Occupational Tax Rates 2023

Understanding Occupational Tax Rates

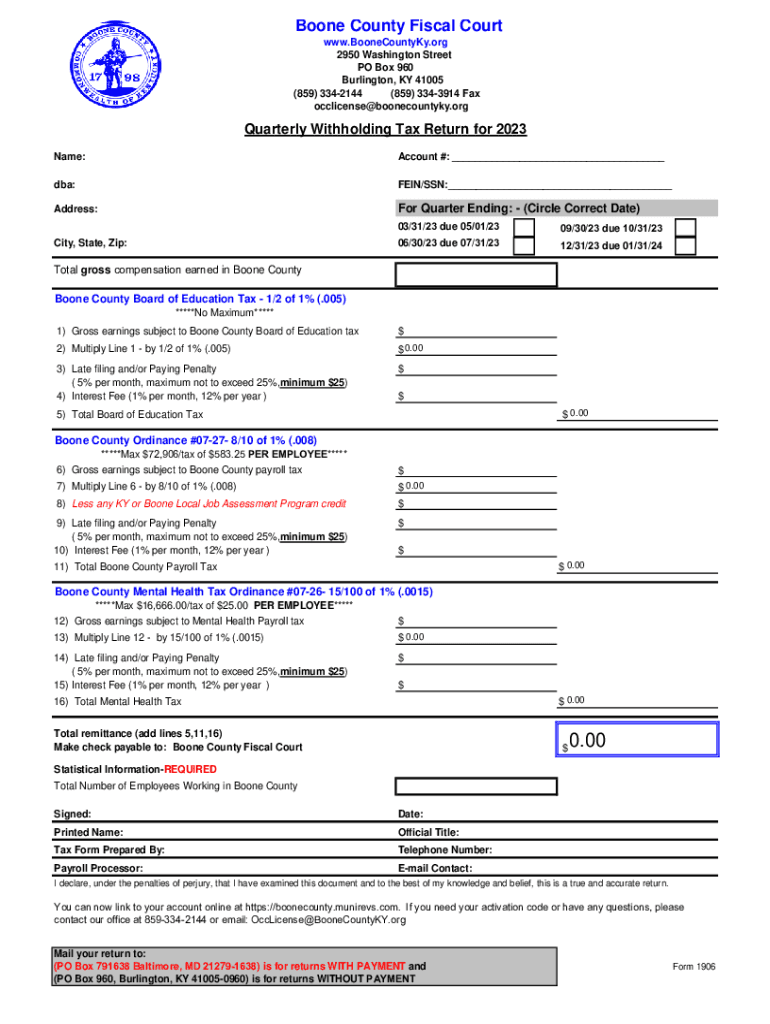

The Boone County quarterly withholding tax return is closely tied to the occupational tax rates established by local government authorities. Occupational tax rates are the percentages applied to an employee's wages to determine the amount withheld for local taxes. These rates can vary significantly depending on the municipality and the nature of the business. It is essential for employers to be aware of the specific rates applicable to their business operations in Boone County to ensure compliance with local tax laws.

Steps to Complete the Occupational Tax Rates

To accurately complete the Boone County quarterly withholding tax return, follow these steps:

- Gather employee wage information, including gross wages for the quarter.

- Determine the applicable occupational tax rate for your business based on the latest local regulations.

- Calculate the total occupational tax withheld by multiplying the gross wages by the applicable rate.

- Complete the quarterly withholding tax return form, ensuring all required fields are filled out accurately.

- Review the completed form for accuracy before submission.

Filing Deadlines and Important Dates

Timely filing of the Boone County quarterly withholding tax return is crucial to avoid penalties. The deadlines for submission typically fall on the last day of the month following the end of each quarter. This means that for the first quarter, the return is due by April 30, for the second quarter by July 31, for the third quarter by October 31, and for the fourth quarter by January 31 of the following year. It is advisable to mark these dates on your calendar to ensure compliance.

Required Documents for Filing

When preparing to file the Boone County quarterly withholding tax return, it is important to have the following documents ready:

- Employee wage records for the quarter.

- Previous quarter’s tax return for reference.

- Documentation of any changes in employee status or tax rates.

- Any additional forms required by local tax authorities.

Form Submission Methods

The Boone County quarterly withholding tax return can be submitted through various methods. Employers can choose to file online through the local tax authority’s website, which often provides a streamlined process. Alternatively, forms can be submitted via mail or in person at designated tax offices. It is important to ensure that the chosen method is secure and that the form is submitted before the deadline to avoid any penalties.

Penalties for Non-Compliance

Failure to file the Boone County quarterly withholding tax return on time can result in significant penalties. These may include fines based on the amount of tax owed and interest on any unpaid taxes. Additionally, repeated non-compliance can lead to more severe consequences, including legal action. It is essential for businesses to adhere to filing requirements to maintain good standing with local tax authorities.

Quick guide on how to complete occupational tax rates

Effortlessly Prepare Occupational Tax Rates on Any Gadget

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal, eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary forms and securely save them online. airSlate SignNow equips you with all the resources you need to swiftly create, modify, and electronically sign your documents without delays. Handle Occupational Tax Rates on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign Occupational Tax Rates with Ease

- Locate Occupational Tax Rates and click on Get Form to begin.

- Make use of the tools we supply to fill out your form.

- Emphasize relevant portions of the documents or obscure sensitive information using the tools specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your desired method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Occupational Tax Rates and ensure exceptional communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct occupational tax rates

Create this form in 5 minutes!

How to create an eSignature for the occupational tax rates

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Boone County quarterly withholding tax return?

The Boone County quarterly withholding tax return is a tax document that businesses in Boone County need to submit every quarter to report withheld income taxes from employees' wages. Filing this return accurately is crucial to remain compliant with local tax regulations. airSlate SignNow can simplify this process, allowing you to eSign and send your returns with ease.

-

How can airSlate SignNow help with my Boone County quarterly withholding tax return?

airSlate SignNow provides an easy-to-use platform for preparing and eSigning your Boone County quarterly withholding tax return. Our solution ensures that all documents are organized and securely stored, making it simple to retrieve and submit tax returns when required. You can also track the status of your documents in real-time.

-

Is there a cost associated with using airSlate SignNow for the Boone County quarterly withholding tax return?

Yes, there is a cost for using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Our pricing structure is transparent, allowing you to choose the plan that best fits your needs. The time and resources saved in completing your Boone County quarterly withholding tax return typically outweigh the investment.

-

What features does airSlate SignNow offer for tax returns like the Boone County quarterly withholding tax return?

airSlate SignNow offers a range of features tailored for tax return management, including document templates, eSignature capabilities, and automated reminders. These features help streamline the process of preparing your Boone County quarterly withholding tax return, reducing the likelihood of errors and ensuring timely submissions.

-

Can I integrate airSlate SignNow with my existing accounting software for the Boone County quarterly withholding tax return?

Yes, airSlate SignNow can integrate with various accounting software to facilitate the seamless preparation of your Boone County quarterly withholding tax return. This integration ensures that all your financial data is up-to-date and readily available, enhancing the accuracy of your tax submissions.

-

What are the benefits of eSigning my Boone County quarterly withholding tax return?

eSigning your Boone County quarterly withholding tax return with airSlate SignNow provides several benefits, including enhanced efficiency and security. You can sign documents from anywhere at any time, eliminating the need for printing and mailing. Additionally, eSigned documents come with built-in verification features, ensuring their integrity.

-

How does airSlate SignNow ensure the security of my Boone County quarterly withholding tax return?

Security is a top priority for airSlate SignNow, and we implement robust measures to protect your Boone County quarterly withholding tax return. Our platform uses encryption and secure cloud storage to safeguard your documents from unauthorized access, ensuring your sensitive information remains confidential.

Get more for Occupational Tax Rates

- Acd31094 rev 07012023new mexico taxation and rev form

- Form it 40 state form 47907 county tax schedule state

- Form st 9 single location virginia retail sales and use tax return virginia retail sales and use tax return form st 9 single

- Form pte virginia pass through credit allocation virginia form pte pass through credit allocation

- Form 1040 v payment voucher

- Form 990 pf return of private foundation or section 4947a1 trust treated as private foundation

- Pr 78ssta streamlined sales ampamp use tax agreement certificate of form

- New mexico income taxes and nm state tax forms efile com

Find out other Occupational Tax Rates

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy