Page 1 of 2 State of California Department of Real Estate Providing Service, Protecting You Mortgage Loan Disclosure Statement R Form

Understanding the California Mortgage Loan Disclosure Statement

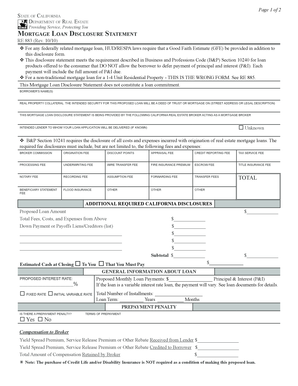

The California mortgage loan disclosure statement, known as the RE 883, is a crucial document that provides borrowers with essential information about their mortgage loans. This form is designed to protect consumers by ensuring they have a clear understanding of the terms and conditions associated with their loan. It includes details such as the loan amount, interest rates, and any fees that may apply, allowing borrowers to make informed decisions.

Steps to Complete the California Mortgage Loan Disclosure Statement

Completing the California mortgage loan disclosure statement involves several key steps:

- Gather necessary information, including personal identification and financial details.

- Fill out the form accurately, ensuring all sections are completed as required.

- Review the completed statement for any errors or omissions.

- Submit the form to the appropriate lender or financial institution.

Following these steps helps ensure that the disclosure statement is filled out correctly, minimizing the risk of delays in the loan process.

Key Elements of the California Mortgage Loan Disclosure Statement

The RE 883 includes several key elements that borrowers should pay close attention to:

- Loan Amount: The total amount being borrowed.

- Interest Rate: The rate at which interest will accrue on the loan.

- Fees: Any additional costs associated with the loan, such as origination fees or closing costs.

- Loan Term: The duration over which the loan will be repaid.

- Monthly Payments: The amount that will be due each month.

Understanding these elements is vital for borrowers to assess their financial obligations and make informed choices.

Legal Use of the California Mortgage Loan Disclosure Statement

The California mortgage loan disclosure statement serves a legal purpose by ensuring compliance with state and federal regulations. Lenders are required to provide this document to borrowers as part of the loan application process. This requirement helps protect consumers by ensuring they are aware of their rights and responsibilities before entering into a mortgage agreement.

Obtaining the California Mortgage Loan Disclosure Statement

Borrowers can obtain the California mortgage loan disclosure statement through their lender or financial institution. It is typically provided during the initial stages of the loan application process. Additionally, the form may be available in a fillable format online, allowing for easier completion and submission.

Digital vs. Paper Version of the California Mortgage Loan Disclosure Statement

Both digital and paper versions of the California mortgage loan disclosure statement are acceptable. The digital format offers convenience, allowing for easier editing and submission. Many lenders now provide options for electronic signatures, streamlining the process further. However, some borrowers may prefer the traditional paper version for their records. Regardless of the format, it is essential to ensure that all information is accurate and complete.

Quick guide on how to complete page 1 of 2 state of california department of real estate providing service protecting you mortgage loan disclosure statement

Effortlessly Prepare Page 1 Of 2 State Of California Department Of Real Estate Providing Service, Protecting You Mortgage Loan Disclosure Statement R on Any Device

Managing documents online has gained popularity among companies and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, allowing you to access the correct format and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Page 1 Of 2 State Of California Department Of Real Estate Providing Service, Protecting You Mortgage Loan Disclosure Statement R on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Modify and eSign Page 1 Of 2 State Of California Department Of Real Estate Providing Service, Protecting You Mortgage Loan Disclosure Statement R with Ease

- Find Page 1 Of 2 State Of California Department Of Real Estate Providing Service, Protecting You Mortgage Loan Disclosure Statement R and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important parts of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that function.

- Create your signature with the Sign feature, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Page 1 Of 2 State Of California Department Of Real Estate Providing Service, Protecting You Mortgage Loan Disclosure Statement R and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the page 1 of 2 state of california department of real estate providing service protecting you mortgage loan disclosure statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CA mortgage loan disclosure statement?

A CA mortgage loan disclosure statement is a document that lenders are required to provide borrowers in California. It outlines key terms of the mortgage loan, including the loan amount, interest rate, and any applicable fees. This transparency helps consumers understand the financial obligations associated with their mortgage.

-

How does airSlate SignNow help with CA mortgage loan disclosure statements?

airSlate SignNow offers an efficient platform for drafting, sending, and eSigning CA mortgage loan disclosure statements. With our solution, real estate professionals can easily manage the paperwork involved in the mortgage process. This streamlines operations and ensures compliance with state regulations.

-

What features does airSlate SignNow provide for mortgage professionals?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage for CA mortgage loan disclosure statements. These tools simplify the workflow for mortgage professionals, reducing errors and saving time. Additionally, our user-friendly interface makes eSigning seamless for clients.

-

Is airSlate SignNow cost-effective for managing CA mortgage loan disclosure statements?

Yes, airSlate SignNow is a cost-effective solution for managing CA mortgage loan disclosure statements. Our flexible pricing plans cater to businesses of all sizes, allowing you to scale your operation without incurring high software costs. This makes it an excellent choice for mortgage lenders and real estate agents looking to optimize their budget.

-

Can I integrate airSlate SignNow with other software for mortgage processing?

Absolutely! airSlate SignNow offers integrations with various mortgage processing software and CRM systems. This allows users to maintain a seamless workflow when handling CA mortgage loan disclosure statements and other important documents. You can enhance productivity by connecting your existing tools with our platform.

-

What are the benefits of using airSlate SignNow for CA mortgage loan disclosure statements?

Using airSlate SignNow for CA mortgage loan disclosure statements provides numerous benefits, including increased efficiency and reduced turnaround times. The platform ensures secure eSigning, reducing the need for physical document handling. Additionally, it enhances client experience, making the mortgage process smoother and more transparent.

-

How secure is airSlate SignNow for handling sensitive mortgage documents?

Security is a top priority at airSlate SignNow. We comply with industry standards to ensure that CA mortgage loan disclosure statements and other sensitive documents are protected. Features like encryption, secure cloud storage, and access controls help keep your documents safe from unauthorized access.

Get more for Page 1 Of 2 State Of California Department Of Real Estate Providing Service, Protecting You Mortgage Loan Disclosure Statement R

- Ayud0003t02 abono de la subvencin para inversiones en form

- Ilovepdf api guides and examples for developers form

- Manulife disability claim member statement pdf form

- Professional corporation pc professional limite form

- Real estate purchase agreement know the factsquicken form

- Sep ira and simple ira distribution form

- Cook county small estate affidavitampquot keyword found websites form

- 147 pdf department of home affairs application for a new form

Find out other Page 1 Of 2 State Of California Department Of Real Estate Providing Service, Protecting You Mortgage Loan Disclosure Statement R

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document