Trs6a Form

What is the TRS6A Form

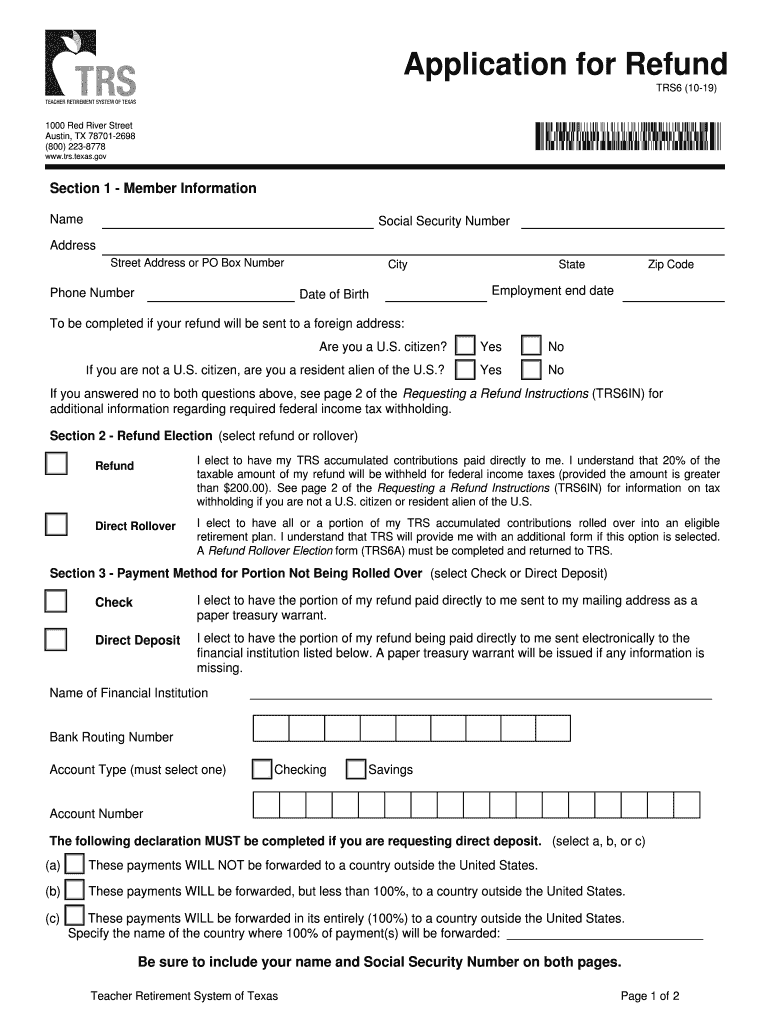

The TRS6A form, also known as the refund rollover election form TRS6A, is a document used by individuals participating in the Texas Retirement System (TRS) to request a refund of their contributions. This form is essential for those who have left employment covered by TRS and wish to withdraw their funds. It is specifically designed to facilitate the rollover of retirement savings into another qualified retirement plan, ensuring that individuals can maintain the tax-deferred status of their funds.

How to Use the TRS6A Form

Using the TRS6A form involves several straightforward steps. First, ensure you have all necessary personal information and details regarding your TRS account. Next, fill out the form accurately, providing information such as your name, Social Security number, and the amount you wish to roll over. After completing the form, review it for accuracy before submitting it to the appropriate TRS office. It is advisable to keep a copy of the submitted form for your records.

Steps to Complete the TRS6A Form

Completing the TRS6A form requires careful attention to detail. Follow these steps:

- Gather your TRS account information, including your member number.

- Provide your personal details, including your name and contact information.

- Indicate the amount you wish to withdraw or roll over.

- Sign and date the form to validate your request.

- Submit the completed form to the TRS office via mail or electronically, if applicable.

Eligibility Criteria

To be eligible to use the TRS6A form, you must have previously contributed to the Texas Retirement System and have left your employment with a TRS-covered employer. Additionally, you must not currently be receiving retirement benefits from TRS. Understanding these criteria is crucial to ensure that your application for a refund is processed smoothly.

Required Documents

When submitting the TRS6A form, certain documents may be required to support your request. These typically include:

- A copy of your identification, such as a driver's license or Social Security card.

- Any previous correspondence with TRS regarding your account.

- Documentation of your employment history with TRS-covered employers.

Having these documents ready can expedite the processing of your refund request.

Legal Use of the TRS6A Form

The TRS6A form is legally binding once completed and submitted according to Texas state laws governing retirement funds. It is important to ensure that all information provided is accurate and truthful, as any discrepancies could lead to delays or denial of your refund request. The form must also comply with the Electronic Signatures in Global and National Commerce Act (ESIGN), ensuring that electronic submissions are recognized legally.

Quick guide on how to complete employment end date

Complete Trs6a Form effortlessly on any device

Online document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage Trs6a Form on any device using the airSlate SignNow applications for Android or iOS and enhance any document-centric procedure today.

The simplest way to modify and eSign Trs6a Form without hassle

- Obtain Trs6a Form and click Get Form to begin.

- Employ the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the stress of lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Trs6a Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the employment end date

How to make an eSignature for the Employment End Date online

How to make an electronic signature for your Employment End Date in Chrome

How to make an electronic signature for signing the Employment End Date in Gmail

How to create an eSignature for the Employment End Date from your smartphone

How to create an eSignature for the Employment End Date on iOS

How to make an eSignature for the Employment End Date on Android OS

People also ask

-

What is a trs6a form?

The trs6a form is an important document used in various business contexts for electronic signatures and form submissions. With airSlate SignNow, you can easily create, send, and manage this form for your company's needs. Understanding its functionality can enhance your document workflow.

-

How can airSlate SignNow help me with the trs6a form?

AirSlate SignNow provides a user-friendly platform to fill out and sign the trs6a form electronically. Our solution streamlines the process, making it fast and efficient for you and your clients to manage this important document. Enjoy the benefits of secure and compliant electronic signatures.

-

What are the pricing options for using airSlate SignNow for the trs6a form?

AirSlate SignNow offers competitive pricing plans that cater to different business sizes and needs. Whether you’re a small startup or a large enterprise, our pricing ensures you can manage the trs6a form and other documents without breaking the bank. Explore our plans to find the best fit for your organization.

-

Can I integrate airSlate SignNow with other software for my trs6a form management?

Yes, airSlate SignNow seamlessly integrates with various applications, making it easy to manage the trs6a form alongside your existing tools. This integration capability enhances your workflow and allows you to pull data from other systems, ensuring consistency and accuracy.

-

What are the benefits of using airSlate SignNow for the trs6a form?

Using airSlate SignNow for your trs6a form offers several benefits, including reduced processing time, improved accuracy, and enhanced security. Our platform ensures that documents are signed legally and securely, giving you peace of mind while managing important business documents.

-

Is airSlate SignNow compliant with legal requirements for the trs6a form?

Absolutely, airSlate SignNow adheres to strict legal standards for electronic signatures, ensuring that your trs6a form is compliant with regulations. Our solution provides legally binding signatures, making it a reliable choice for professionals who need assurance in their document processes.

-

How do I get started with airSlate SignNow for the trs6a form?

Getting started with airSlate SignNow for the trs6a form is simple. Sign up for a free trial on our website, where you can access all features and familiarize yourself with the platform. Once set up, you can easily create and manage your trs6a forms in no time.

Get more for Trs6a Form

- Prwgzgings pampquotlamp39amp39iampquot b ncbi nlm nih form

- Patient safety statement lakeside behavioral health system form

- Va form 10 10066

- Cplr 2105 form

- Plumb construction contract template form

- Plumb contract template form

- Plumb maintenance contract template form

- Plumb service contract template form

Find out other Trs6a Form

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple