State of Michigan Forms 5089

What is the State Of Michigan Forms 5089

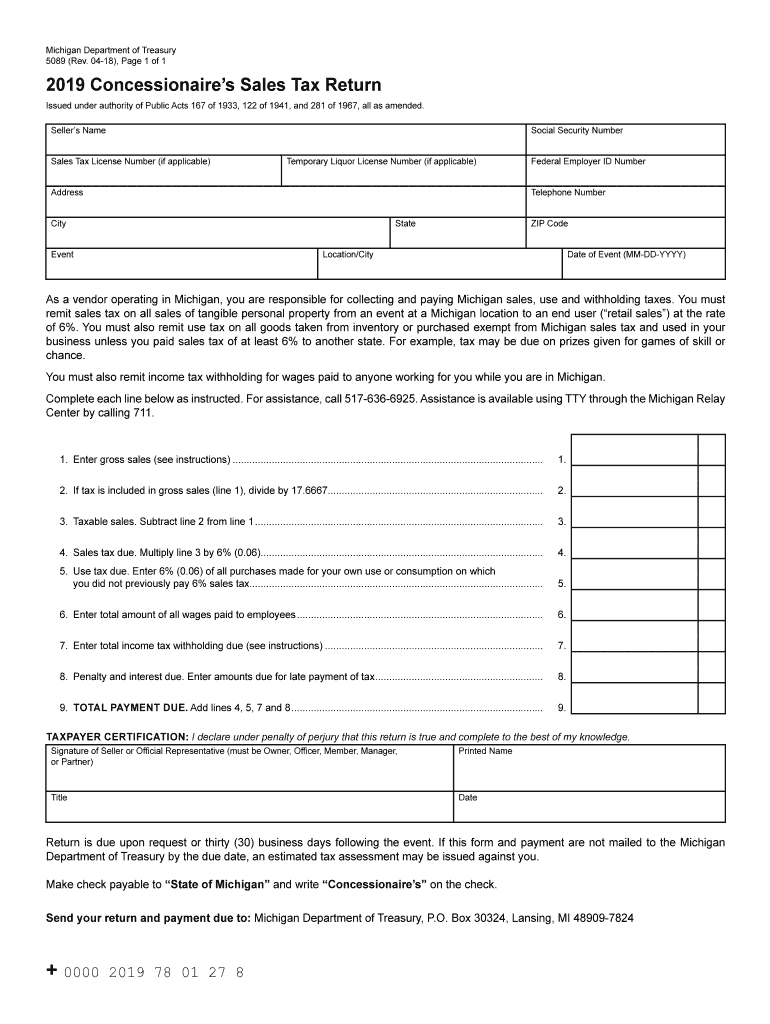

The State of Michigan Forms 5089 is a crucial document used for reporting Michigan income tax. This form is specifically designed for individuals who need to report their income and calculate their tax obligations based on the Michigan state income tax rate. It is essential for ensuring compliance with state tax regulations and helps taxpayers accurately determine their tax liabilities.

How to use the State Of Michigan Forms 5089

Using the State of Michigan Forms 5089 involves several steps to ensure accurate completion. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form with your personal information and income details. Be sure to follow the instructions carefully to avoid errors. Once completed, you can submit the form electronically or by mail, depending on your preference.

Steps to complete the State Of Michigan Forms 5089

Completing the State of Michigan Forms 5089 requires careful attention to detail. Start by entering your name, address, and Social Security number at the top of the form. Then, list all sources of income, including wages, dividends, and any other earnings. Calculate your total income and apply the appropriate Michigan state income tax rate to determine your tax due. Finally, review the form for accuracy before submitting it.

Legal use of the State Of Michigan Forms 5089

The legal use of the State of Michigan Forms 5089 is governed by state tax laws. This form must be filled out accurately and submitted by the tax filing deadline to avoid penalties. It is recognized as a legal document and can be used in court if necessary. Ensuring compliance with the legal requirements surrounding this form is essential for all taxpayers in Michigan.

Filing Deadlines / Important Dates

Filing deadlines for the State of Michigan Forms 5089 are critical to avoid penalties. Typically, the deadline for submitting your tax return is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It's important to stay informed about any changes to these dates to ensure timely filing.

Required Documents

To complete the State of Michigan Forms 5089, several documents are required. These include your W-2 forms from employers, 1099 forms for any freelance work or additional income, and documentation of any deductions or credits you plan to claim. Having these documents ready will streamline the process and help ensure accuracy in your tax reporting.

Penalties for Non-Compliance

Failing to comply with the requirements of the State of Michigan Forms 5089 can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for taxpayers to understand the importance of timely and accurate filing to avoid these consequences and maintain good standing with the state tax authority.

Quick guide on how to complete income tax changes for individuals state of michigan

Complete State Of Michigan Forms 5089 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any delays. Manage State Of Michigan Forms 5089 on any device using the airSlate SignNow apps for Android or iOS and streamline your document-related tasks today.

The easiest way to edit and electronically sign State Of Michigan Forms 5089 without any hassle

- Locate State Of Michigan Forms 5089 and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature with the Sign feature, which takes moments and holds the same legal validity as a traditional ink signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign State Of Michigan Forms 5089 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income tax changes for individuals state of michigan

How to create an electronic signature for your Income Tax Changes For Individuals State Of Michigan online

How to create an eSignature for your Income Tax Changes For Individuals State Of Michigan in Chrome

How to make an eSignature for signing the Income Tax Changes For Individuals State Of Michigan in Gmail

How to generate an eSignature for the Income Tax Changes For Individuals State Of Michigan straight from your smartphone

How to generate an eSignature for the Income Tax Changes For Individuals State Of Michigan on iOS devices

How to create an eSignature for the Income Tax Changes For Individuals State Of Michigan on Android devices

People also ask

-

What is Michigan state income tax?

Michigan state income tax is a tax levied on the income earned by individuals and businesses within the state of Michigan. It is calculated based on a percentage of your taxable income, which varies depending on various factors such as filing status and deductions. Understanding how Michigan state income tax works is crucial for individuals and businesses alike to ensure compliance and optimize their tax liabilities.

-

How does airSlate SignNow support tax document management for Michigan state income tax?

airSlate SignNow enables users to efficiently manage tax-related documents, including those necessary for filing Michigan state income tax. The platform allows easy sending and signing of essential forms electronically, helping to streamline the tax preparation process. With airSlate SignNow, you can ensure that all documents are secure, organized, and accessible when you need them for Michigan state income tax purposes.

-

What pricing plans does airSlate SignNow offer for managing Michigan state income tax documents?

airSlate SignNow offers various pricing plans designed to accommodate businesses of all sizes. Each plan allows you to manage documents related to Michigan state income tax with features like eSignature, document templates, and integration options. The flexibility in pricing ensures that you can find a solution that fits your budget while effectively handling your Michigan state income tax requirements.

-

Are there any specific features in airSlate SignNow beneficial for Michigan state income tax filings?

Yes, airSlate SignNow includes features specifically beneficial for Michigan state income tax filings, such as automated workflows and templates tailored to tax documents. These features help reduce manual errors and save time during the tax filing process. By automating tasks related to Michigan state income tax, users can focus on crucial financial decisions instead.

-

Can I integrate airSlate SignNow with other accounting software for Michigan state income tax management?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easier to manage your Michigan state income tax processes. Integrating with platforms like QuickBooks or Xero can streamline documentation and improve accuracy, ensuring seamless compliance with Michigan state income tax regulations.

-

What are the benefits of using airSlate SignNow for Michigan state income tax eSigning?

Using airSlate SignNow for Michigan state income tax eSigning simplifies the process and enhances security. With advanced eSignature capabilities, you can sign and send tax documents quickly and securely, minimizing delays and ensuring that essential filings are submitted on time. This efficiency can be a signNow advantage during busy tax seasons.

-

How can airSlate SignNow help businesses in Michigan prepare for state income tax changes?

airSlate SignNow keeps your business agile in response to changes in Michigan state income tax laws by providing up-to-date document templates and workflows. Our platform allows you to quickly adapt and implement any necessary changes to your tax documents, ensuring compliance and reducing potential risks associated with tax law changes.

Get more for State Of Michigan Forms 5089

- Redacted this settlement agreement is entered into thisday of form

- Oregon residential real estate sales disclosure statement form

- Oregon sample forms multifamily nw

- Purchase wholesale contract template form

- Quality plan contract template form

- Quick contract template form

- Quickbooks contract template form

- Quinceanera contract template form

Find out other State Of Michigan Forms 5089

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure