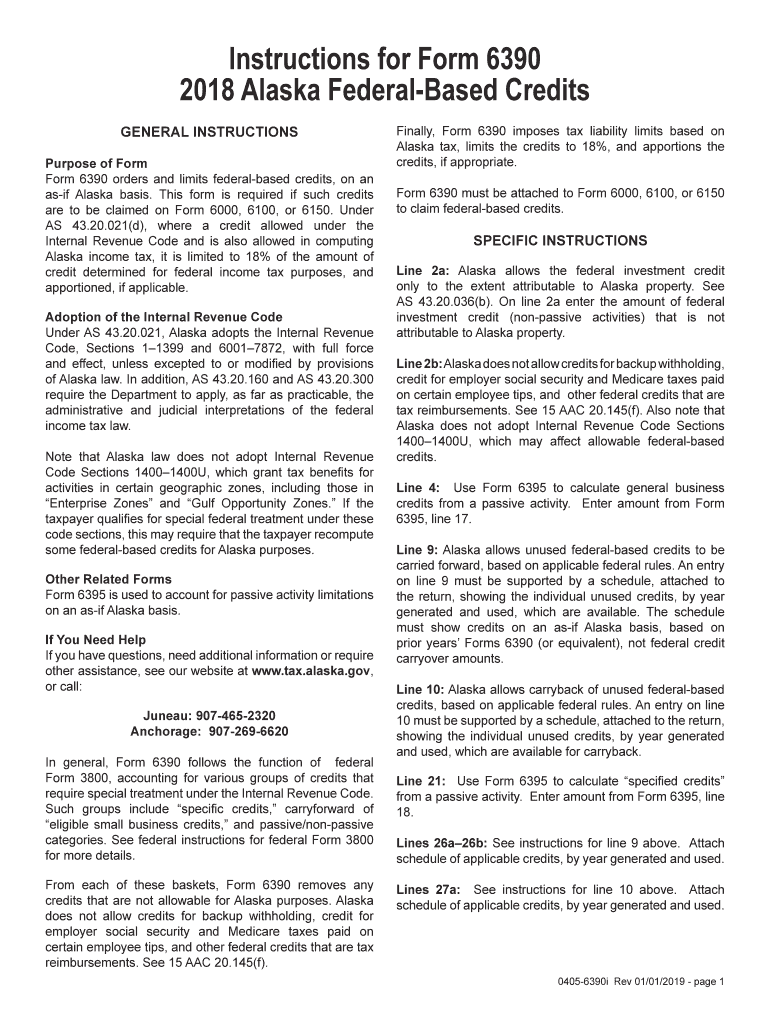

Instructions for Form 6390 Alaska Federal Based Credits

What is the Instructions For Form 6390 Alaska Federal Based Credits

The Instructions for Form 6390 Alaska Federal Based Credits provide essential guidelines for individuals and businesses seeking to claim specific tax credits offered by the state of Alaska. This form is particularly relevant for taxpayers who have incurred eligible expenses related to certain activities or investments in Alaska. Understanding the instructions is crucial for ensuring compliance with state tax laws and maximizing potential credits.

Steps to complete the Instructions For Form 6390 Alaska Federal Based Credits

Completing the Instructions for Form 6390 involves several key steps:

- Gather necessary documentation, including receipts and records of eligible expenses.

- Review the eligibility criteria to ensure that your activities qualify for the credits.

- Fill out the form accurately, providing all required information as outlined in the instructions.

- Double-check your entries for accuracy and completeness to avoid delays in processing.

- Submit the form by the specified deadline, either electronically or via mail, as per the guidelines.

Legal use of the Instructions For Form 6390 Alaska Federal Based Credits

The legal use of the Instructions for Form 6390 is governed by state tax regulations. To ensure compliance, taxpayers must adhere to the guidelines provided in the instructions, which outline how to properly claim credits. Failure to follow these regulations may result in penalties or disqualification from receiving credits. It is essential to keep records of all submitted documentation in case of audits or inquiries from tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions for Form 6390 are critical for ensuring that you receive any applicable credits. Typically, these deadlines align with the state tax filing calendar. Taxpayers should be aware of the specific dates for submission to avoid late fees or penalties. It is advisable to mark these dates on your calendar and prepare your documentation well in advance.

Eligibility Criteria

To qualify for the credits outlined in the Instructions for Form 6390, taxpayers must meet specific eligibility criteria. These may include factors such as residency status, types of expenses incurred, and the nature of the activities that generated the credits. Thoroughly reviewing these criteria is essential before completing the form to ensure that you meet all necessary requirements.

Required Documents

When completing the Instructions for Form 6390, certain documents are required to substantiate your claims. These may include:

- Receipts for eligible expenses.

- Proof of residency in Alaska.

- Documentation of the activities or investments that qualify for credits.

Having these documents ready can streamline the filing process and support your claims during any reviews or audits.

Form Submission Methods (Online / Mail / In-Person)

The Instructions for Form 6390 can be submitted through various methods, depending on taxpayer preference and state guidelines. Options typically include:

- Online submission through the state tax portal.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices, if available.

Choosing the appropriate submission method can affect processing times, so it is advisable to consider the most efficient option for your situation.

Quick guide on how to complete instructions for form 6390 2018 alaska federal based credits

Complete Instructions For Form 6390 Alaska Federal Based Credits effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely keep it online. airSlate SignNow equips you with all the resources you need to create, alter, and electronically sign your documents promptly without delays. Handle Instructions For Form 6390 Alaska Federal Based Credits on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to alter and electronically sign Instructions For Form 6390 Alaska Federal Based Credits effortlessly

- Obtain Instructions For Form 6390 Alaska Federal Based Credits and then click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize key sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow meets your requirements in document management with just a few clicks from a device of your choosing. Edit and electronically sign Instructions For Form 6390 Alaska Federal Based Credits and guarantee excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 6390 2018 alaska federal based credits

How to generate an eSignature for the Instructions For Form 6390 2018 Alaska Federal Based Credits online

How to make an eSignature for your Instructions For Form 6390 2018 Alaska Federal Based Credits in Google Chrome

How to create an eSignature for putting it on the Instructions For Form 6390 2018 Alaska Federal Based Credits in Gmail

How to create an electronic signature for the Instructions For Form 6390 2018 Alaska Federal Based Credits from your smartphone

How to create an electronic signature for the Instructions For Form 6390 2018 Alaska Federal Based Credits on iOS

How to make an eSignature for the Instructions For Form 6390 2018 Alaska Federal Based Credits on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to 2019 ak?

airSlate SignNow is an intuitive eSigning platform that allows businesses to send and sign documents electronically. In relation to the 2019 ak, it streamlines the document management process for companies looking for a cost-effective solution that maintains security and compliance.

-

How much does airSlate SignNow cost for users looking to use it for 2019 ak documents?

The pricing for airSlate SignNow is competitive and tailored to fit various business needs, including those focusing on 2019 ak documents. Plans typically start from a basic option for small businesses to premium packages for larger teams, making it accessible for anyone needing efficient document management.

-

What key features of airSlate SignNow enhance the signing process for 2019 ak?

Key features of airSlate SignNow include customizable templates, advanced security protocols, and mobile capabilities that enhance the signing process for 2019 ak documents. These tools ensure that users can manage documents efficiently, while also maintaining professionalism and security.

-

What are the benefits of using airSlate SignNow for 2019 ak documentation?

Using airSlate SignNow for 2019 ak documentation offers numerous benefits, including increased efficiency, time savings, and reduced paper use. The platform's ease of use allows teams to focus on more critical tasks while ensuring seamless document flow and compliance.

-

Can airSlate SignNow integrate with other applications for managing 2019 ak documents?

Yes, airSlate SignNow offers several integrations with popular business applications, which is particularly beneficial for managing 2019 ak documents. Users can connect their existing software solutions to streamline workflows and improve overall efficiency.

-

Is airSlate SignNow secure to use for sensitive 2019 ak materials?

Absolutely, airSlate SignNow employs industry-standard security measures to protect sensitive 2019 ak materials. This includes encryption, secure storage, and compliance with regulations like GDPR and HIPAA, ensuring that your documents remain safe and confidential.

-

How does airSlate SignNow improve collaboration on 2019 ak projects?

airSlate SignNow enhances collaboration on 2019 ak projects through its real-time commenting and document tracking features. Users can work together more efficiently, keeping everyone on the same page and making it easier to finalize agreements swiftly.

Get more for Instructions For Form 6390 Alaska Federal Based Credits

- Towards an uml based graphical representation of grid workflow askalon form

- Page 1 of 2 state of california department of real estate providing service protecting you mortgage loan disclosure statement form

- Claim form san francisco housing authority

- Newportbeachca govgovernmentdepartmentswelcome to the building divisioncity of newport beach form

- De anza apartments form

- Post production contract template form

- Post nuptial contract template form

- Postpartum doula contract template 787753858 form

Find out other Instructions For Form 6390 Alaska Federal Based Credits

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple