6323 Form

What is the 6323 Form

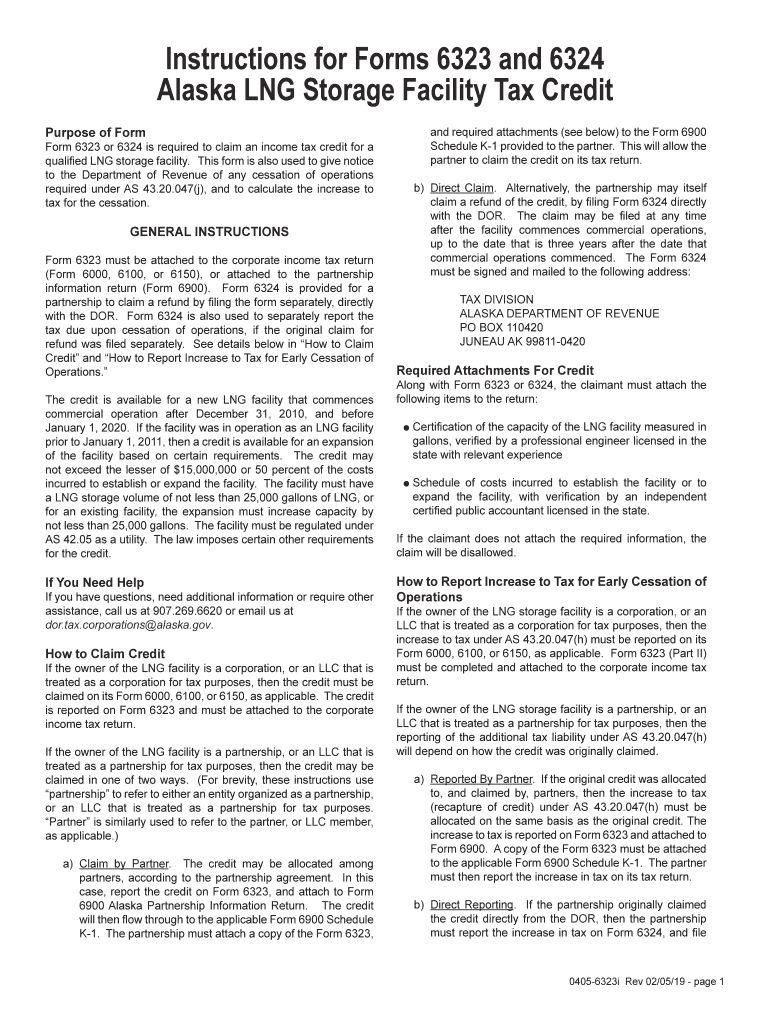

The 6323 form, often referred to as the Alaska 6323 credit form, is a document used by businesses and individuals in Alaska to claim specific tax credits. This form is essential for those looking to benefit from the Alaska facility credit, which is designed to incentivize economic activity within the state. Understanding the purpose and requirements of the 6323 credit form is crucial for ensuring compliance with state tax regulations.

How to use the 6323 Form

Using the 6323 credit fillable form involves several key steps. First, ensure that you have the correct version of the form, which can be downloaded from authorized sources. Next, fill out the required fields accurately, including personal information and details related to the credit being claimed. After completing the form, it can be submitted electronically or via traditional mail, depending on the submission guidelines provided by the state. It is important to double-check all entries to avoid delays or issues with processing.

Steps to complete the 6323 Form

Completing the 6323 credit form involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Download the 6323 credit fillable form from a reliable source.

- Read the instructions carefully to understand the requirements.

- Fill in your personal information, including name, address, and tax identification number.

- Provide detailed information regarding the credit you are claiming, including any necessary calculations.

- Review the form for completeness and accuracy.

- Submit the form as instructed, either online or by mail.

Legal use of the 6323 Form

The legal use of the 6323 credit form is governed by specific regulations set forth by the state of Alaska. To ensure that the form is legally binding, it must be filled out correctly and submitted in accordance with state laws. This includes adhering to deadlines and providing necessary documentation that supports the credit claim. Proper legal use not only protects the taxpayer but also ensures compliance with state tax obligations.

Eligibility Criteria

To qualify for the Alaska 6323 credit, applicants must meet certain eligibility criteria. Generally, this includes being a resident of Alaska or operating a business within the state. Additionally, the applicant must demonstrate that they meet the specific conditions outlined for the credit, such as the nature of the business activities and the associated economic benefits. It is advisable to review the eligibility requirements carefully before completing the form to ensure compliance.

Filing Deadlines / Important Dates

Filing deadlines for the 6323 credit form are critical to ensure timely processing of claims. Typically, the form must be submitted by a specific date each tax year, which is often aligned with the state tax filing deadlines. It is important to stay informed about these dates to avoid penalties or missed opportunities for claiming the credit. Checking the official state tax website or consulting with a tax professional can provide the most accurate and up-to-date information regarding deadlines.

Quick guide on how to complete 2018 instructions for form 4136 internal revenue service

Complete 6323 Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage 6323 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign 6323 Form without any hassle

- Obtain 6323 Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to preserve your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign 6323 Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2018 instructions for form 4136 internal revenue service

How to make an electronic signature for the 2018 Instructions For Form 4136 Internal Revenue Service online

How to create an eSignature for the 2018 Instructions For Form 4136 Internal Revenue Service in Chrome

How to create an eSignature for signing the 2018 Instructions For Form 4136 Internal Revenue Service in Gmail

How to generate an eSignature for the 2018 Instructions For Form 4136 Internal Revenue Service right from your smartphone

How to generate an eSignature for the 2018 Instructions For Form 4136 Internal Revenue Service on iOS

How to create an eSignature for the 2018 Instructions For Form 4136 Internal Revenue Service on Android devices

People also ask

-

What is the Alaska 6323i credit download?

The Alaska 6323i credit download is a digital document that allows users to access important credit information specific to Alaska. By utilizing this feature on airSlate SignNow, you can easily manage your credit documents and ensure compliance with state regulations.

-

How much does the Alaska 6323i credit download feature cost?

The cost of using the Alaska 6323i credit download feature varies based on your subscription plan with airSlate SignNow. We offer several pricing tiers to accommodate different business needs, making it a cost-effective solution for managing your credit documents.

-

What are the key features of the Alaska 6323i credit download?

The key features of the Alaska 6323i credit download include easy access to credit reports, seamless eSigning options, and secure storage. These features help you streamline your document management process while ensuring that your sensitive information is protected.

-

Can I integrate the Alaska 6323i credit download with other applications?

Yes, the Alaska 6323i credit download can be integrated with various third-party applications such as CRM systems, accounting software, and more. This enables you to enhance your workflow and manage your documents more efficiently within your existing tools.

-

What benefits does airSlate SignNow offer for managing Alaska 6323i credit downloads?

Using airSlate SignNow for your Alaska 6323i credit downloads provides numerous benefits, including improved efficiency and reduced turnaround times for document approvals. Our platform also offers a user-friendly interface that simplifies the process of sending and eSigning important documents.

-

Is the Alaska 6323i credit download secure?

Absolutely! The Alaska 6323i credit download feature is designed with advanced security measures to keep your data safe. airSlate SignNow employs encryption standards and secure cloud storage to ensure your sensitive information remains protected at all times.

-

How do I get started with downloading the Alaska 6323i credit?

Getting started with the Alaska 6323i credit download is simple. Just sign up for an airSlate SignNow account, select the appropriate plan, and navigate to the documentation section where you can easily download and manage your credit documents.

Get more for 6323 Form

- Multiple forms of phosphoinositide specific phospholipase c of ncbi nlm nih

- An econometric analysis of capital utilization econ umd form

- Photography cancellation contract template form

- Photography contract template 787753786 form

- Photography deposit contract template form

- Photography event contract template form

- Photography mini session contract template form

- Photography for wedding contract template form

Find out other 6323 Form

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template