Mi 1041d Form

What is the MI 1041D?

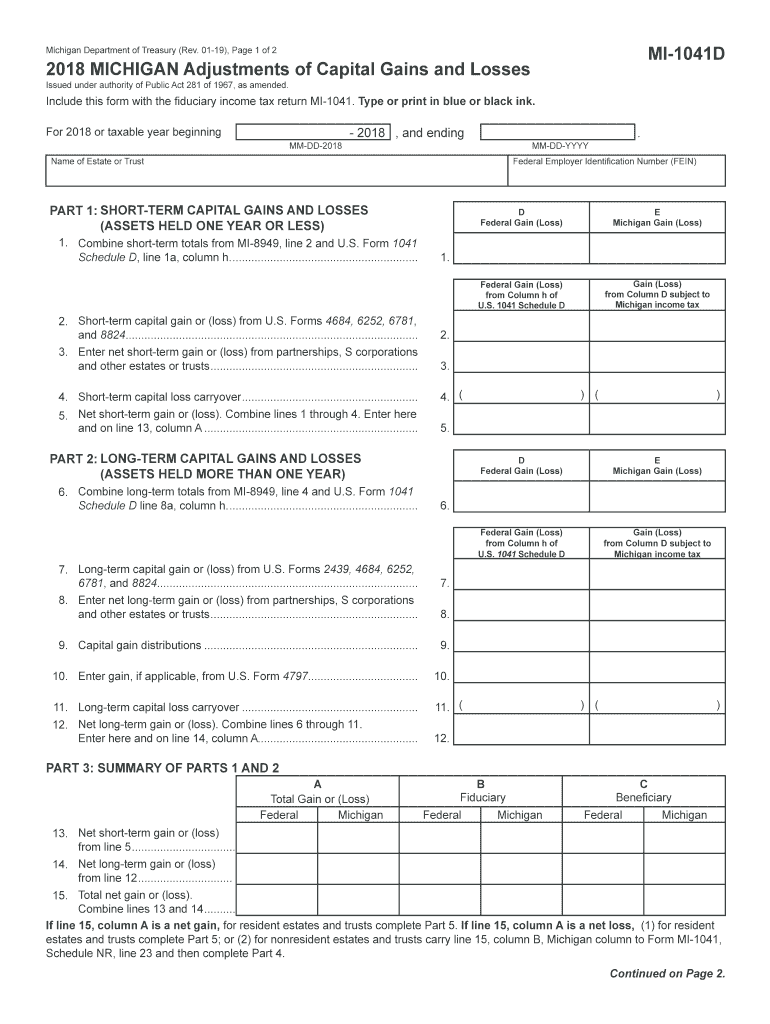

The MI 1041D form, officially known as the Michigan Adjustments of Capital Gains and Losses, is a tax document used by fiduciaries in Michigan. This form is specifically designed for estates and trusts to report adjustments to capital gains and losses that are subject to Michigan income tax. It plays a crucial role in ensuring that the tax obligations of estates and trusts are accurately calculated and reported to the state.

How to Use the MI 1041D

To effectively use the MI 1041D form, fiduciaries must first gather all necessary financial information related to capital gains and losses. This includes details about the sale of assets, any losses incurred, and other pertinent financial data. The form allows fiduciaries to adjust the federal capital gains and losses to align with Michigan tax laws. Accurate completion of this form is essential for proper tax reporting and compliance with state regulations.

Steps to Complete the MI 1041D

Completing the MI 1041D involves several key steps:

- Gather all relevant financial documents, including federal tax returns and records of capital transactions.

- Fill out the form by entering the required information regarding capital gains and losses.

- Ensure that all adjustments made are compliant with Michigan tax laws.

- Review the completed form for accuracy before submission.

Following these steps will help ensure that the MI 1041D is completed correctly and submitted on time.

Legal Use of the MI 1041D

The MI 1041D form is legally binding when completed and submitted in accordance with Michigan tax laws. It is essential for fiduciaries to understand the legal implications of the information provided on this form. Accurate reporting is necessary to avoid potential penalties or audits from the state. Compliance with all relevant tax regulations ensures that the form serves its intended purpose without legal complications.

Filing Deadlines / Important Dates

Fiduciaries must be aware of specific deadlines for filing the MI 1041D. Typically, the form is due on the same date as the federal return for estates and trusts, which is generally the fifteenth day of the fourth month following the end of the tax year. It is important to stay informed about any changes to these deadlines to avoid late filing penalties.

Required Documents

To complete the MI 1041D, fiduciaries need to prepare several key documents:

- Federal Form 1041, U.S. Income Tax Return for Estates and Trusts

- Records of capital gains and losses

- Documentation of any adjustments made

- Any supporting schedules or additional forms required by the state

Having these documents ready will facilitate a smoother completion process for the MI 1041D.

Quick guide on how to complete 2018 michigan adjustments of capital gains and losses mi 1041d

Complete Mi 1041d effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed paperwork, as you can easily locate the correct form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without interruptions. Manage Mi 1041d on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The easiest way to modify and eSign Mi 1041d seamlessly

- Obtain Mi 1041d and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Mi 1041d and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2018 michigan adjustments of capital gains and losses mi 1041d

How to create an electronic signature for the 2018 Michigan Adjustments Of Capital Gains And Losses Mi 1041d online

How to create an eSignature for your 2018 Michigan Adjustments Of Capital Gains And Losses Mi 1041d in Chrome

How to generate an eSignature for signing the 2018 Michigan Adjustments Of Capital Gains And Losses Mi 1041d in Gmail

How to create an electronic signature for the 2018 Michigan Adjustments Of Capital Gains And Losses Mi 1041d from your mobile device

How to generate an eSignature for the 2018 Michigan Adjustments Of Capital Gains And Losses Mi 1041d on iOS

How to create an eSignature for the 2018 Michigan Adjustments Of Capital Gains And Losses Mi 1041d on Android

People also ask

-

What is the MI 1041D 2018 form used for?

The MI 1041D 2018 form is a tax document utilized by businesses in Michigan to report income and calculate taxes owed. Using this form accurately is crucial for compliance and ensuring all deductions are accounted for. With airSlate SignNow, you can easily eSign and submit the MI 1041D 2018 form securely online.

-

How can airSlate SignNow help with the MI 1041D 2018 filing process?

airSlate SignNow streamlines the filing process for the MI 1041D 2018 by offering an intuitive platform to create, send, and eSign forms digitally. This reduces paperwork and enhances efficiency, allowing you to focus on your business rather than administrative tasks. The platform also ensures your documents are compliant and securely stored.

-

What are the pricing plans for using airSlate SignNow for MI 1041D 2018?

airSlate SignNow offers various pricing plans to accommodate different business needs. These plans include features specifically designed to assist with tax forms like the MI 1041D 2018, providing you with cost-effective solutions. Customers can choose a plan that best fits their volume of document processing and signing needs.

-

Can I integrate airSlate SignNow with my accounting software for MI 1041D 2018?

Yes, airSlate SignNow integrates seamlessly with various accounting software solutions. This integration allows for efficient data transfer and management, making the completion of the MI 1041D 2018 form much simpler. By linking your tools, you can ensure accurate information is utilized in filing your taxes.

-

What are the key features of airSlate SignNow that aid in completing the MI 1041D 2018?

airSlate SignNow includes features such as document templates, secure eSigning, and automated reminders that facilitate the completion of the MI 1041D 2018. These tools help minimize errors and ensure timely submissions, which are critical for tax compliance. The platform is designed to make the process user-friendly and efficient.

-

Is electronic signing of the MI 1041D 2018 form legally valid?

Yes, electronic signatures on the MI 1041D 2018 form are legally valid and recognized across Michigan. airSlate SignNow complies with all legal standards for eSigning, ensuring that your filed documents meet regulatory requirements. This convenience allows for faster processing and reduced turnaround times.

-

How secure is airSlate SignNow for filing the MI 1041D 2018?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. When you file the MI 1041D 2018 form using our platform, you can be assured that your sensitive information is protected throughout the process. The safety of your documents is paramount as you eSign and transmit them digitally.

Get more for Mi 1041d

- Pacific screening application form

- Housing stability planattach to applicationapp form

- New mexico residential real estate sales disclosure statement form

- Sober living application form

- Residential bulding permit application the city of clanton alabama form

- Cdl test waiver for military members form

- Quit smok contract template form

- Quote contract template form

Find out other Mi 1041d

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast