Michigan Withholding Form

What is the Michigan Withholding

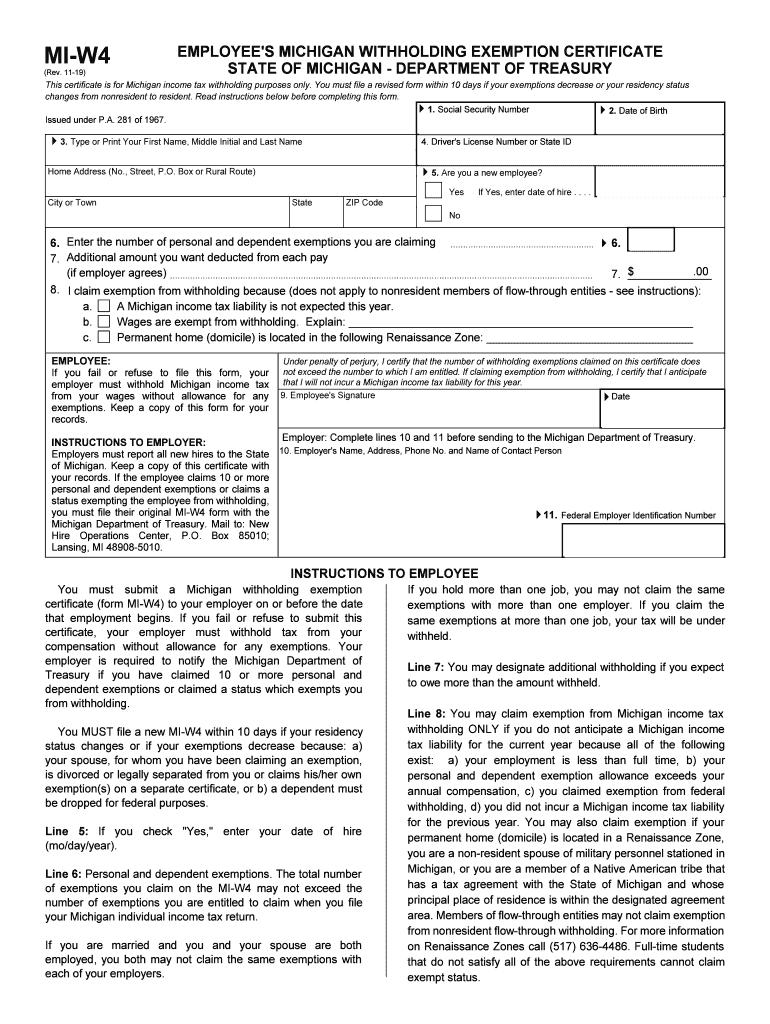

The Michigan withholding form, specifically the 2019 Michigan W-4, is essential for employees to communicate their tax withholding preferences to their employers. This form allows individuals to specify the amount of state income tax to be withheld from their paychecks. Understanding this form is crucial for ensuring that the correct amount is deducted, which can help avoid underpayment or overpayment of taxes throughout the year.

How to complete the Michigan Withholding

Completing the 2019 Michigan W-4 involves several key steps. First, individuals should gather necessary personal information, including their name, address, and Social Security number. Next, they need to determine their filing status, which can be single, married, or head of household. The form includes sections for claiming allowances and exemptions, which directly affect the amount withheld. It's important to accurately assess personal circumstances to avoid issues with tax liabilities.

Key elements of the Michigan Withholding

The 2019 Michigan W-4 contains several critical components that individuals must understand. These include:

- Personal Information: Basic details such as name, address, and Social Security number.

- Filing Status: Options include single, married, or head of household.

- Allowances: The number of allowances claimed affects the withholding amount.

- Exemptions: Eligibility for claiming exemptions can reduce withholding.

Each of these elements plays a significant role in determining the correct withholding amount, making it essential for employees to review them carefully.

Steps to submit the Michigan Withholding

Submitting the 2019 Michigan W-4 is a straightforward process. Once the form is completed, individuals should provide it to their employer's payroll department. It's advisable to keep a copy for personal records. If there are any changes in personal circumstances, such as marital status or number of dependents, employees should submit a new form to ensure accurate withholding moving forward.

Legal use of the Michigan Withholding

The 2019 Michigan W-4 is legally binding and must be filled out accurately to comply with state tax laws. Employers are required to withhold the appropriate amount of state income tax based on the information provided on the form. Failure to submit a completed W-4 can result in default withholding rates, which may not align with an individual's tax obligations. Understanding the legal implications of this form is crucial for both employees and employers.

Form Submission Methods

The 2019 Michigan W-4 can be submitted through various methods. The most common method is to hand it directly to the employer's payroll department. Alternatively, some employers may allow electronic submission through their payroll systems. It's important to confirm with the employer regarding their preferred submission method to ensure timely processing of the form.

Quick guide on how to complete you must file a revised form within 10 days if your exemptions decrease or your residency status

Effortlessly prepare Michigan Withholding on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage Michigan Withholding on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

How to modify and electronically sign Michigan Withholding with ease

- Find Michigan Withholding and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or conceal sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which only takes seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Michigan Withholding and ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the you must file a revised form within 10 days if your exemptions decrease or your residency status

How to make an eSignature for the You Must File A Revised Form Within 10 Days If Your Exemptions Decrease Or Your Residency Status in the online mode

How to generate an electronic signature for the You Must File A Revised Form Within 10 Days If Your Exemptions Decrease Or Your Residency Status in Google Chrome

How to create an electronic signature for signing the You Must File A Revised Form Within 10 Days If Your Exemptions Decrease Or Your Residency Status in Gmail

How to make an electronic signature for the You Must File A Revised Form Within 10 Days If Your Exemptions Decrease Or Your Residency Status right from your smartphone

How to create an electronic signature for the You Must File A Revised Form Within 10 Days If Your Exemptions Decrease Or Your Residency Status on iOS

How to make an electronic signature for the You Must File A Revised Form Within 10 Days If Your Exemptions Decrease Or Your Residency Status on Android OS

People also ask

-

What is a 2019 Michigan W4 form?

The 2019 Michigan W4 form is an employee's withholding allowance certificate used in Michigan for tax purposes. It helps employers determine the correct amount of state income tax to withhold from employee wages. Completing this form accurately ensures proper tax withholding throughout the year.

-

How can airSlate SignNow assist with filling out the 2019 Michigan W4?

airSlate SignNow offers a user-friendly platform that simplifies the process of completing the 2019 Michigan W4 form. With our document templates, you can easily input your information and ensure all necessary fields are filled out precisely. Additionally, our platform enables quick editing and collaboration with HR teams.

-

Is there a cost associated with using airSlate SignNow for the 2019 Michigan W4?

airSlate SignNow provides a cost-effective solution for electronic document signing, including the 2019 Michigan W4 form. We offer various pricing plans to suit different business needs, ensuring you only pay for what you use. You can access premium features at competitive rates.

-

What are the benefits of eSigning the 2019 Michigan W4 with airSlate SignNow?

eSigning the 2019 Michigan W4 with airSlate SignNow brings convenience and efficiency to your document management. It allows employees to sign anytime, anywhere, eliminating delays and paper clutter. Plus, you gain access to a secure audit trail, enhancing compliance and accountability.

-

Can I integrate airSlate SignNow with other software for the 2019 Michigan W4?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your workflow when managing the 2019 Michigan W4 form. Integrations with popular HR and payroll systems facilitate easy data transfer, ensuring accuracy in employee tax withholding. This saves time and eliminates repetitive tasks.

-

What features does airSlate SignNow offer to simplify the 2019 Michigan W4 process?

airSlate SignNow offers several features to streamline the completion of the 2019 Michigan W4 form. These include customizable templates, real-time collaboration, and reminders for signing. The platform is designed for ease of use, ensuring that both employers and employees can quickly navigate the form.

-

How secure is my data when using airSlate SignNow for the 2019 Michigan W4?

Data security is a top priority for airSlate SignNow. When using our platform for the 2019 Michigan W4, your information is protected with encryption and secure access controls. We comply with industry-standard security measures to ensure that all sensitive data remains confidential and secure.

Get more for Michigan Withholding

- Cr 187 motion to vacate conviction or sentence form

- Them state paragraph numbers from the complaint or explain below or on form

- Unlawful detainer local formssuperior court of california

- Motion to vacate conviction or sentence form

- Real estate addendum contract template form

- Real estate amendment contract template form

- Real estate assignment contract template form

- Real estate commission contract template form

Find out other Michigan Withholding

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF