Michigan Tax Form 163

What is the Michigan Tax Form 163

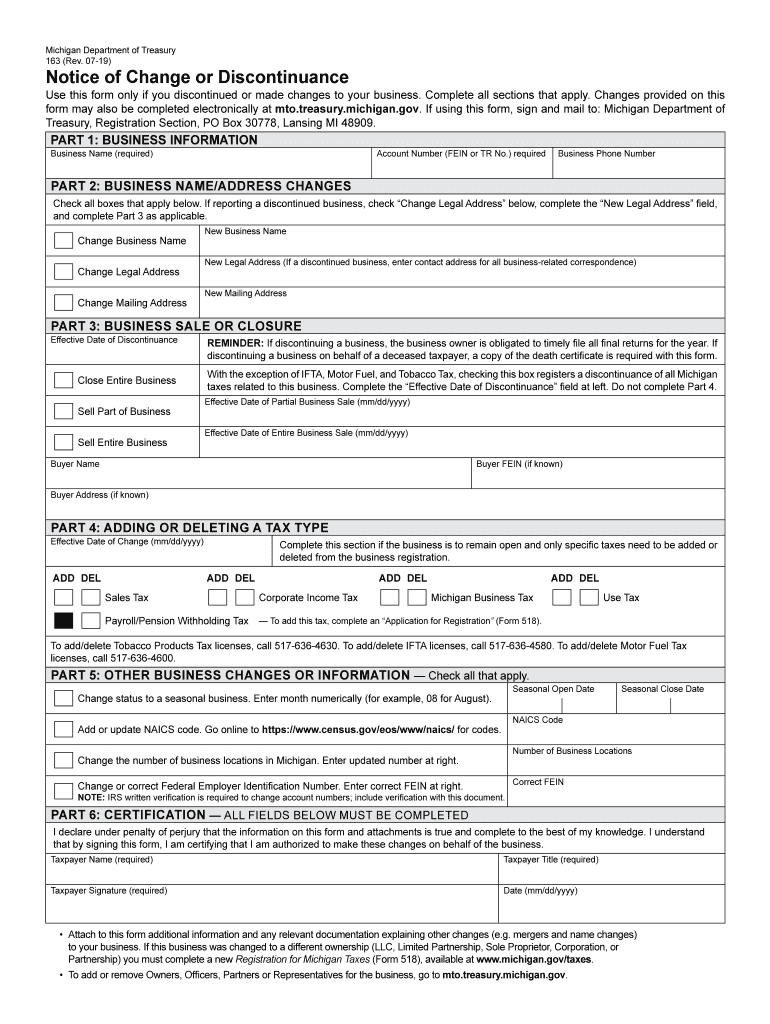

The Michigan Tax Form 163 is a vital document used for reporting certain tax-related information to the Michigan Department of Treasury. This form is specifically designed for businesses and individuals who need to notify the state about the discontinuance of a business or a change in business operations. It is essential for maintaining compliance with state tax laws and ensuring that all necessary information is accurately reported.

How to use the Michigan Tax Form 163

Using the Michigan Form 163 involves filling out the required sections accurately to reflect the status of your business. This includes providing details such as the business name, address, and the specific reasons for discontinuance or changes. It is crucial to ensure that all information is complete and correct to avoid any issues with the state. Once completed, the form must be submitted to the appropriate department to fulfill your reporting obligations.

Steps to complete the Michigan Tax Form 163

Completing the Michigan Form 163 requires careful attention to detail. Here are the steps to follow:

- Gather all necessary business information, including your business name, address, and tax identification number.

- Clearly indicate the reason for discontinuance or change in business operations.

- Fill out all required fields on the form, ensuring accuracy in your entries.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail to the Michigan Department of Treasury.

Legal use of the Michigan Tax Form 163

The Michigan Form 163 holds legal significance when it comes to reporting business changes to the state. To be considered legally valid, the form must be completed accurately and submitted in accordance with state regulations. Electronic submission is permissible, provided that the e-signature used complies with applicable laws. This ensures that the form is recognized as a legitimate document for legal and tax purposes.

Key elements of the Michigan Tax Form 163

Understanding the key elements of the Michigan Form 163 is essential for proper completion. Important components include:

- Business Identification: This includes the name and address of the business.

- Reason for Discontinuance: A clear explanation of why the business is discontinuing operations.

- Signature: The form must be signed by an authorized representative of the business.

- Date of Submission: The date when the form is submitted is crucial for compliance tracking.

Form Submission Methods

The Michigan Form 163 can be submitted through various methods to accommodate different preferences. Options include:

- Online Submission: Completing and submitting the form electronically through the Michigan Department of Treasury's website.

- Mail: Printing the completed form and sending it via postal service to the designated address.

- In-Person: Delivering the form directly to a local Michigan Department of Treasury office.

Quick guide on how to complete michigan notice of discontinuance formampquot keyword found

Prepare Michigan Tax Form 163 with ease on any device

Managing documents online has become increasingly favored by companies and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Handle Michigan Tax Form 163 across any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign Michigan Tax Form 163 effortlessly

- Find Michigan Tax Form 163 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to store your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, or mistakes requiring new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Modify and eSign Michigan Tax Form 163 and guarantee exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan notice of discontinuance formampquot keyword found

How to generate an electronic signature for the Michigan Notice Of Discontinuance Form' Keyword Found online

How to create an electronic signature for your Michigan Notice Of Discontinuance Form' Keyword Found in Chrome

How to create an electronic signature for putting it on the Michigan Notice Of Discontinuance Form' Keyword Found in Gmail

How to generate an electronic signature for the Michigan Notice Of Discontinuance Form' Keyword Found from your smartphone

How to make an electronic signature for the Michigan Notice Of Discontinuance Form' Keyword Found on iOS

How to generate an electronic signature for the Michigan Notice Of Discontinuance Form' Keyword Found on Android devices

People also ask

-

What is Michigan Form 163 and how can airSlate SignNow assist with it?

Michigan Form 163 is a crucial document used for various tax purposes in Michigan. airSlate SignNow simplifies the process of completing and signing this form electronically, allowing businesses to enhance efficiency and reduce paperwork. With our platform, you can sign and send Michigan Form 163 securely and quickly.

-

Is airSlate SignNow compatible with Michigan Form 163?

Absolutely! airSlate SignNow is fully compatible with Michigan Form 163, providing a seamless way to complete and sign the form. Our platform ensures that all signatures and form data are captured accurately, facilitating compliance and reducing errors.

-

What are the pricing options for using airSlate SignNow for Michigan Form 163?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, starting with a free trial. This allows you to explore all features related to Michigan Form 163 without any initial investment. Our competitive pricing ensures that you get an easy-to-use solution that doesn't break the bank.

-

What features does airSlate SignNow offer for managing Michigan Form 163?

Our platform provides advanced features such as document templates, bulk sending, and secure e-signatures specifically designed for Michigan Form 163. These features streamline the workflow, making it easy for you to prepare, send, and track your documents all in one place.

-

How does using airSlate SignNow benefit my business when handling Michigan Form 163?

By using airSlate SignNow for Michigan Form 163, you enhance your document management efficiency and reduce turnaround times. Our electronic signing process not only saves time but also helps maintain compliance with state regulations, allowing you to focus on more critical aspects of your business.

-

Can airSlate SignNow integrate with other tools for managing Michigan Form 163?

Yes, airSlate SignNow offers numerous integrations with popular business applications to streamline your workflow when managing Michigan Form 163. Whether you're using CRMs, document storage solutions, or other software, our platform can integrate seamlessly to enhance your productivity.

-

Is it secure to sign Michigan Form 163 using airSlate SignNow?

Definitely! airSlate SignNow prioritizes security and compliance when handling Michigan Form 163. We utilize encryption and secure methods to ensure that your documents and signatures are protected throughout the entire signing process.

Get more for Michigan Tax Form 163

- Louisiana sales tax form

- Kentucky resale print form

- R1029i 823sales tax return general instructions form

- Pa chapter american academy of pediatrics updated july form

- The red book resources for employment supports form

- Recruit contract template form

- Recruiter contract template form

- Recruitment agency client contract template form

Find out other Michigan Tax Form 163

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form