Texas State Tax Return Form

What is the Texas State Tax Return Form

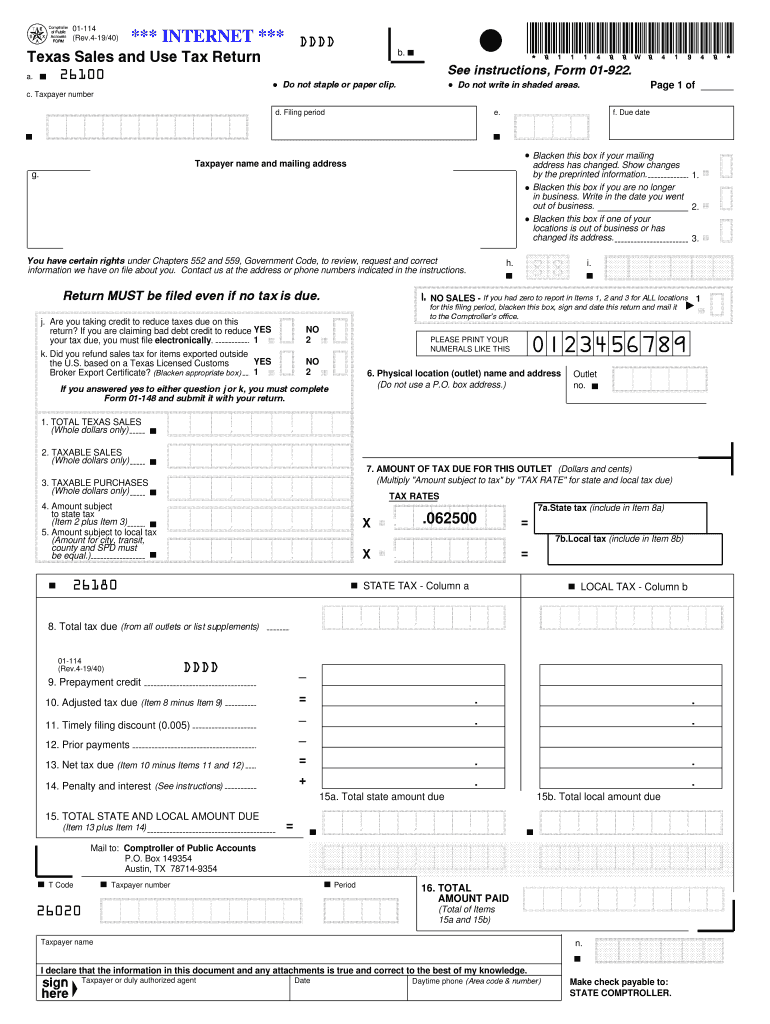

The Texas State Tax Return Form, commonly referred to as the Texas Comptroller sales and use tax return, is a document that businesses must file to report their sales tax obligations. This form is essential for ensuring compliance with state tax laws and for accurately calculating the amount of sales tax owed to the Texas Comptroller. The form captures various details such as total sales, exempt sales, and the amount of tax collected. Understanding this form is crucial for businesses operating in Texas to avoid penalties and maintain good standing with state authorities.

Steps to Complete the Texas State Tax Return Form

Completing the Texas sales and use tax return form involves several key steps:

- Gather necessary documents, including sales records and previous tax returns.

- Enter total sales and exempt sales amounts in the appropriate sections of the form.

- Calculate the total sales tax due based on the applicable rates.

- Review the completed form for accuracy to ensure all information is correct.

- Submit the form either online, by mail, or in person, depending on your preference.

Following these steps helps ensure that your submission is accurate and compliant with Texas tax regulations.

How to Obtain the Texas State Tax Return Form

The Texas Comptroller sales tax return form can be obtained through the Texas Comptroller's official website. Businesses can download the form in PDF format, which can be filled out electronically or printed for manual completion. It is important to ensure that you are using the most current version of the form, as updates may occur periodically. Additionally, many tax software programs also provide access to this form, allowing for easier integration into your overall tax filing process.

Legal Use of the Texas State Tax Return Form

To ensure the legal validity of the Texas sales and use tax return form, it is essential to comply with specific regulations. The form must be signed and dated by an authorized individual within the business. Electronic signatures are permissible, provided they meet the requirements set forth by the ESIGN Act and UETA. This legal framework ensures that eSignatures are recognized as valid and enforceable, making it easier for businesses to file their returns digitally.

Form Submission Methods (Online / Mail / In-Person)

Businesses have multiple options for submitting the Texas sales tax return form:

- Online: The most efficient method, allowing for immediate processing and confirmation of submission.

- Mail: Businesses can print the completed form and send it to the Texas Comptroller's office via postal service. Ensure adequate postage and allow for processing time.

- In-Person: For those who prefer direct interaction, forms can be submitted at designated Comptroller offices.

Choosing the right submission method can streamline the filing process and help avoid delays.

Penalties for Non-Compliance

Failure to file the Texas sales and use tax return form on time can result in significant penalties. Businesses may incur late fees, which can accumulate over time, leading to increased financial burdens. Additionally, non-compliance can result in audits and further scrutiny from the Texas Comptroller’s office. It is vital for businesses to stay informed about filing deadlines and ensure timely submissions to avoid these consequences.

Quick guide on how to complete tweet added by

Effortlessly Prepare Texas State Tax Return Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to access the appropriate forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without hassle. Handle Texas State Tax Return Form on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to Edit and Electronically Sign Texas State Tax Return Form with Ease

- Find Texas State Tax Return Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Select important sections of your documents or redact sensitive details using tools specifically offered by airSlate SignNow for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to finalize your changes.

- Decide how you want to send your document—via email, SMS, or a shareable link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Edit and electronically sign Texas State Tax Return Form to ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tweet added by

How to generate an eSignature for your Tweet Added By online

How to make an electronic signature for the Tweet Added By in Chrome

How to generate an electronic signature for putting it on the Tweet Added By in Gmail

How to make an electronic signature for the Tweet Added By from your smartphone

How to create an electronic signature for the Tweet Added By on iOS

How to create an electronic signature for the Tweet Added By on Android

People also ask

-

What is tx comptroller sales tax and how does it affect my business?

Tx comptroller sales tax refers to the tax collected by the Texas Comptroller's office on the sale of goods and services in Texas. This tax is essential for businesses operating in the state, as it affects pricing, profit margins, and compliance. Understanding tx comptroller sales tax is crucial for accurate financial reporting and ensuring your business remains compliant with state regulations.

-

How can airSlate SignNow help with tx comptroller sales tax documentation?

AirSlate SignNow facilitates the electronic signing and sending of documents, making it easier to manage paperwork related to tx comptroller sales tax. With our platform, you can streamline the creation and distribution of tax forms and compliance documents, ensuring your business remains organized and compliant. This efficiency helps you focus more on business growth rather than paperwork.

-

Are there any features in airSlate SignNow specifically useful for managing tx comptroller sales tax?

Yes, airSlate SignNow offers features that enhance your ability to manage documents associated with tx comptroller sales tax such as customizable templates, audit trails, and secure e-signatures. These features ensure that your tax documents are correctly completed, signed, and stored securely, minimizing the risk of errors or compliance issues. Your team can collaborate effortlessly on tax-related documentation.

-

What are the pricing options for airSlate SignNow in relation to tx comptroller sales tax functionalities?

AirSlate SignNow offers competitive pricing plans that cater to various business needs, ensuring all features related to tx comptroller sales tax management are accessible. Plans are designed to provide cost-effective solutions for e-signatures and document management without sacrificing quality. You can choose a plan that best fits your business size and transaction volume.

-

Can I integrate airSlate SignNow with my existing accounting software for tx comptroller sales tax?

Absolutely! AirSlate SignNow can easily integrate with popular accounting software, allowing you to manage tx comptroller sales tax documents more efficiently. This integration can help streamline your workflow and ensure that your tax calculations and document submissions are up-to-date and accurate, simplifying the compliance process.

-

How does airSlate SignNow ensure compliance with tx comptroller sales tax regulations?

AirSlate SignNow is designed with compliance in mind, ensuring that all processes surrounding tx comptroller sales tax adhere to state regulations. Our platform includes features such as secure document storage, audit trails, and compliance checks that help protect your business from potential tax-related issues. Using our solution helps you maintain a high standard for regulatory compliance.

-

Is electronic signing valid for tx comptroller sales tax documents?

Yes, electronic signing through airSlate SignNow is valid for tx comptroller sales tax documents, as it complies with federal and Texas state laws regarding electronic signatures. This means you can confidently use our platform for your tax paperwork without worrying about legal validity. Simplifying your signing process can lead to increased efficiency in managing your tax obligations.

Get more for Texas State Tax Return Form

- 2006index of newsletters isba form

- Bullying at school advice for families form

- Christus st vincent guidelines for continuous visual form

- Pr agency contract template form

- Practice manager contract template form

- Pre construction contract template form

- Pre deposit contract template form

- Pre incorporation contract template form

Find out other Texas State Tax Return Form

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online

- Sign Alabama Life-Insurance Quote Form Free

- Sign California Apply for Lead Pastor Easy

- Sign Rhode Island Certeficate of Insurance Request Free

- Sign Hawaii Life-Insurance Quote Form Fast

- Sign Indiana Life-Insurance Quote Form Free

- Sign Maryland Church Donation Giving Form Later

- Can I Sign New Jersey Life-Insurance Quote Form

- Can I Sign Pennsylvania Church Donation Giving Form

- Sign Oklahoma Life-Insurance Quote Form Later

- Can I Sign Texas Life-Insurance Quote Form

- Sign Texas Life-Insurance Quote Form Fast

- How To Sign Washington Life-Insurance Quote Form

- Can I Sign Wisconsin Life-Insurance Quote Form

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe