Employee's Withholding Allowance Certificate Sierra County Form

What is the Employee's Withholding Allowance Certificate?

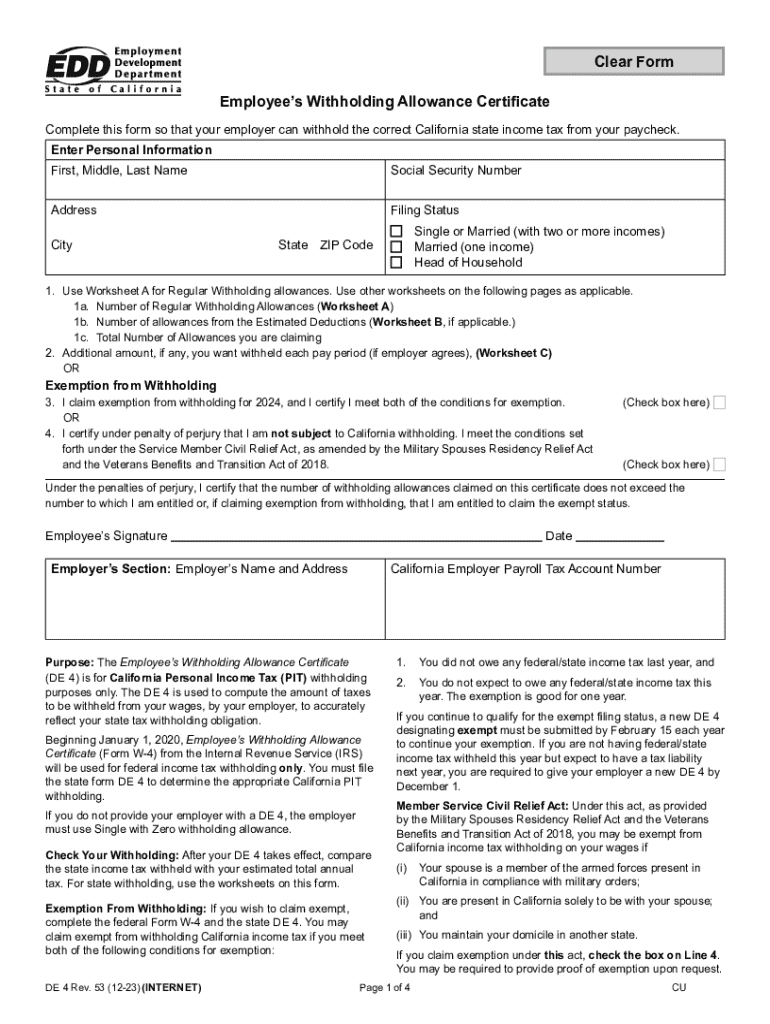

The Employee's Withholding Allowance Certificate, commonly known as the California DE 4 form, is a crucial document for employees in Sierra County and throughout California. This form allows employees to indicate the number of withholding allowances they claim for state income tax purposes. The number of allowances directly affects the amount of state income tax withheld from their paychecks. Understanding and accurately completing this form is essential for ensuring that the correct amount of tax is withheld, helping to avoid underpayment or overpayment of taxes throughout the year.

Steps to Complete the Employee's Withholding Allowance Certificate

Completing the California DE 4 form involves several straightforward steps:

- Personal Information: Fill in your name, address, and Social Security number at the top of the form.

- Filing Status: Indicate your filing status, which can be single, married, or head of household.

- Allowances: Calculate and enter the number of allowances you are claiming based on your personal circumstances, such as dependents and other deductions.

- Additional Withholding: If you wish to have extra tax withheld, specify the amount in the designated section.

- Signature: Finally, sign and date the form to validate it.

Legal Use of the Employee's Withholding Allowance Certificate

The California DE 4 form is legally recognized by the state of California for determining the appropriate amount of income tax withholding. Employers must ensure that they have a valid DE 4 form on file for each employee to comply with state tax laws. This form must be updated whenever there are significant changes in an employee's tax situation, such as marriage, divorce, or the birth of a child, to maintain accurate withholding levels.

Filing Deadlines / Important Dates

It is important for employees to submit their California DE 4 form to their employer upon hire or whenever they wish to adjust their withholding allowances. Employers are required to process this form promptly to ensure that the correct amount of state income tax is withheld from employees' paychecks. Additionally, employees should review their withholding at the beginning of each year or when their financial situation changes, to avoid any surprises during tax season.

Eligibility Criteria

All employees working in California, including those in Sierra County, are eligible to complete and submit the California DE 4 form. This includes full-time, part-time, and temporary employees. It is important for employees to accurately assess their eligibility for withholding allowances based on their personal financial circumstances, as this will affect their tax obligations. Additionally, employees who have multiple jobs should consider the total allowances across all positions to ensure proper withholding.

Examples of Using the Employee's Withholding Allowance Certificate

Understanding how to use the California DE 4 form can help employees make informed decisions about their tax withholdings. For example, an employee with two children may claim additional allowances to reduce their tax withholding, thereby increasing their take-home pay. Conversely, an employee who expects to owe taxes due to side income might choose to claim fewer allowances or request additional withholding to avoid a tax bill at the end of the year. Each scenario should be carefully evaluated to align with the employee's financial goals.

Quick guide on how to complete employees withholding allowance certificate sierra county

Complete Employee's Withholding Allowance Certificate Sierra County effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents promptly without delays. Manage Employee's Withholding Allowance Certificate Sierra County on any platform with airSlate SignNow Android or iOS applications and streamline any document-centric process today.

The simplest way to modify and electronically sign Employee's Withholding Allowance Certificate Sierra County without hassle

- Obtain Employee's Withholding Allowance Certificate Sierra County and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your preference. Modify and electronically sign Employee's Withholding Allowance Certificate Sierra County and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the employees withholding allowance certificate sierra county

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Can I integrate the de 4 form with other software?

Yes, airSlate SignNow allows seamless integration with various software applications, enhancing the functionality of the de 4 form. You can connect it with popular tools like Google Drive, Salesforce, and more. This integration helps streamline your workflow and ensures that all your documents are easily accessible.

-

Is the de 4 form secure for sensitive information?

Absolutely! airSlate SignNow prioritizes security, ensuring that the de 4 form is protected with advanced encryption and compliance with industry standards. Your documents are stored securely, and you can track who has accessed them, providing peace of mind when handling sensitive information.

-

What is the de 4 form and how can it benefit my business?

The de 4 form is a crucial document for businesses that need to manage and sign contracts efficiently. By utilizing airSlate SignNow, you can streamline the signing process, reduce paperwork, and enhance productivity. This digital solution allows for quick access and secure signing, making it an essential tool for modern businesses.

-

What features does airSlate SignNow offer for the de 4 form?

airSlate SignNow provides a range of features for the de 4 form, including customizable templates, automated workflows, and real-time tracking. These features help simplify the signing process and enhance collaboration among team members. You can also add fields for signatures, dates, and other necessary information easily.

-

How much does it cost to use airSlate SignNow for the de 4 form?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for the de 4 form. You can choose from monthly or annual subscriptions, with various features included at each tier. This ensures that you only pay for what you need while benefiting from a cost-effective solution.

-

How can the de 4 form improve my team's efficiency?

Using the de 4 form with airSlate SignNow can signNowly improve your team's efficiency by reducing the time spent on manual paperwork. The platform allows for quick document preparation and instant eSigning, which accelerates the approval process. This means your team can focus on more critical tasks rather than getting bogged down by administrative duties.

-

Can I integrate the de 4 form with other software?

Yes, airSlate SignNow allows seamless integration with various software applications, enhancing the functionality of the de 4 form. You can connect it with popular tools like Google Drive, Salesforce, and more. This integration helps streamline your workflow and ensures that all your documents are easily accessible.

-

Can I track the status of the de 4 form once sent?

Yes, airSlate SignNow provides tracking capabilities for the de 4 form, allowing you to monitor its status in real-time. You will receive notifications when the document is viewed, signed, or completed. This feature ensures that you stay informed throughout the signing process.

-

Is the de 4 form secure for sensitive information?

Absolutely! airSlate SignNow prioritizes security, ensuring that the de 4 form is protected with advanced encryption and compliance with industry standards. Your documents are stored securely, and you can track who has accessed them, providing peace of mind when handling sensitive information.

-

What features does airSlate SignNow offer for the de 4 form?

airSlate SignNow provides a range of features for the de 4 form, including customizable templates, automated workflows, and real-time tracking. These features help simplify the signing process and enhance collaboration among team members. You can also add fields for signatures, dates, and other necessary information easily.

-

How can the de 4 form improve my team's efficiency?

Using the de 4 form with airSlate SignNow can signNowly improve your team's efficiency by reducing the time spent on manual paperwork. The platform allows for quick document preparation and instant eSigning, which accelerates the approval process. This means your team can focus on more critical tasks rather than getting bogged down by administrative duties.

-

Can I track the status of the de 4 form once sent?

Yes, airSlate SignNow provides tracking capabilities for the de 4 form, allowing you to monitor its status in real-time. You will receive notifications when the document is viewed, signed, or completed. This feature ensures that you stay informed throughout the signing process.

Get more for Employee's Withholding Allowance Certificate Sierra County

- I vilken stad har elin lindman gjort sina intervjuer form

- Attachment 6 i eligibility income and deduction checklist form

- Mibfa payment dates form

- One time ach authorization form

- Equal housing lender poster pdf form

- Amy morin 13 things mentally strong pdf form

- Food likes and dislikes questionnaire form

- Barter contract template form

Find out other Employee's Withholding Allowance Certificate Sierra County

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile