6 Rev PDF Form

What is the 6 Rev PDF?

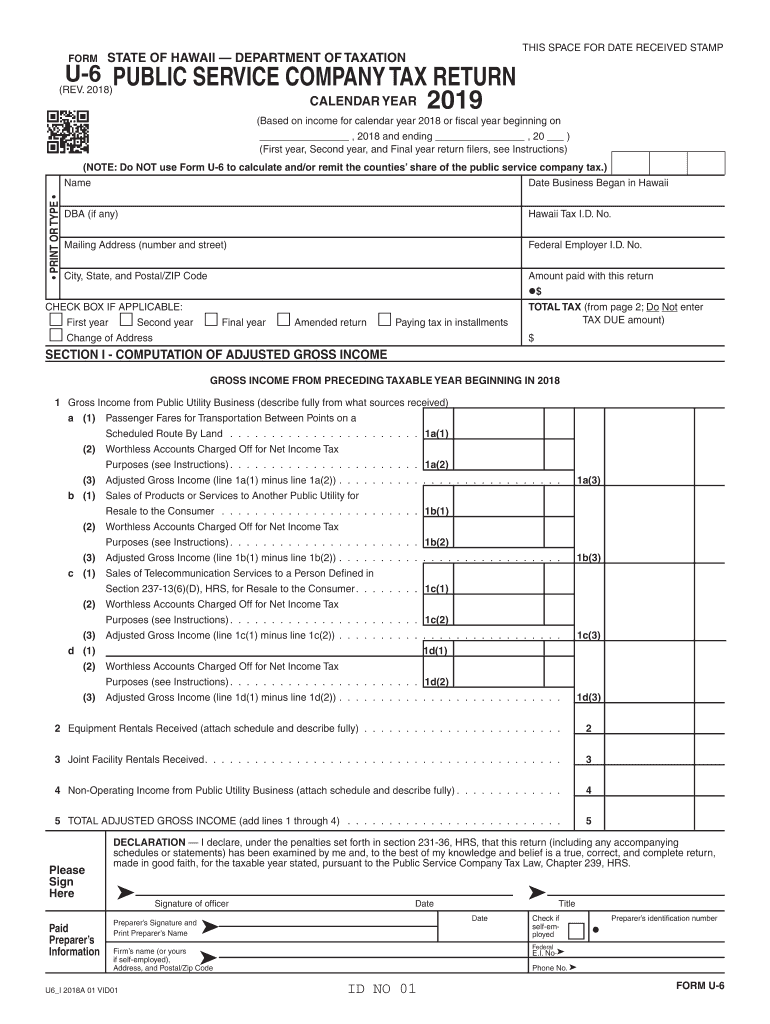

The 6 Rev PDF, also known as the Hawaii U-6 form, is a tax document used by businesses operating in Hawaii to report their income, expenses, and other relevant financial information. It is essential for ensuring compliance with state tax regulations. This form is particularly important for entities such as corporations, partnerships, and limited liability companies (LLCs) that need to file an annual return. Understanding the purpose and requirements of the Hawaii U-6 form is crucial for accurate tax reporting and avoiding potential penalties.

Steps to Complete the 6 Rev PDF

Completing the Hawaii U-6 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, balance sheets, and previous tax returns. Next, fill out the form by entering your business information, including the name, address, and tax identification number. Be sure to report all income and expenses accurately. After completing the form, review it for any errors or omissions. Finally, sign and date the form before submission.

Legal Use of the 6 Rev PDF

The Hawaii U-6 form is legally binding when completed and submitted according to state regulations. To ensure its legal standing, businesses must adhere to the guidelines set forth by the Hawaii Department of Taxation. This includes providing accurate information and maintaining compliance with all relevant tax laws. Additionally, using a secure platform for electronic submission can enhance the legal validity of the document, as it provides a digital certificate and audit trail.

Filing Deadlines / Important Dates

Filing deadlines for the Hawaii U-6 form are critical for compliance. Typically, the form must be submitted by the 20th day of the fourth month following the end of the tax year. For example, if your tax year ends on December 31, the due date for the form would be April 20 of the following year. It is essential to stay informed about any changes in deadlines or requirements to avoid late fees and penalties.

Required Documents

When preparing to file the Hawaii U-6 form, several documents are required to ensure accurate reporting. These may include:

- Income statements detailing all revenue sources

- Balance sheets summarizing assets, liabilities, and equity

- Previous tax returns for reference

- Receipts and invoices for deductible expenses

Having these documents readily available will facilitate a smoother completion process and help ensure compliance with state regulations.

Form Submission Methods

The Hawaii U-6 form can be submitted through various methods, including online, by mail, or in person. For online submissions, using a secure eSignature platform can streamline the process and enhance document security. If submitting by mail, ensure that the form is sent to the correct address and postmarked by the deadline. In-person submissions may be made at designated tax offices, providing an opportunity to ask questions directly to tax officials.

Quick guide on how to complete public service company tax hawaii department of taxation

Complete 6 Rev Pdf effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily access the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without holdups. Manage 6 Rev Pdf on any platform with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign 6 Rev Pdf seamlessly

- Locate 6 Rev Pdf and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize key sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature using the Sign feature, which takes seconds and has the same legal validity as a standard wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, and mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign 6 Rev Pdf and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the public service company tax hawaii department of taxation

How to generate an eSignature for your Public Service Company Tax Hawaii Department Of Taxation in the online mode

How to create an eSignature for the Public Service Company Tax Hawaii Department Of Taxation in Chrome

How to create an eSignature for signing the Public Service Company Tax Hawaii Department Of Taxation in Gmail

How to make an electronic signature for the Public Service Company Tax Hawaii Department Of Taxation right from your mobile device

How to create an electronic signature for the Public Service Company Tax Hawaii Department Of Taxation on iOS

How to generate an eSignature for the Public Service Company Tax Hawaii Department Of Taxation on Android devices

People also ask

-

What is the 2020 hawaii u 6 in relation to airSlate SignNow?

The 2020 hawaii u 6 refers to a specific service package offered by airSlate SignNow that enables users to manage documents and electronic signatures efficiently. This solution is particularly designed for businesses operating in Hawaii, providing them with local support and resources to excel in document management.

-

How does airSlate SignNow support the 2020 hawaii u 6?

AirSlate SignNow supports the 2020 hawaii u 6 by offering robust features tailored for businesses in Hawaii, such as secure e-signatures and document tracking. With our platform, businesses can streamline their operations and ensure compliance with local regulations while benefiting from a user-friendly interface.

-

What pricing options are available for the 2020 hawaii u 6?

The pricing for the 2020 hawaii u 6 varies based on the specific features and services required. AirSlate SignNow offers flexible subscription plans that cater to different business sizes and needs, ensuring that you get the best value while managing your document workflows effectively.

-

What features are included in the 2020 hawaii u 6 package?

The 2020 hawaii u 6 package includes essential features such as customizable templates, mobile-friendly e-signature options, and detailed audit trails. These features empower businesses to enhance efficiency and reduce turnaround time for their important documents.

-

Can the 2020 hawaii u 6 integrate with other tools?

Yes, the 2020 hawaii u 6 seamlessly integrates with various third-party applications, enhancing your document management workflow. You can connect airSlate SignNow with popular platforms such as Google Drive, Salesforce, and many others, ensuring a smooth transition between tools.

-

How does the 2020 hawaii u 6 benefit my business?

The 2020 hawaii u 6 provides numerous benefits, including increased efficiency, reduced operational costs, and improved document security. By utilizing airSlate SignNow, your business can accelerate processes and focus on more strategic initiatives, ultimately driving growth.

-

Is the 2020 hawaii u 6 suitable for all business sizes?

Absolutely! The 2020 hawaii u 6 is designed to meet the needs of businesses of all sizes, from startups to large enterprises. The adaptable features and pricing plans ensure that every business can leverage airSlate SignNow’s capabilities to enhance their document processes.

Get more for 6 Rev Pdf

- Addendum a for workers wells fargo insurance services form

- 2023wcocctax whitley county kentuckyreconciliat form

- Get treasurydirect gov form 1048 fs form 1048 claim for lost

- Ontario pharmacy smoking cessation program tspace form

- Remote work contract template form

- Renewable marriage contract template form

- Renewal contract template form

- Renewal email contract template form

Find out other 6 Rev Pdf

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online