Louisiana Sales Tax Form 2023-2026

What is the Louisiana Sales Tax Form

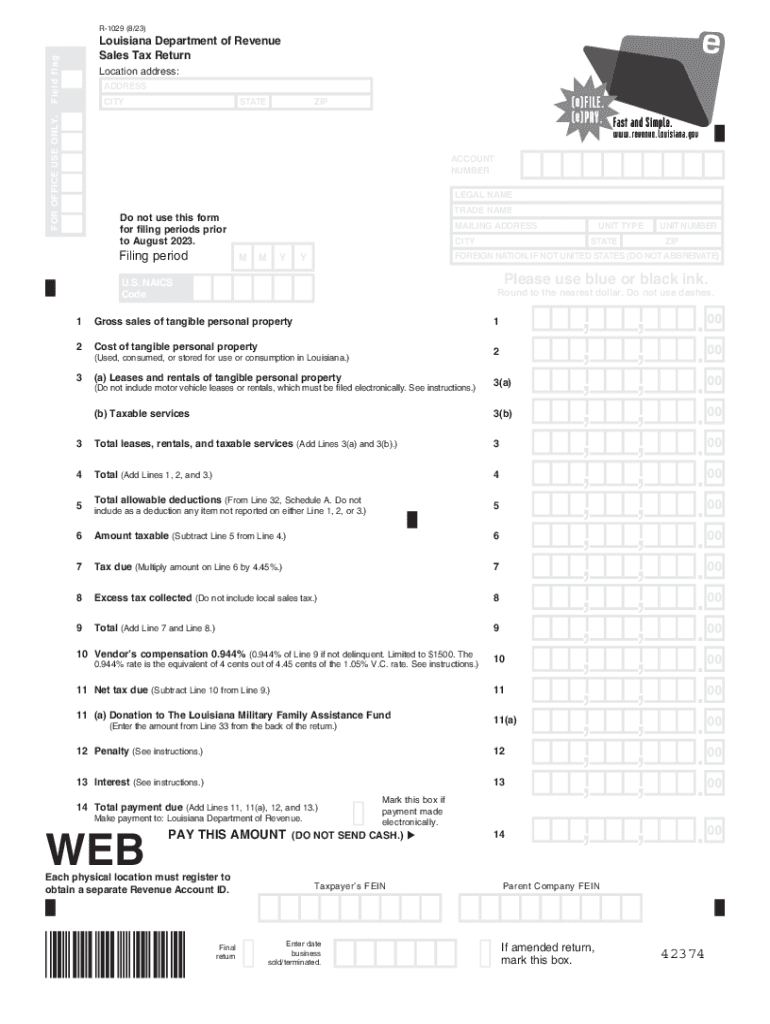

The Louisiana sales tax form, specifically the R-1029, is a document used by businesses to report and remit sales tax collected on taxable sales within the state. This form is essential for ensuring compliance with state tax regulations and helps facilitate the proper allocation of tax revenue to local jurisdictions. The R-1029 form is designed to capture various details related to sales transactions, including the total sales amount, taxable sales, and the total sales tax due.

How to use the Louisiana Sales Tax Form

To effectively use the Louisiana sales tax form, businesses must first gather all relevant sales data for the reporting period. This includes sales receipts, invoices, and any documentation that supports the reported figures. Once the data is collected, businesses can fill out the R-1029 form by entering the required information in the designated fields. It is important to ensure accuracy to avoid potential penalties. After completing the form, businesses must submit it to the Louisiana Department of Revenue along with the payment for any sales tax owed.

Steps to complete the Louisiana Sales Tax Form

Completing the Louisiana sales tax form involves several key steps:

- Gather all sales records for the reporting period.

- Calculate total sales and determine which sales are taxable.

- Fill out the R-1029 form, ensuring all fields are completed accurately.

- Double-check calculations for total sales tax due.

- Submit the completed form and payment by the deadline.

Following these steps helps ensure compliance and minimizes the risk of errors that could lead to penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Louisiana sales tax form are typically set by the Louisiana Department of Revenue. Businesses must be aware of these deadlines to avoid late fees and penalties. Generally, the R-1029 form is due on the 20th day of the month following the reporting period. For example, sales made in January must be reported by February 20. It is crucial to stay informed about any changes to these deadlines, as they can vary based on specific circumstances or state regulations.

Required Documents

When completing the Louisiana sales tax form, businesses should have the following documents on hand:

- Sales receipts and invoices for the reporting period.

- Previous sales tax returns for reference.

- Documentation of any exempt sales, if applicable.

- Bank statements showing sales deposits.

Having these documents readily available can streamline the process of filling out the R-1029 form and ensure accuracy in reporting.

Penalties for Non-Compliance

Failure to comply with Louisiana sales tax regulations can result in significant penalties. Businesses that do not file the R-1029 form on time may incur late fees, which can accumulate quickly. Additionally, underreporting sales or sales tax can lead to further penalties, including interest on unpaid taxes. It is important for businesses to understand these potential consequences and prioritize timely and accurate filing to avoid unnecessary financial burdens.

Quick guide on how to complete louisiana sales tax form

Prepare Louisiana Sales Tax Form seamlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents swiftly without any holdups. Manage Louisiana Sales Tax Form on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The most efficient way to modify and eSign Louisiana Sales Tax Form with ease

- Find Louisiana Sales Tax Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important parts of the documents or obscure sensitive information with the tools that airSlate SignNow has specifically designed for that purpose.

- Generate your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Louisiana Sales Tax Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct louisiana sales tax form

Create this form in 5 minutes!

How to create an eSignature for the louisiana sales tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Louisiana sales tax and how does it affect eSigning documents?

Louisiana sales tax is a state tax applied to the sale of goods and services in Louisiana. When using airSlate SignNow for eSigning documents, it's important to understand how this tax may affect transaction-related documents, such as invoices or purchase agreements. Ensuring compliance with Louisiana sales tax regulations can help avoid legal issues and maintain accurate financial records.

-

How can airSlate SignNow help me with Louisiana sales tax documentation?

airSlate SignNow streamlines the process of creating, sending, and tracking documents related to Louisiana sales tax. With our eSigning solution, you can easily prepare tax documents and have them signed electronically, ensuring a smooth and efficient workflow. This helps maintain accurate records and compliance with Louisiana sales tax laws.

-

What features does airSlate SignNow offer for managing Louisiana sales tax?

AirSlate SignNow provides features like customizable templates, automated workflows, and secure storage, specifically designed to assist businesses in managing Louisiana sales tax documentation effectively. These features ensure that your tax documents are not only quick to create and sign but also compliant with local regulations. You can also track the status of tax-related documents in real-time.

-

Is airSlate SignNow cost-effective for businesses dealing with Louisiana sales tax?

Yes, airSlate SignNow offers a cost-effective solution for businesses managing Louisiana sales tax paperwork. With our competitive pricing plans, you can benefit from an easy-to-use eSigning platform without breaking the bank. This is particularly advantageous for businesses that need to manage their sales tax compliance efficiently.

-

Can I integrate airSlate SignNow with my accounting software for Louisiana sales tax?

Absolutely! airSlate SignNow easily integrates with popular accounting software that helps manage Louisiana sales tax, such as QuickBooks and Xero. This integration ensures that your document management and tax calculations remain synchronized, streamlining your accounting processes while adhering to Louisiana sales tax regulations.

-

What are the benefits of using airSlate SignNow for Louisiana sales tax documents?

Using airSlate SignNow to manage Louisiana sales tax documents offers several benefits, including increased efficiency, reduced paperwork, and enhanced security. The electronic signature process accelerates approvals and helps avoid delays, while our secure storage protects sensitive tax information. This not only simplifies compliance with Louisiana sales tax but also saves you valuable time.

-

How does airSlate SignNow ensure compliance with Louisiana sales tax laws?

airSlate SignNow is designed with compliance in mind, offering features that help businesses adhere to Louisiana sales tax laws. By providing templates that reflect current tax regulations and an easy way to obtain electronic signatures, we facilitate compliance and minimize the risk of audits. Our platform is continually updated to reflect any changes in Louisiana sales tax legislation.

Get more for Louisiana Sales Tax Form

- Pdf 1 of 15 state of florida department of business and professional form

- Town of bluffton business license 549450062 form

- State of south carolina secretary of state members statement of form

- To download the minor consent form parenti morris eyecare

- Why delta dental form

- Arsbn 91535 form

- Communicable disease reporting form pdf

- Mobile food vendor permit form

Find out other Louisiana Sales Tax Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT