Form 5060 Mo

What is the Form 5060 Mo

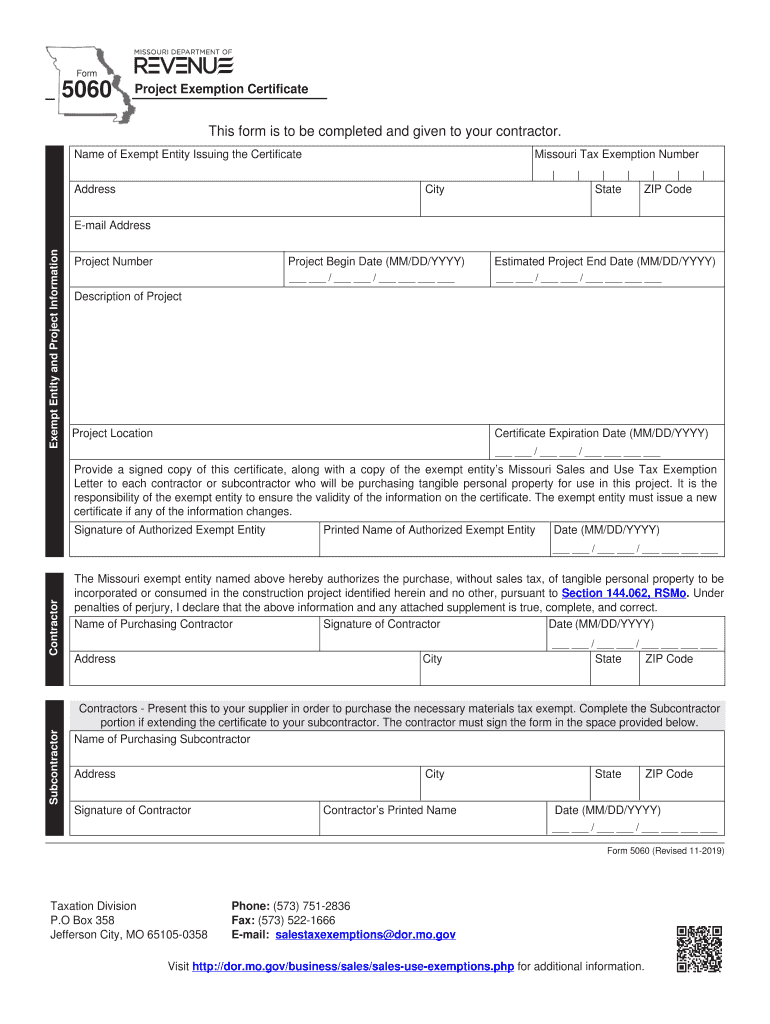

The Missouri exemption form, commonly referred to as the Form 5060, is a document used for project exemption certificates in the state of Missouri. This form allows businesses to claim exemptions from sales and use taxes for specific projects, particularly in construction and manufacturing. By submitting the Form 5060, entities can avoid paying sales tax on materials and equipment used in qualifying projects, thereby reducing overall project costs.

How to use the Form 5060 Mo

To effectively use the Form 5060, businesses must first determine if their project qualifies for tax exemption. This involves reviewing the criteria set by the Missouri Department of Revenue. Once eligibility is established, the form must be filled out accurately, detailing the nature of the project and the items for which the exemption is being claimed. After completion, the form should be submitted to the appropriate tax authority, ensuring that all required signatures and documentation are included.

Steps to complete the Form 5060 Mo

Completing the Form 5060 involves several key steps:

- Gather necessary information about the project, including its scope and timeline.

- Identify the specific materials and equipment that will be exempt from sales tax.

- Fill out the form with accurate details, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the Missouri Department of Revenue or the relevant local authority.

Legal use of the Form 5060 Mo

The legal use of the Form 5060 is governed by Missouri tax laws. To be valid, the form must be used in accordance with the specific guidelines outlined by the state. This includes ensuring that the project qualifies for the exemption and that all information provided is truthful and accurate. Misuse of the form or providing false information can lead to penalties, including fines and back taxes owed.

Eligibility Criteria

Eligibility for using the Form 5060 is primarily based on the nature of the project. Generally, projects must be related to manufacturing, construction, or specific types of services that qualify under Missouri tax law. Additionally, the business applying for the exemption must be registered in Missouri and in good standing with tax obligations. It is essential to consult the latest guidelines from the Missouri Department of Revenue to confirm eligibility.

Form Submission Methods

The Form 5060 can be submitted through various methods, including online, by mail, or in person. For online submissions, businesses can use the Missouri Department of Revenue's e-filing system if available. For mail submissions, the completed form should be sent to the designated address provided by the department. In-person submissions can be made at local tax offices, ensuring that all necessary documentation is presented at the time of filing.

Quick guide on how to complete name of exempt entity issuing the certificate

Prepare Form 5060 Mo effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the features needed to create, edit, and electronically sign your documents swiftly without any holdups. Manage Form 5060 Mo on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to modify and electronically sign Form 5060 Mo without any hassle

- Locate Form 5060 Mo and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you select. Edit and electronically sign Form 5060 Mo to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the name of exempt entity issuing the certificate

How to create an eSignature for your Name Of Exempt Entity Issuing The Certificate in the online mode

How to generate an electronic signature for your Name Of Exempt Entity Issuing The Certificate in Chrome

How to generate an electronic signature for putting it on the Name Of Exempt Entity Issuing The Certificate in Gmail

How to create an electronic signature for the Name Of Exempt Entity Issuing The Certificate straight from your mobile device

How to make an eSignature for the Name Of Exempt Entity Issuing The Certificate on iOS devices

How to make an electronic signature for the Name Of Exempt Entity Issuing The Certificate on Android OS

People also ask

-

What is the Missouri exemption form and how can it benefit my business?

The Missouri exemption form is a document that allows businesses to claim certain tax exemptions. Utilizing this form can signNowly reduce your tax liability, freeing up capital for your business operations. By using airSlate SignNow, you can easily create, send, and eSign your Missouri exemption form, ensuring a smooth process.

-

How do I fill out the Missouri exemption form using airSlate SignNow?

Filling out the Missouri exemption form with airSlate SignNow is straightforward. You can upload a template, fill in the required fields online, and even have your team eSign it from anywhere. Our platform provides a user-friendly interface to ensure you complete your form accurately and efficiently.

-

Is there a fee associated with using airSlate SignNow for the Missouri exemption form?

airSlate SignNow offers various pricing plans to accommodate different business needs. Depending on the features you choose, the fees can be very affordable, providing great value for managing your Missouri exemption form and other documents. Check our pricing page for detailed information on plans and features.

-

Can I track the status of my Missouri exemption form after sending it for eSignature?

Yes, with airSlate SignNow, you can easily track the status of your Missouri exemption form. Our platform allows you to see when the document is viewed, signed, and completed, ensuring you stay updated throughout the process. This transparency helps streamline your paperwork and keeps your records organized.

-

Does airSlate SignNow integrate with other tools for managing the Missouri exemption form?

Absolutely! airSlate SignNow offers integrations with a variety of applications, including CRM and project management software. This ensures that your workflow is seamless and that your Missouri exemption form can be easily managed alongside other essential documents and tools you use daily.

-

What security measures does airSlate SignNow implement for documents like the Missouri exemption form?

Security is a top priority at airSlate SignNow. We use advanced encryption technologies and stringent security protocols to protect your documents, including the Missouri exemption form. Our platform complies with industry standards, ensuring that your sensitive information is safe and secure throughout the signing process.

-

Can I customize the Missouri exemption form with airSlate SignNow?

Yes, airSlate SignNow allows you to fully customize your Missouri exemption form. You can add your company logo, specify fields needed, and tailor the document to fit your specific requirements. This flexibility helps maintain your brand's identity while ensuring compliance with state regulations.

Get more for Form 5060 Mo

- Genitourinary medicine and theinternet form

- Provide service contract template form

- Protect co signer contract template form

- Provision of service contract template form

- Provisions contract template form

- Psychologist contract template form

- Psychology supervision contract template form

- Psychotherapy contract template form

Find out other Form 5060 Mo

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement