Hawaii 323 Form

What is the Hawaii N 323?

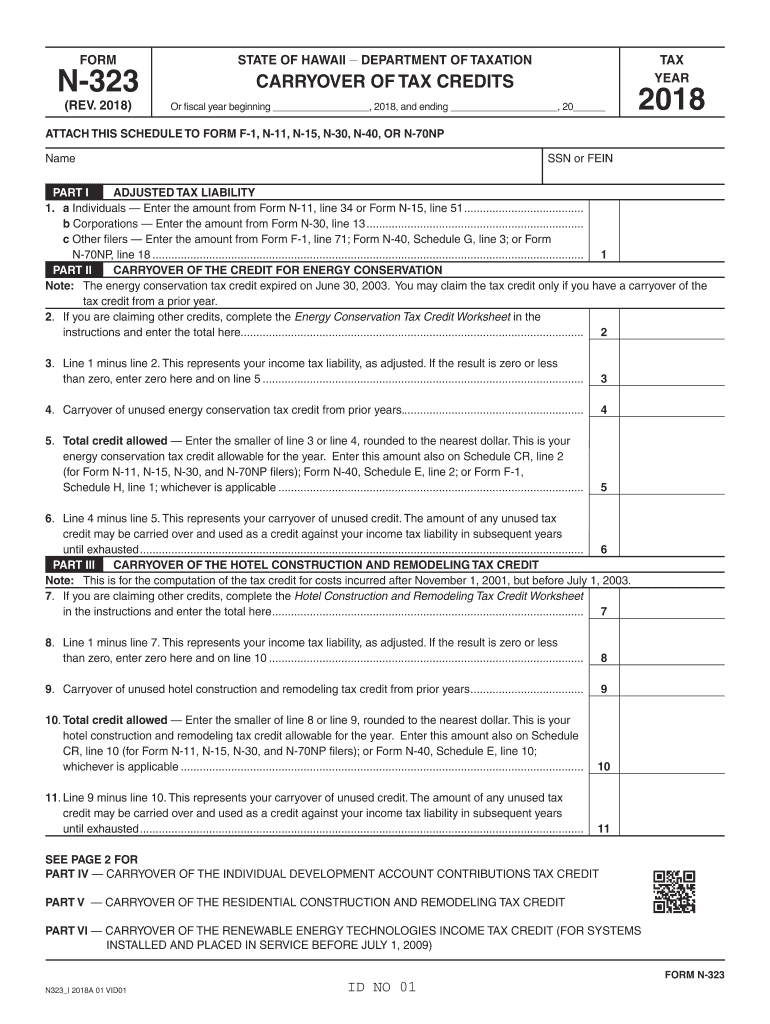

The Hawaii N 323 is a tax form used by residents of Hawaii to report certain tax information. Specifically, it is designed for individuals and businesses to claim a carryover of tax credits from previous years. This form is essential for ensuring that taxpayers receive the benefits they are entitled to, especially when it comes to state-specific tax credits. Understanding the purpose and requirements of the Hawaii N 323 is crucial for accurate tax reporting and compliance.

How to use the Hawaii N 323

Using the Hawaii N 323 involves several steps to ensure that the form is filled out correctly. First, gather all necessary documentation related to your tax credits and any previous tax returns that may affect your claim. Next, carefully follow the instructions provided with the form, ensuring that each section is completed accurately. It is advisable to review the form for any errors before submission, as inaccuracies can lead to delays or penalties.

Steps to complete the Hawaii N 323

Completing the Hawaii N 323 requires attention to detail. Here are the key steps:

- Gather all relevant tax documents, including prior year returns and credit information.

- Fill out the personal information section, ensuring accuracy in your name and identification details.

- Detail the specific credits you are claiming, referencing prior tax years as necessary.

- Review the form for completeness and accuracy, checking all calculations.

- Submit the completed form by the designated deadline, either online or by mail.

Legal use of the Hawaii N 323

The Hawaii N 323 is legally binding when filled out and submitted in accordance with state tax laws. It is important to ensure that all information provided is truthful and accurate, as any discrepancies can result in legal penalties. The form must be signed and dated by the taxpayer or an authorized representative to validate its submission. Compliance with all state regulations surrounding the use of this form is essential for maintaining good standing with the Hawaii Department of Taxation.

Filing Deadlines / Important Dates

Filing deadlines for the Hawaii N 323 are crucial for taxpayers to observe. Typically, the form must be submitted by the same deadline as your state income tax return. For most taxpayers, this date falls on April 20 of each year. However, if you are filing for an extension, be sure to check the specific extended deadlines applicable to your situation. Missing these deadlines can lead to penalties and interest on any unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

The Hawaii N 323 can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file online through the Hawaii Department of Taxation's e-filing system, which offers a streamlined process. Alternatively, the form can be mailed to the appropriate tax office, ensuring that it is postmarked by the filing deadline. In-person submissions are also accepted at designated tax offices, providing an option for those who prefer direct interaction.

Quick guide on how to complete form n 323 2018 carryover of tax credits forms 2018

Complete Hawaii 323 seamlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Hawaii 323 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented task today.

How to modify and electronically sign Hawaii 323 with ease

- Find Hawaii 323 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device you choose. Alter and electronically sign Hawaii 323 to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form n 323 2018 carryover of tax credits forms 2018

How to make an eSignature for your Form N 323 2018 Carryover Of Tax Credits Forms 2018 in the online mode

How to create an electronic signature for your Form N 323 2018 Carryover Of Tax Credits Forms 2018 in Chrome

How to create an electronic signature for signing the Form N 323 2018 Carryover Of Tax Credits Forms 2018 in Gmail

How to make an eSignature for the Form N 323 2018 Carryover Of Tax Credits Forms 2018 straight from your smartphone

How to make an eSignature for the Form N 323 2018 Carryover Of Tax Credits Forms 2018 on iOS devices

How to create an eSignature for the Form N 323 2018 Carryover Of Tax Credits Forms 2018 on Android OS

People also ask

-

What is the importance of hawaii n 323 tax for businesses?

The hawaii n 323 tax is crucial for businesses operating in Hawaii as it ensures compliance with state tax regulations. Understanding this tax can help businesses avoid penalties and maintain good standing. Utilizing tools like airSlate SignNow can streamline the documentation process related to this tax.

-

How can airSlate SignNow help with hawaii n 323 tax compliance?

airSlate SignNow simplifies the document management process needed for hawaii n 323 tax compliance by allowing businesses to easily create, send, and eSign necessary forms. Our platform ensures that all documents meet state requirements, reducing the risk of errors and delays. This efficiency supports timely submissions and adherence to tax obligations.

-

What features does airSlate SignNow offer that are relevant to hawaii n 323 tax documentation?

Key features of airSlate SignNow relevant to hawaii n 323 tax documentation include customizable templates, secure eSigning, and real-time tracking of document status. These features enhance the user experience by ensuring that all needed documents are readily accessible and can be executed quickly. Additionally, the platform's compliance checks can help ensure all forms are filled out correctly.

-

Is there a cost associated with using airSlate SignNow for hawaii n 323 tax documents?

Yes, airSlate SignNow is a cost-effective solution for managing hawaii n 323 tax documents. Our pricing plans are designed to fit the budgets of various businesses while ensuring access to comprehensive features. By investing in airSlate SignNow, businesses can save time and resources in managing tax documentation.

-

Can airSlate SignNow be integrated with other software for hawaii n 323 tax processing?

Absolutely! airSlate SignNow offers integrations with various accounting software and tax preparation tools that are essential for managing hawaii n 323 tax processing. This connectivity ensures that all your financial data flows seamlessly, allowing for efficient document management and reporting. Integration enhances productivity and minimizes manual entry.

-

What benefits does airSlate SignNow provide for tracking hawaii n 323 tax submissions?

With airSlate SignNow, businesses gain the advantage of real-time tracking of hawaii n 323 tax submission statuses. Users are notified when documents are viewed, signed, and completed, ensuring transparency throughout the process. This capability fosters accountability and helps businesses meet their compliance deadlines efficiently.

-

How secure is airSlate SignNow for handling confidential hawaii n 323 tax documents?

Security is a top priority for airSlate SignNow, especially when handling sensitive hawaii n 323 tax documents. Our platform employs advanced encryption and authentication measures to protect your data. Clients can trust that their confidential information is safeguarded against unauthorized access.

Get more for Hawaii 323

Find out other Hawaii 323

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself