Hawaii Form N 288c

What is the Hawaii Form N 288c

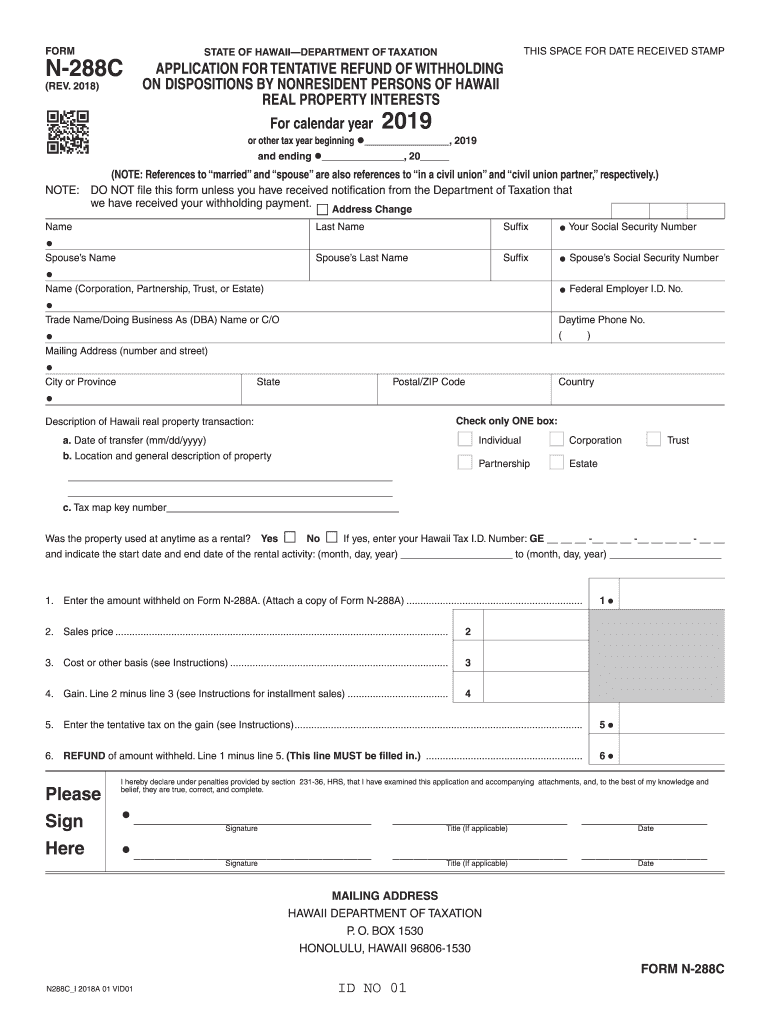

The Hawaii Form N 288c is a tax form used primarily for reporting the withholding of tax on dispositions of Hawaii real property by foreign persons. This form is crucial for ensuring compliance with the Hawaii Real Property Tax Act (HARPTA). By completing this form, sellers of real estate can report their tax obligations and ensure that the appropriate withholding is applied during the sale process. The form is specifically designed for transactions involving non-resident sellers, making it essential for foreign investors and real estate professionals operating in Hawaii.

How to use the Hawaii Form N 288c

Using the Hawaii Form N 288c involves several steps that ensure accurate reporting of tax withholdings. First, the seller must fill out the form with relevant information, including the seller's details, property information, and the amount realized from the sale. Next, the form must be submitted to the appropriate tax authority, along with any required documentation. It is important to ensure that all information is accurate and complete to avoid delays or penalties. The form can be used in conjunction with other tax forms, such as the Form N 288a, to provide a comprehensive overview of the transaction.

Steps to complete the Hawaii Form N 288c

Completing the Hawaii Form N 288c requires careful attention to detail. The following steps outline the process:

- Gather necessary information, including the seller's name, address, and taxpayer identification number.

- Provide details about the property being sold, including the address and sale price.

- Calculate the amount of tax to be withheld based on the sale price and applicable rates.

- Complete the form by entering all required information accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the Hawaii Department of Taxation along with any necessary supporting documents.

Legal use of the Hawaii Form N 288c

The legal use of the Hawaii Form N 288c is governed by state tax laws and regulations. This form serves as a declaration of the seller's tax obligations regarding the sale of real property. It is essential for ensuring compliance with HARPTA, which mandates withholding on certain real estate transactions involving foreign sellers. Failure to correctly complete and submit this form can result in penalties, including additional taxes owed or fines. Therefore, it is important for sellers and real estate professionals to understand the legal implications of using this form.

Key elements of the Hawaii Form N 288c

Several key elements must be included in the Hawaii Form N 288c to ensure its validity:

- Seller Information: Full name, address, and taxpayer identification number.

- Property Details: Address and description of the property being sold.

- Sale Price: Total amount realized from the sale.

- Withholding Calculation: The amount of tax to be withheld based on the sale price.

- Signature: The seller's signature certifying the accuracy of the information provided.

Form Submission Methods

The Hawaii Form N 288c can be submitted through various methods to accommodate different preferences. Sellers have the option to submit the form online, by mail, or in person. Online submission is often the quickest method, allowing for immediate processing. Mailing the form requires ensuring that it is sent to the correct address and may involve additional time for processing. In-person submission can provide immediate confirmation of receipt but may require scheduling an appointment or visiting a tax office during business hours.

Quick guide on how to complete form n 288c rev 2018 application for tentative refund of withholding on dispositions by nonresident persons of hawaii real

Complete Hawaii Form N 288c effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed paperwork, as you can access the required form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without any delays. Handle Hawaii Form N 288c on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric activity today.

How to modify and eSign Hawaii Form N 288c with ease

- Find Hawaii Form N 288c and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Shade important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to submit your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the concerns of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Hawaii Form N 288c to ensure smooth communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form n 288c rev 2018 application for tentative refund of withholding on dispositions by nonresident persons of hawaii real

How to make an eSignature for the Form N 288c Rev 2018 Application For Tentative Refund Of Withholding On Dispositions By Nonresident Persons Of Hawaii Real in the online mode

How to generate an electronic signature for your Form N 288c Rev 2018 Application For Tentative Refund Of Withholding On Dispositions By Nonresident Persons Of Hawaii Real in Chrome

How to create an electronic signature for signing the Form N 288c Rev 2018 Application For Tentative Refund Of Withholding On Dispositions By Nonresident Persons Of Hawaii Real in Gmail

How to make an electronic signature for the Form N 288c Rev 2018 Application For Tentative Refund Of Withholding On Dispositions By Nonresident Persons Of Hawaii Real from your mobile device

How to make an electronic signature for the Form N 288c Rev 2018 Application For Tentative Refund Of Withholding On Dispositions By Nonresident Persons Of Hawaii Real on iOS devices

How to generate an eSignature for the Form N 288c Rev 2018 Application For Tentative Refund Of Withholding On Dispositions By Nonresident Persons Of Hawaii Real on Android devices

People also ask

-

What is the significance of hawaii n288c in document signing?

Hawaii n288c refers to a specific regulatory compliance code that ensures digital signatures uphold legal standards in Hawaii. By using airSlate SignNow, businesses can confidently sign documents while adhering to the hawaii n288c requirements, ensuring their agreements are legally binding.

-

How does airSlate SignNow support hawaii n288c compliance?

airSlate SignNow is designed with compliance in mind, including features that align with hawaii n288c. Our platform includes advanced security features and audit trails that help maintain the integrity of documents, ensuring that all electronic signatures are compliant with local laws.

-

What are the pricing options for using airSlate SignNow for hawaii n288c?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Customers aiming to ensure hawaii n288c compliance can choose from affordable monthly or annual plans, providing access to features that facilitate secure and legal electronic signing.

-

What features does airSlate SignNow offer for hawaii n288c users?

Users of airSlate SignNow benefit from a range of features designed to support hawaii n288c compliance. These include customizable templates, secure storage, and an intuitive user interface, which streamline the document signing process while ensuring legal adherence.

-

Can airSlate SignNow integrate with other tools for hawaii n288c applications?

Yes, airSlate SignNow seamlessly integrates with numerous business applications to enhance workflow efficiency while ensuring hawaii n288c compliance. This integration allows users to sync with CRM systems, cloud storage solutions, and other productivity tools, optimizing the document management process.

-

What benefits does airSlate SignNow provide for businesses focusing on hawaii n288c?

Choosing airSlate SignNow helps businesses simplify their document signing process while meeting hawaii n288c standards. The platform not only speeds up transaction times but also enhances security, as all signatures are backed by robust authentication methods required for compliance.

-

How quickly can I start using airSlate SignNow for hawaii n288c signing?

Getting started with airSlate SignNow for hawaii n288c signing is fast and straightforward. Users can create an account in minutes, and with our easy-to-follow onboarding process, you can begin sending documents for electronic signature without delay.

Get more for Hawaii Form N 288c

- Em loyers flrst report of injury u s de lrtme t f l550 9 form

- Please print name please sign name form

- Adams change order revision 1 1 xlsx form

- Rent apartment contract template form

- Rent contract template form

- Rent deposit contract template form

- Rent house contract template form

- Rent out a room contract template form

Find out other Hawaii Form N 288c

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast