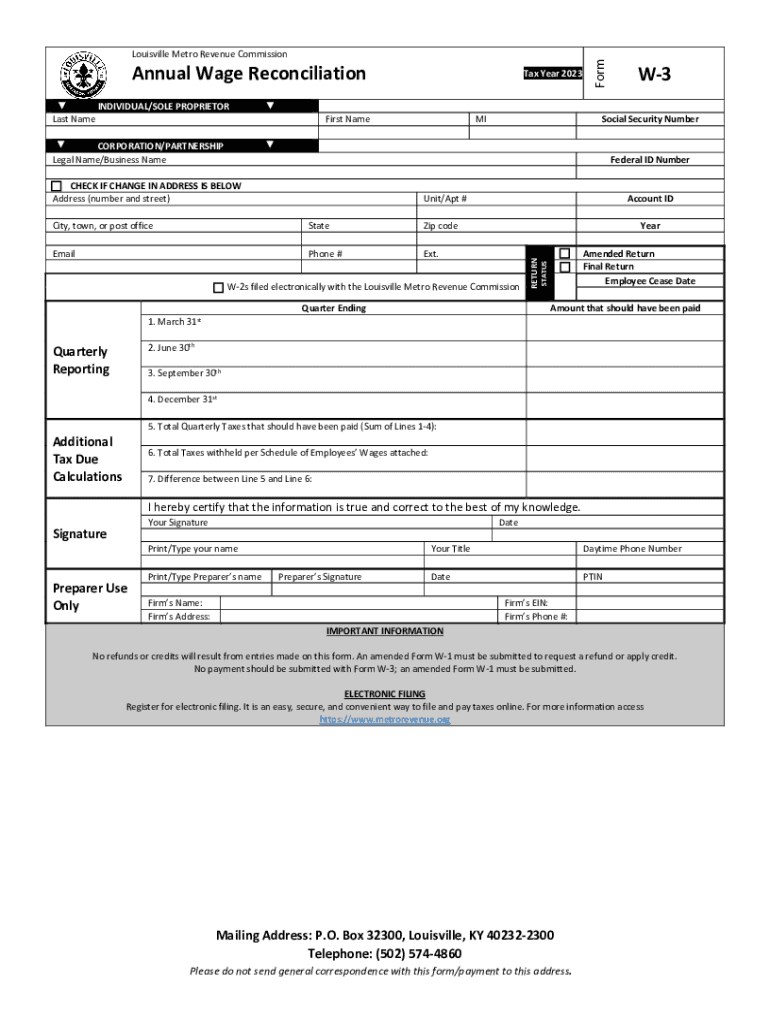

The Annual Wage Reconciliation is a crucial document used by employers in the United States to summarize and verify the wages paid to employees throughout the year. This form consolidates information regarding employee earnings, tax withholdings, and other relevant payroll data. It serves as a key tool for ensuring compliance with federal and state tax regulations, allowing both employers and employees to confirm that the correct amounts have been reported to the Internal Revenue Service (IRS) and state tax authorities.

Steps to complete the Annual Wage Reconciliation

Completing the Annual Wage Reconciliation involves several important steps to ensure accuracy and compliance. First, gather all payroll records for the year, including W-2 forms and any relevant tax documents. Next, calculate the total wages paid to each employee, ensuring that all earnings, bonuses, and deductions are included. After compiling this data, fill out the reconciliation form with the necessary details, such as the employer's identification number, employee information, and total wages. Finally, review the completed form for accuracy before submitting it to the appropriate tax authorities.

IRS Guidelines

The IRS provides specific guidelines for completing the Annual Wage Reconciliation, which must be adhered to for compliance. Employers are required to report all wages, tips, and other compensation accurately. The guidelines also outline the deadlines for submission, which typically coincide with the annual tax filing season. It is essential for employers to familiarize themselves with these guidelines to avoid penalties and ensure that all information is reported correctly.

Filing Deadlines / Important Dates

Filing deadlines for the Annual Wage Reconciliation are critical for employers to observe. Generally, the form must be submitted to the IRS by January thirty-first of the following year, along with employee W-2 forms. Additionally, state-specific deadlines may apply, so it is important to check local regulations. Missing these deadlines can result in penalties and interest charges, making timely submission essential for compliance.

Required Documents

To complete the Annual Wage Reconciliation, several key documents are required. Employers should have access to employee W-2 forms, payroll records, and any relevant tax documentation. It is also advisable to maintain copies of the reconciliation form itself for record-keeping purposes. Having these documents organized and readily available can streamline the reconciliation process and ensure accuracy in reporting.

Penalties for Non-Compliance

Failure to comply with the requirements for the Annual Wage Reconciliation can result in significant penalties. The IRS may impose fines for late submissions, inaccuracies, or failure to file altogether. These penalties can vary based on the severity of the non-compliance and may increase over time if the issues are not rectified. Employers should prioritize accurate and timely filing to avoid these potential consequences.

Who Issues the Form

The Annual Wage Reconciliation form is typically issued by the employer, who is responsible for compiling the necessary payroll data and submitting it to the IRS and state tax authorities. Employers must ensure that the information reported is accurate and reflects all wages paid to employees throughout the year. This form is essential for maintaining compliance with tax regulations and for providing employees with accurate income information for their personal tax filings.

Quick guide on how to complete annual wage reconciliation

Effortlessly prepare Annual Wage Reconciliation on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Annual Wage Reconciliation on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Annual Wage Reconciliation with ease

- Obtain Annual Wage Reconciliation and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes only seconds and holds the same legal validity as a conventional ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing additional copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Alter and eSign Annual Wage Reconciliation and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct annual wage reconciliation

Create this form in 5 minutes!

How to create an eSignature for the annual wage reconciliation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Annual Wage Reconciliation?

Annual Wage Reconciliation is the process of ensuring that the wages paid throughout the year match the amounts reported on an annual tax return. This reconciliation process is crucial for accurate tax reporting and compliance. Utilizing tools like airSlate SignNow can streamline your Annual Wage Reconciliation by providing efficient eSigning and document management.

-

How does airSlate SignNow support Annual Wage Reconciliation?

airSlate SignNow supports Annual Wage Reconciliation by allowing businesses to easily send and eSign necessary documents, such as wage reports and tax forms. Our platform makes document tracking easier, ensuring all forms are signed and submitted on time. This helps prevent errors and ensures compliance with tax regulations.

-

What features are included in airSlate SignNow for Annual Wage Reconciliation?

airSlate SignNow includes features such as customizable templates, secure eSigning, and automated workflows which are all beneficial for Annual Wage Reconciliation. These tools help reduce manual errors and save time during the busy tax season. Additionally, you can track document status and receive notifications for better management.

-

Is there a specific pricing model for Annual Wage Reconciliation services?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, making Annual Wage Reconciliation cost-effective. Depending on your usage and feature requirements, you can select a plan that best fits your needs. Our transparent pricing ensures you only pay for what you use.

-

Can airSlate SignNow integrate with payroll systems for Annual Wage Reconciliation?

Yes, airSlate SignNow can integrate seamlessly with various payroll systems, which is essential for effective Annual Wage Reconciliation. This integration allows for the automatic transfer of wage data and simplifies the document signing process. You can ensure synchronization between payroll records and your signed documents.

-

What benefits does eSigning offer for the Annual Wage Reconciliation process?

eSigning with airSlate SignNow offers numerous benefits for Annual Wage Reconciliation, including faster turnaround times, improved accuracy, and enhanced security. By digitizing the signing process, businesses can avoid the delays associated with paper documents and maintain a secure trail of consent. This increases productivity and reduces the risk of errors.

-

How can I ensure compliance during the Annual Wage Reconciliation process?

Ensuring compliance during Annual Wage Reconciliation involves using tools that provide audit trails and secure storage for your documents. airSlate SignNow ensures that your documents are legally binding and stored securely, making it easier to meet compliance requirements. Regularly updating your records and utilizing our features will help maintain accuracy.

Get more for Annual Wage Reconciliation

- R6140 823credit utilization formpursuant to th

- Washington state department of revenue business tax form

- File or amend my returnwashington department of revenue form

- Tax and fee reportingwashington state liquor and form

- November combined excise tax return november combined excise tax return form

- Confidential tax information authorization

- Buyers retail sales tax exemption certificate form

- Po box 9034 form fill out and sign printable

Find out other Annual Wage Reconciliation

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple