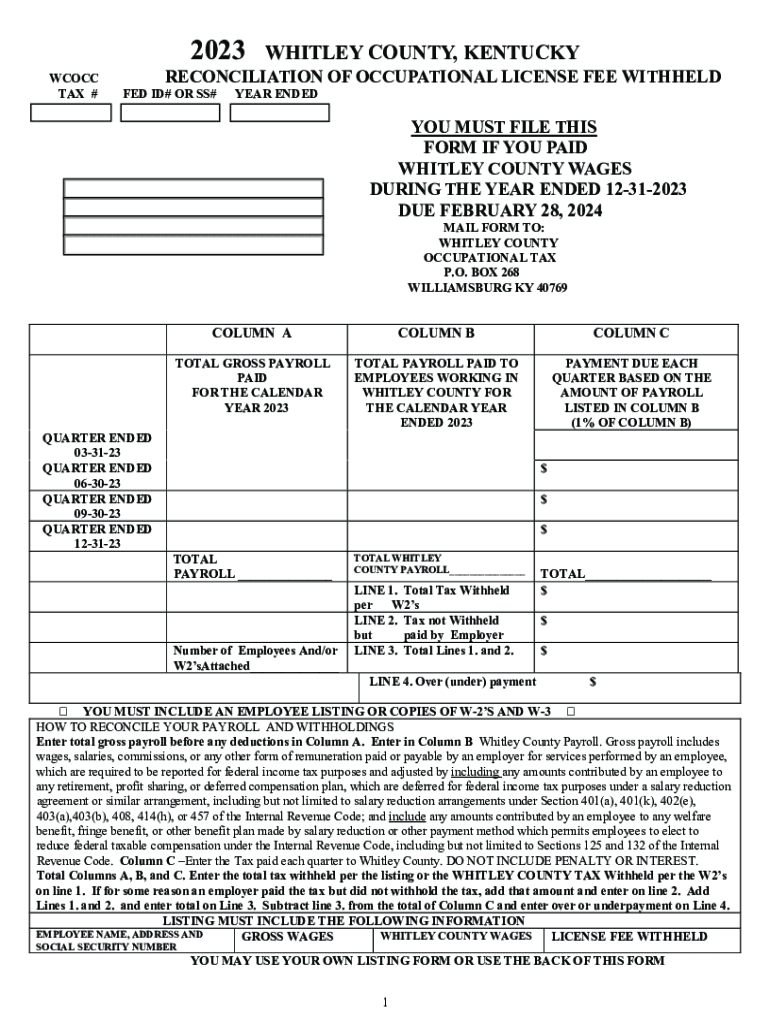

2023WCOCC TAX #WHITLEY COUNTY, KENTUCKYRECONCILIAT 2023

Understanding the Whitley County Occupational Tax

The Whitley County Occupational Tax is a local tax imposed on individuals and businesses operating within Whitley County, Kentucky. This tax is typically assessed on income earned within the county and is crucial for funding local services and infrastructure. Understanding this tax is essential for compliance and ensuring that all obligations are met.

Steps to Complete the Whitley County Occupational Tax Form

Filling out the Whitley County Occupational Tax form involves several steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Obtain the correct form, typically the 2023WCOCC, from the Whitley County tax office or their official website.

- Carefully fill out the form, ensuring all income is reported accurately.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either online, by mail, or in person.

Required Documents for Filing

When filing the Whitley County Occupational Tax, certain documents are required to support your income claims. These may include:

- W-2 forms from employers, detailing wages earned.

- 1099 forms for any freelance or contract work.

- Business income statements if self-employed.

- Any additional documentation that verifies income sources.

Filing Deadlines and Important Dates

It is important to be aware of the filing deadlines for the Whitley County Occupational Tax to avoid penalties. Typically, the tax return is due on April 15 of each year. However, it is advisable to check for any updates or changes to these deadlines through official county announcements.

Penalties for Non-Compliance

Failure to file the Whitley County Occupational Tax form or pay the owed tax can result in significant penalties. These may include:

- Late fees that accumulate over time.

- Interest on unpaid taxes.

- Potential legal action for severe non-compliance.

Legal Use of the Whitley County Occupational Tax Form

The Whitley County Occupational Tax form must be used in accordance with local laws and regulations. It is essential to ensure that the information provided is accurate and complete to avoid any legal repercussions. This form serves as a declaration of income and is used to calculate the tax owed to the county.

Quick guide on how to complete 2023wcocctax whitley county kentuckyreconciliat

Effortlessly prepare 2023WCOCC TAX #WHITLEY COUNTY, KENTUCKYRECONCILIAT on any device

Digital document management has become increasingly popular with companies and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to generate, modify, and electronically sign your documents quickly and without any holdups. Manage 2023WCOCC TAX #WHITLEY COUNTY, KENTUCKYRECONCILIAT on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and electronically sign 2023WCOCC TAX #WHITLEY COUNTY, KENTUCKYRECONCILIAT with ease

- Obtain 2023WCOCC TAX #WHITLEY COUNTY, KENTUCKYRECONCILIAT and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark relevant parts of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign 2023WCOCC TAX #WHITLEY COUNTY, KENTUCKYRECONCILIAT to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2023wcocctax whitley county kentuckyreconciliat

Create this form in 5 minutes!

How to create an eSignature for the 2023wcocctax whitley county kentuckyreconciliat

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Whitley County occupational tax?

Whitley County occupational tax is a tax levied on individuals working within Whitley County, designed to fund local services and infrastructure. Understanding this tax is essential for both employers and employees to ensure compliance and proper tax payments.

-

How does airSlate SignNow assist with Whitley County occupational tax documentation?

AirSlate SignNow provides an efficient platform for managing Whitley County occupational tax documents, enabling users to eSign and send necessary forms quickly. This streamlines the process, reduces paperwork, and ensures compliance with local tax regulations.

-

What features does airSlate SignNow offer for managing occupational tax documents in Whitley County?

AirSlate SignNow offers features such as secure eSignatures, document templates, and real-time tracking for Whitley County occupational tax documents. These tools help businesses and employees efficiently manage their tax-related paperwork, ensuring nothing gets overlooked.

-

Is there a cost associated with using airSlate SignNow for occupational tax forms?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs when managing Whitley County occupational tax forms. Our plans are designed to be cost-effective, ensuring you receive excellent value for your investment.

-

Can I integrate airSlate SignNow with other software to manage Whitley County occupational tax requirements?

Absolutely! AirSlate SignNow seamlessly integrates with many business applications, which makes handling Whitley County occupational tax requirements easier. This integration helps automate workflows, saving time and reducing the potential for errors.

-

What are the benefits of using airSlate SignNow for Whitley County occupational tax processes?

Using airSlate SignNow for Whitley County occupational tax processes enhances efficiency, reduces processing time, and ensures document security. It allows businesses to maintain compliance while simplifying their tax management workflow.

-

How secure is airSlate SignNow for handling sensitive tax information?

AirSlate SignNow ensures the security of sensitive information regarding Whitley County occupational tax by employing advanced encryption and secure cloud storage. Your documents are safe and accessible only to authorized users, providing peace of mind.

Get more for 2023WCOCC TAX #WHITLEY COUNTY, KENTUCKYRECONCILIAT

- Additional submittal form

- Code of conduct due to legal restrictions it is n form

- Banner permit applicationdepartment of streets form

- 643 quince street mendota ca 93640 form

- Redbook forms 495611469

- Tree bank registration form

- 8 kentucky eye examination form for school en

- Applications and formslake worth texasbuilding permits lake worth beachbuilding permits lake worth beachlake worth texas

Find out other 2023WCOCC TAX #WHITLEY COUNTY, KENTUCKYRECONCILIAT

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure