Form 5076 Mi

What is the Form 5076 Mi

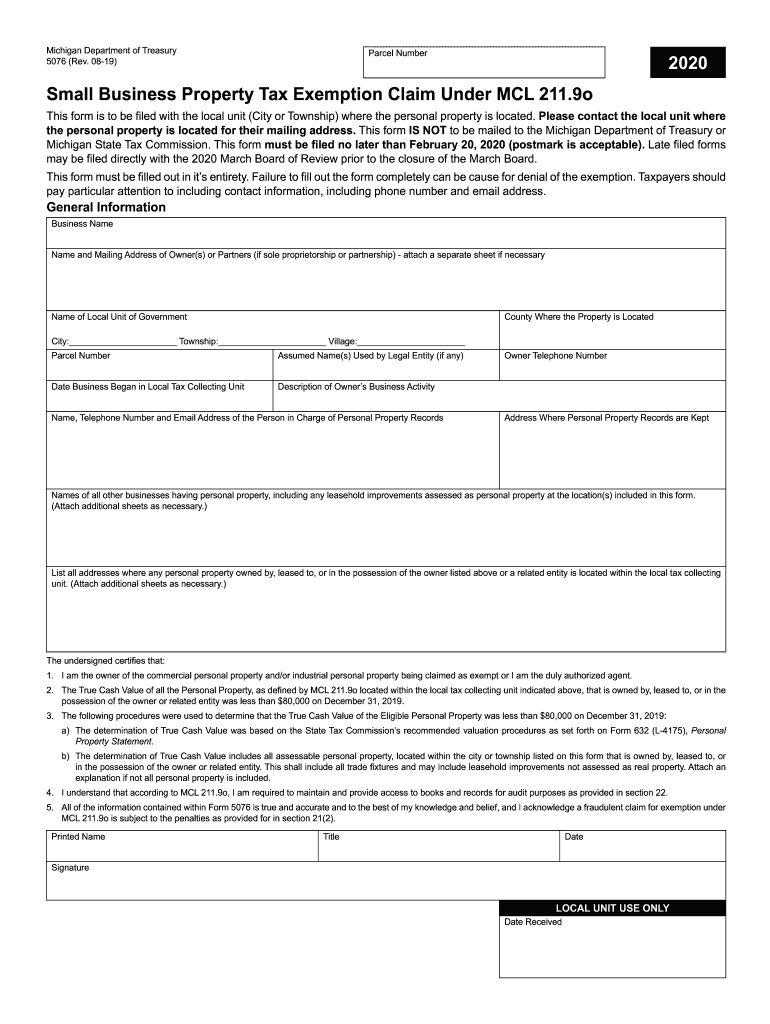

The 2020 Form 5076, also known as the 2020 Michigan exemption form, is a tax document used by property owners in Michigan to claim a small exemption on their property taxes. This form allows eligible homeowners to reduce their taxable value, thereby lowering their property tax liability. The form is specifically designed for individuals who meet certain criteria related to income and property value.

How to use the Form 5076 Mi

To use the 2020 Form 5076, property owners must first ensure they qualify for the small exemption based on their income and property value. Once eligibility is confirmed, the form should be filled out accurately, providing all required information. This includes personal details, property information, and income verification. After completing the form, it must be submitted to the local assessing office to be considered for the exemption.

Steps to complete the Form 5076 Mi

Completing the 2020 Form 5076 involves several key steps:

- Gather necessary documentation, including proof of income and property details.

- Fill out the form with accurate information, ensuring all sections are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to your local assessing office by the specified deadline.

Legal use of the Form 5076 Mi

The 2020 Form 5076 is legally binding when filled out correctly and submitted on time. It is essential to comply with all state regulations regarding property tax exemptions. Failure to provide accurate information or to submit the form by the deadline may result in the denial of the exemption and potential penalties.

Eligibility Criteria

To qualify for the 2020 small exemption using Form 5076, applicants must meet specific criteria. Generally, this includes having a household income below a certain threshold and owning a primary residence in Michigan. Additionally, the property's taxable value must not exceed a specified limit. It is crucial for applicants to review the eligibility requirements carefully to ensure compliance.

Required Documents

When submitting the 2020 Form 5076, applicants must provide supporting documents to verify their eligibility. Commonly required documents include:

- Proof of income, such as tax returns or pay stubs.

- Property tax statements or assessments.

- Identification documents to confirm residency.

Form Submission Methods (Online / Mail / In-Person)

The 2020 Form 5076 can be submitted through various methods to accommodate different preferences. Property owners may choose to submit the form online through their local assessing office's website, mail it directly to the office, or deliver it in person. Each method has its own guidelines, so it is important to follow the specific instructions provided by the local office to ensure proper processing.

Quick guide on how to complete 5076 small business property tax exemption claim under mcl 211

Effortlessly Prepare Form 5076 Mi on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers a superb environmentally friendly alternative to conventional printed and signed paperwork, as you can easily access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without any delays. Handle Form 5076 Mi on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to Modify and eSign Form 5076 Mi with Ease

- Locate Form 5076 Mi and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information thoroughly and click on the Done button to save your changes.

- Choose your preferred method of submitting your form, whether by email, SMS, or invite link, or download it onto your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 5076 Mi to ensure outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 5076 small business property tax exemption claim under mcl 211

How to create an eSignature for your 5076 Small Business Property Tax Exemption Claim Under Mcl 211 in the online mode

How to create an eSignature for the 5076 Small Business Property Tax Exemption Claim Under Mcl 211 in Google Chrome

How to create an eSignature for putting it on the 5076 Small Business Property Tax Exemption Claim Under Mcl 211 in Gmail

How to make an eSignature for the 5076 Small Business Property Tax Exemption Claim Under Mcl 211 right from your mobile device

How to make an electronic signature for the 5076 Small Business Property Tax Exemption Claim Under Mcl 211 on iOS

How to generate an eSignature for the 5076 Small Business Property Tax Exemption Claim Under Mcl 211 on Android

People also ask

-

What is Form 5076 Mi and how does it work with airSlate SignNow?

Form 5076 Mi is a document used for various legal and administrative purposes in Michigan. With airSlate SignNow, you can easily create, send, and eSign your Form 5076 Mi, ensuring that your documents are securely signed and managed from anywhere, at any time.

-

How can airSlate SignNow enhance my experience with Form 5076 Mi?

airSlate SignNow streamlines the process of handling Form 5076 Mi by providing a user-friendly interface that allows for quick document creation and signing. The platform’s advanced features like templates and reminders make it easier to manage your forms efficiently.

-

Is airSlate SignNow a cost-effective solution for processing Form 5076 Mi?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses processing Form 5076 Mi. With flexible pricing plans, you can choose the package that best fits your needs without compromising on features or functionality.

-

What features does airSlate SignNow offer for Form 5076 Mi?

airSlate SignNow offers a variety of features for managing Form 5076 Mi, including customizable templates, secure eSigning, and automated workflows. These tools help reduce errors and save time, making your form management process more efficient.

-

Can I integrate airSlate SignNow with other applications for Form 5076 Mi?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing your workflow for Form 5076 Mi. Whether it’s through CRM systems, cloud storage, or project management tools, you can streamline your processes and improve productivity.

-

What are the benefits of using airSlate SignNow for Form 5076 Mi?

Using airSlate SignNow for Form 5076 Mi provides numerous benefits, including improved turnaround times, enhanced security for your documents, and easy access to signed forms. This allows businesses to focus on what matters most while ensuring compliance and efficiency.

-

Is airSlate SignNow mobile-friendly for managing Form 5076 Mi?

Yes, airSlate SignNow is fully mobile-friendly, allowing you to manage Form 5076 Mi on the go. You can create, send, and sign documents from your smartphone or tablet, ensuring you stay productive wherever you are.

Get more for Form 5076 Mi

- Cat boarding check in form coral veterinary

- Gold key properties management rental application form

- Cr 187 form

- Race car sponsorship contract template form

- Radio advertis contract template form

- Radio contract template form

- Radio broadcast contract template form

- Radio personality contract template form

Find out other Form 5076 Mi

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online