Hitax Hawaii State Gov Form N 884 N 11

What is the Hitax Hawaii State Gov Form N-884 N-11?

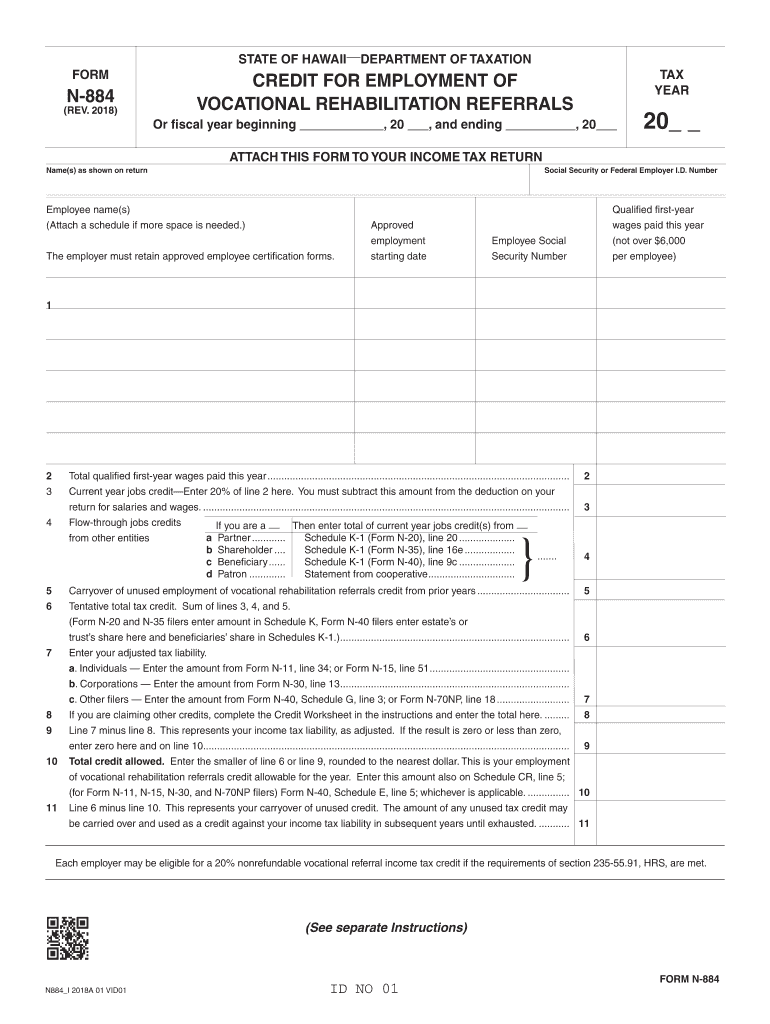

The Hitax Hawaii State Gov Form N-884 N-11 is a tax-related document used by residents of Hawaii for specific taxation purposes. This form is essential for individuals who need to report certain income or claim specific tax benefits. Understanding the purpose and requirements of this form is crucial for compliance with state tax regulations.

How to use the Hitax Hawaii State Gov Form N-884 N-11

Using the Hitax Hawaii State Gov Form N-884 N-11 involves several steps. First, ensure you have all necessary personal information and documentation ready, such as your Social Security number and income statements. Next, download the form from the official state website or access it through a digital platform that supports electronic signatures. After filling out the required fields accurately, review the form for any errors before submission. This ensures that your application is processed smoothly and efficiently.

Steps to complete the Hitax Hawaii State Gov Form N-884 N-11

Completing the Hitax Hawaii State Gov Form N-884 N-11 requires attention to detail. Follow these steps:

- Gather all necessary documents, including income statements and identification.

- Download the form from the official Hawaii state website.

- Fill in your personal information, ensuring accuracy in all fields.

- Provide details related to your income and any deductions you wish to claim.

- Review the completed form for any mistakes or missing information.

- Submit the form electronically or via mail, depending on your preference.

Legal use of the Hitax Hawaii State Gov Form N-884 N-11

The Hitax Hawaii State Gov Form N-884 N-11 is legally recognized when completed and submitted according to state regulations. To ensure its legal standing, it must be filled out accurately and submitted by the designated deadlines. Compliance with the relevant tax laws is essential to avoid penalties or legal issues.

Key elements of the Hitax Hawaii State Gov Form N-884 N-11

Several key elements are crucial when completing the Hitax Hawaii State Gov Form N-884 N-11:

- Personal Information: Your name, address, and Social Security number.

- Income Details: Accurate reporting of all income sources.

- Deductions: Information on any deductions you are eligible to claim.

- Signature: A valid signature is required to validate the form.

Filing Deadlines / Important Dates

Filing deadlines for the Hitax Hawaii State Gov Form N-884 N-11 are critical to ensure compliance with state tax regulations. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for individual taxpayers. It is advisable to check for any updates or changes to these dates annually, as they may vary.

Quick guide on how to complete form n 884 rev 2018 forms 2018

Effortlessly Prepare Hitax Hawaii State Gov Form N 884 N 11 on Any Device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed papers, allowing you to obtain the correct form and safely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without any holdups. Manage Hitax Hawaii State Gov Form N 884 N 11 on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The simplest way to modify and eSign Hitax Hawaii State Gov Form N 884 N 11 with ease

- Find Hitax Hawaii State Gov Form N 884 N 11 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and then click on the Done button to store your modifications.

- Choose your preferred method to send your form, whether by email, text (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing out new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Alter and eSign Hitax Hawaii State Gov Form N 884 N 11 and ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form n 884 rev 2018 forms 2018

How to generate an eSignature for your Form N 884 Rev 2018 Forms 2018 in the online mode

How to create an electronic signature for the Form N 884 Rev 2018 Forms 2018 in Google Chrome

How to create an eSignature for putting it on the Form N 884 Rev 2018 Forms 2018 in Gmail

How to make an eSignature for the Form N 884 Rev 2018 Forms 2018 right from your smartphone

How to generate an eSignature for the Form N 884 Rev 2018 Forms 2018 on iOS

How to generate an eSignature for the Form N 884 Rev 2018 Forms 2018 on Android

People also ask

-

What is the Hitax Hawaii State Gov Form N 884 N 11?

The Hitax Hawaii State Gov Form N 884 N 11 is a specific tax form required by the state of Hawaii for certain tax filings. It is essential for businesses and individuals to ensure compliance with Hawaii tax regulations. Using airSlate SignNow can simplify the process of completing and submitting this form electronically.

-

How can airSlate SignNow help me with the Hitax Hawaii State Gov Form N 884 N 11?

airSlate SignNow offers a seamless platform for filling out and eSigning the Hitax Hawaii State Gov Form N 884 N 11. Our user-friendly interface allows you to easily upload, edit, and send your tax documents, ensuring that they are completed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for the Hitax Hawaii State Gov Form N 884 N 11?

Yes, airSlate SignNow provides various pricing plans to cater to different business needs, including options for handling the Hitax Hawaii State Gov Form N 884 N 11. We offer flexible subscription models that allow you to choose the plan that best fits your budget and requirements.

-

What features does airSlate SignNow provide for managing the Hitax Hawaii State Gov Form N 884 N 11?

airSlate SignNow includes features such as document templates, eSigning, and secure cloud storage, making it easy to manage the Hitax Hawaii State Gov Form N 884 N 11. Additionally, our platform allows for real-time collaboration, enabling multiple users to work on the document simultaneously.

-

Can I integrate airSlate SignNow with other applications to handle the Hitax Hawaii State Gov Form N 884 N 11?

Absolutely! airSlate SignNow supports integrations with various applications such as Google Drive, Dropbox, and CRM systems. This makes it easier to manage and store your documents, including the Hitax Hawaii State Gov Form N 884 N 11, within your existing workflow.

-

What are the benefits of using airSlate SignNow for the Hitax Hawaii State Gov Form N 884 N 11?

Using airSlate SignNow for the Hitax Hawaii State Gov Form N 884 N 11 streamlines the filing process, reduces paperwork, and minimizes errors. Our solution ensures that your documents are securely signed and stored, saving you time and enhancing your productivity.

-

How secure is my information when using airSlate SignNow for the Hitax Hawaii State Gov Form N 884 N 11?

airSlate SignNow prioritizes the security of your information. We use advanced encryption and secure servers to protect your data while you complete and submit the Hitax Hawaii State Gov Form N 884 N 11, ensuring your sensitive tax information remains confidential.

Get more for Hitax Hawaii State Gov Form N 884 N 11

- Assu rant health medical expense examples list form

- Occupational tax rates form

- Maximizing the benefits of housing vouchers in new york form

- Ds 115 used by out of state drivers to request restoration of their new york state driving privileges following a revocation of form

- Title and registration license plates issued form

- Utah duplicate title application form fillable tc 123

- Form oh bmv 4826 fill online printable fillable blank

- Remix contract template form

Find out other Hitax Hawaii State Gov Form N 884 N 11

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT