Utah State Tax Form

What is the Utah State Tax Form

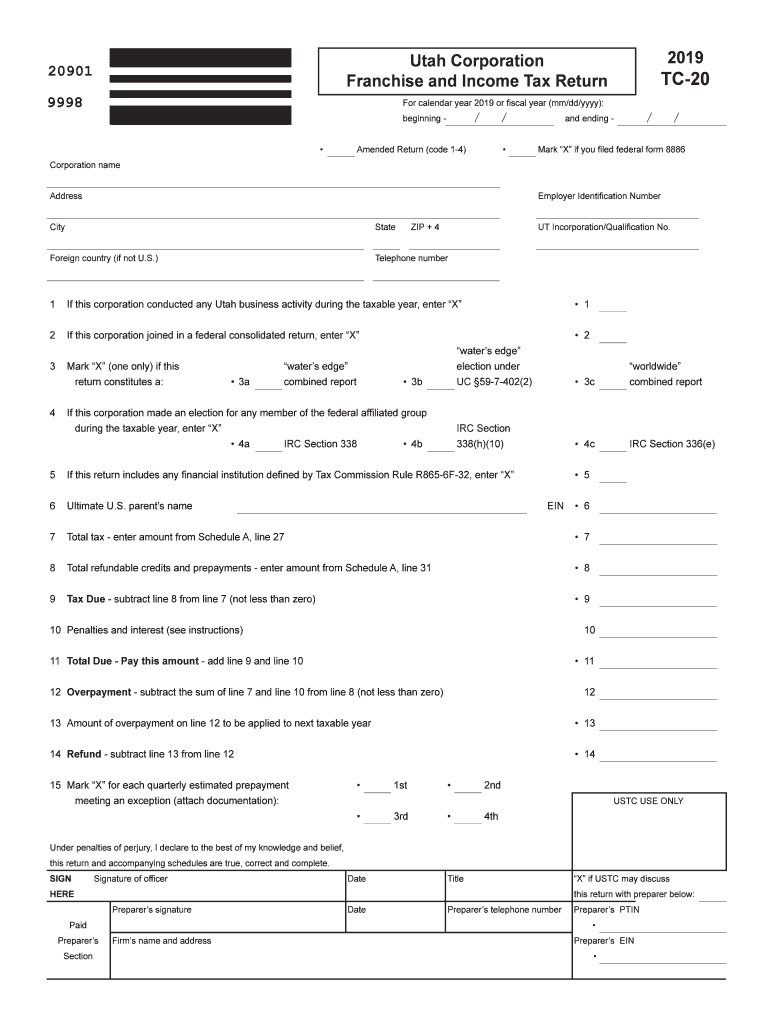

The Utah State Tax Form is a crucial document used by residents and businesses in Utah to report their income and calculate their tax obligations. This form is essential for ensuring compliance with state tax laws and for determining the amount of tax owed or refund due. The form includes various sections that require taxpayers to provide detailed information about their income, deductions, and credits applicable for the tax year.

Steps to complete the Utah State Tax Form

Completing the Utah State Tax Form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including W-2s, 1099s, and any other income statements. Next, fill out the personal information section, including your name, address, and Social Security number. After that, report your total income, followed by any allowable deductions and credits. Finally, calculate your total tax liability and determine if you owe taxes or are due a refund. It is advisable to review the form thoroughly before submission to avoid errors.

How to obtain the Utah State Tax Form

The Utah State Tax Form can be obtained through the Utah State Tax Commission's official website. The form is available for download in PDF format, allowing taxpayers to print and fill it out manually. Additionally, the form can be accessed at local government offices, libraries, or tax preparation service locations throughout the state. It is important to ensure that you are using the correct version of the form for the tax year you are filing.

Legal use of the Utah State Tax Form

The legal use of the Utah State Tax Form requires adherence to specific guidelines set forth by the Utah State Tax Commission. The form must be completed accurately and submitted by the designated filing deadline to avoid penalties. Electronic filing options are available, which can expedite processing and enhance security. It is essential to retain copies of submitted forms and any supporting documentation for future reference, as they may be required for audits or inquiries from tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Utah State Tax Form typically align with federal tax deadlines. For most individuals, the due date is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers can also request an extension, which allows for additional time to file, but any taxes owed must still be paid by the original deadline to avoid interest and penalties. It is advisable to stay informed about any changes to deadlines or important dates announced by the Utah State Tax Commission.

Required Documents

To complete the Utah State Tax Form accurately, taxpayers must gather several required documents. These include income statements such as W-2 forms from employers, 1099 forms for freelance or contract work, and documentation for any other sources of income. Additionally, records of deductible expenses, such as mortgage interest statements, property tax receipts, and medical expenses, should be collected. Having these documents organized will facilitate a smoother filing process and help ensure that all eligible deductions are claimed.

Quick guide on how to complete 2019 tc 20 forms utah corporation franchise or income tax

Complete Utah State Tax Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Utah State Tax Form on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Utah State Tax Form with ease

- Locate Utah State Tax Form and click Get Form to begin.

- Utilize the tools we provide to complete your paperwork.

- Highlight important sections of your documents or obscure sensitive information with features specifically designed for that purpose by airSlate SignNow.

- Produce your signature using the Sign tool, which takes seconds and carries the same legal authority as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Wave goodbye to lost or misfiled documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Utah State Tax Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 tc 20 forms utah corporation franchise or income tax

How to make an eSignature for the 2019 Tc 20 Forms Utah Corporation Franchise Or Income Tax online

How to generate an electronic signature for the 2019 Tc 20 Forms Utah Corporation Franchise Or Income Tax in Google Chrome

How to make an eSignature for signing the 2019 Tc 20 Forms Utah Corporation Franchise Or Income Tax in Gmail

How to generate an electronic signature for the 2019 Tc 20 Forms Utah Corporation Franchise Or Income Tax straight from your smart phone

How to make an electronic signature for the 2019 Tc 20 Forms Utah Corporation Franchise Or Income Tax on iOS

How to generate an electronic signature for the 2019 Tc 20 Forms Utah Corporation Franchise Or Income Tax on Android OS

People also ask

-

What makes airSlate SignNow a top choice for businesses in 2019 Utah?

In 2019 Utah, airSlate SignNow stands out for its user-friendly interface and comprehensive eSignature features. Businesses can streamline document workflows, save time, and reduce costs with this efficient solution. Its reliability and security ensure that your business's sensitive information is protected.

-

How does airSlate SignNow pricing compare for businesses in 2019 Utah?

For 2019 Utah businesses, airSlate SignNow offers competitive pricing plans that cater to various needs. Customers can choose from flexible subscription models that provide exceptional value for the features offered. This makes it a cost-effective solution for businesses of all sizes looking to digitize their document processes.

-

What are the key features of airSlate SignNow available in 2019 Utah?

In 2019 Utah, airSlate SignNow offers an array of features including document templates, team collaboration tools, and secure cloud storage. Users can easily send and eSign documents, track their status, and integrate with other applications to further enhance productivity. These features make it a powerful tool for any organization.

-

What benefits does airSlate SignNow provide for small businesses in 2019 Utah?

Small businesses in 2019 Utah benefit greatly from airSlate SignNow by improving their operational efficiency and reducing paperwork. Its straightforward eSigning process helps small teams save time and resources while ensuring compliance with legal standards. This empowers them to focus more on their core business activities.

-

Can airSlate SignNow integrate with other software commonly used in 2019 Utah?

Yes, airSlate SignNow integrates seamlessly with various software commonly used by businesses in 2019 Utah, such as CRM and document management systems. This integration allows businesses to enhance their current workflows and maximize productivity without the need for signNow changes. It makes for a smoother operational experience.

-

Is airSlate SignNow secure for handling documents in 2019 Utah?

Absolutely, airSlate SignNow is committed to providing top-notch security for handling documents in 2019 Utah. It employs robust encryption measures and follows strict compliance protocols to ensure your documents' safety. Users can confidently send and eSign sensitive information without worrying about data bsignNowes.

-

What kind of customer support does airSlate SignNow offer to clients in 2019 Utah?

AirSlate SignNow provides comprehensive customer support to clients in 2019 Utah, ensuring that help is available when needed. Their support team is accessible through various channels including chat, email, and phone. This commitment to customer service enhances user satisfaction and promotes successful adoption of the platform.

Get more for Utah State Tax Form

- Self storage rental agreement self storage units in presque isle wi form

- Affidavit of nonprosecution form doc

- Private yoga contract template form

- Probation contract template form

- Probation period probation contract template form

- Probation period contract template form

- Probationary period contract template form

- Probationary contract template form

Find out other Utah State Tax Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document