K 99CSV Information Returns Specifications for Electronic Filing Comma Separated Value CSV Format Rev 10 19 Electronic

Understanding the K-99CSV Information Returns Specifications for Electronic Filing

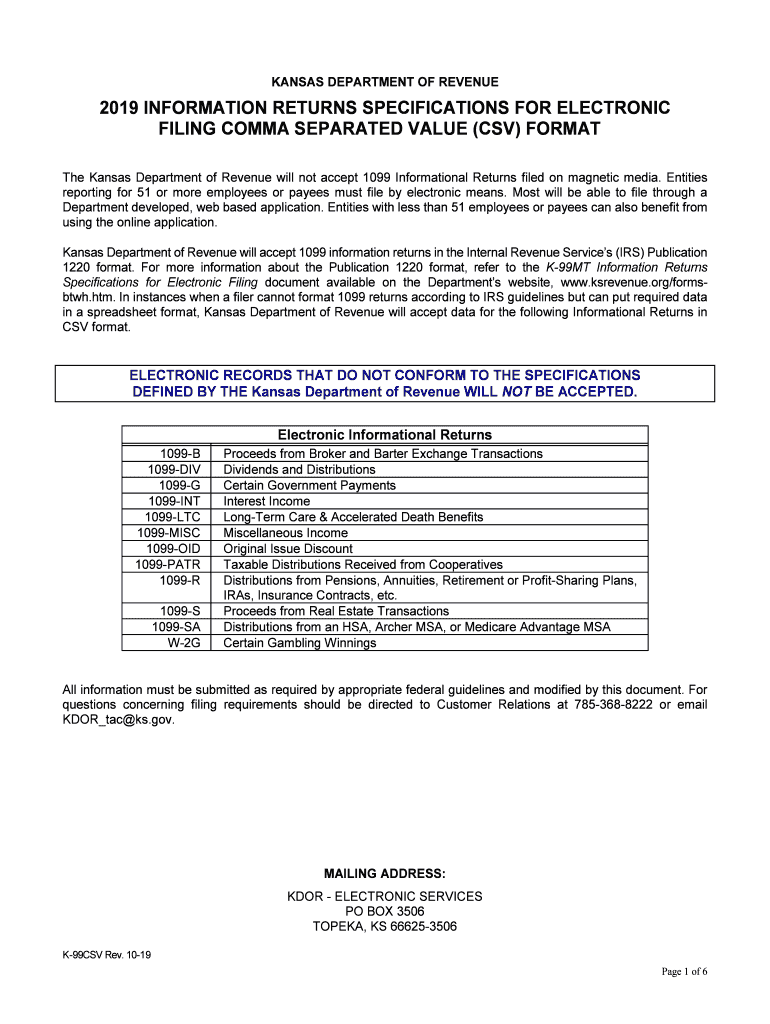

The K-99CSV Information Returns Specifications for Electronic Filing is a crucial document for businesses and individuals who need to report certain types of income. This specification outlines the format and requirements for submitting information returns electronically to the Kansas Department of Revenue. It is essential for ensuring compliance with state regulations and for the accurate processing of tax information. The specifications include details on data fields, file structure, and submission protocols that must be adhered to for successful filing.

Steps to Complete the K-99CSV Information Returns Specifications

Completing the K-99CSV specifications involves several key steps to ensure accuracy and compliance. First, gather all necessary data related to the income being reported. This includes names, addresses, and taxpayer identification numbers. Next, format the data according to the specifications outlined in the K-99CSV document, ensuring that all required fields are included. After formatting, validate the file to check for errors before submission. Finally, submit the completed file electronically to the Kansas Department of Revenue through the designated online portal.

Legal Use of the K-99CSV Specifications

The K-99CSV specifications are legally binding when all requirements are met. Compliance with electronic filing standards ensures that the submitted documents are recognized by the Kansas Department of Revenue. It is important to use a reliable electronic signature solution that adheres to the ESIGN and UETA acts, which govern the legality of electronic signatures in the United States. This legal framework establishes that electronic submissions hold the same weight as traditional paper filings, provided they follow the specified guidelines.

Filing Deadlines and Important Dates

Staying informed about filing deadlines is crucial for compliance with the Kansas Department of Revenue. Generally, the deadlines for submitting K-99CSV forms align with the federal tax filing deadlines. However, specific dates may vary based on the type of income being reported. It is advisable to check the Kansas Department of Revenue's official announcements for any updates or changes to deadlines to avoid penalties.

Required Documents for K-99CSV Filing

To complete the K-99CSV filing, certain documents are necessary. These typically include the taxpayer's identification information, income details, and any relevant supporting documentation that verifies the income being reported. It is also important to have access to the K-99CSV specifications document itself, as it provides the necessary guidelines for formatting and submitting the information correctly.

Form Submission Methods

The K-99CSV form can be submitted electronically, which is the preferred method for the Kansas Department of Revenue. This electronic submission process allows for quicker processing and reduces the risk of errors associated with paper filings. While electronic filing is encouraged, it is also possible to submit the form via mail or in person, though these methods may result in longer processing times. Always ensure that any submission method used complies with the specifications outlined in the K-99CSV document.

Quick guide on how to complete k 99csv 2019 information returns specifications for electronic filing comma separated value csv format rev 10 19 electronic

Complete K 99CSV Information Returns Specifications For Electronic Filing Comma Separated Value CSV Format Rev 10 19 Electronic effortlessly on any device

Digital document administration has become increasingly popular with both organizations and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and safely store it online. airSlate SignNow offers all the tools you require to create, edit, and electronically sign your documents quickly and without delays. Manage K 99CSV Information Returns Specifications For Electronic Filing Comma Separated Value CSV Format Rev 10 19 Electronic on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to edit and electronically sign K 99CSV Information Returns Specifications For Electronic Filing Comma Separated Value CSV Format Rev 10 19 Electronic without effort

- Find K 99CSV Information Returns Specifications For Electronic Filing Comma Separated Value CSV Format Rev 10 19 Electronic and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of the documents or obscure sensitive details with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget worrying about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign K 99CSV Information Returns Specifications For Electronic Filing Comma Separated Value CSV Format Rev 10 19 Electronic and ensure outstanding communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the k 99csv 2019 information returns specifications for electronic filing comma separated value csv format rev 10 19 electronic

How to generate an eSignature for the K 99csv 2019 Information Returns Specifications For Electronic Filing Comma Separated Value Csv Format Rev 10 19 Electronic online

How to make an eSignature for the K 99csv 2019 Information Returns Specifications For Electronic Filing Comma Separated Value Csv Format Rev 10 19 Electronic in Chrome

How to create an electronic signature for putting it on the K 99csv 2019 Information Returns Specifications For Electronic Filing Comma Separated Value Csv Format Rev 10 19 Electronic in Gmail

How to generate an electronic signature for the K 99csv 2019 Information Returns Specifications For Electronic Filing Comma Separated Value Csv Format Rev 10 19 Electronic right from your smart phone

How to generate an electronic signature for the K 99csv 2019 Information Returns Specifications For Electronic Filing Comma Separated Value Csv Format Rev 10 19 Electronic on iOS

How to generate an eSignature for the K 99csv 2019 Information Returns Specifications For Electronic Filing Comma Separated Value Csv Format Rev 10 19 Electronic on Android devices

People also ask

-

What are the Kansas specifications for electronic filing?

The Kansas specifications for electronic filing dictate the necessary requirements for submitting documents digitally within the state. This includes acceptable file formats, security measures, and accessibility standards. Understanding these specifications is crucial for seamless compliance when utilizing airSlate SignNow for electronic filing.

-

How does airSlate SignNow comply with Kansas specifications for electronic filing?

airSlate SignNow adheres to Kansas specifications for electronic filing by ensuring all documents meet the required security protocols and formats. Our platform is designed to help users navigate the compliance landscape effectively. This commitment to compliance provides peace of mind when sending and eSigning documents in accordance with state laws.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to meet the needs of different users and organizations. These plans are competitive and designed to fit budgets while ensuring compliance with Kansas specifications for electronic filing. Subscribing allows users to access an array of features beneficial for efficient document management.

-

What features does airSlate SignNow provide for electronic filing in Kansas?

airSlate SignNow provides essential features like eSignature capabilities, document templates, and integration options, all of which comply with Kansas specifications for electronic filing. These tools streamline the process of sending and signing documents, making it easier for businesses to operate efficiently. With an intuitive interface, users can also manage their documents effectively.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers integration with various applications, such as CRM systems and cloud storage services. This capability enhances operational efficiency while ensuring that all electronic filings adhere to Kansas specifications. By integrating your existing tools, you can create a seamless workflow for managing document signatures.

-

What are the benefits of using airSlate SignNow for electronic filing in Kansas?

Using airSlate SignNow for electronic filing in Kansas simplifies the document management process and ensures compliance with state specifications. The platform's user-friendly interface allows for quick document preparation and eSigning, reducing turnaround times. Additionally, its cost-effectiveness makes it an attractive option for businesses of all sizes.

-

Is airSlate SignNow secure for electronic filings in Kansas?

Absolutely. airSlate SignNow employs robust security measures to protect your documents and data during electronic filing. This includes encryption and authentication protocols that comply with Kansas specifications for electronic filing. You can trust that your sensitive information remains safe throughout the signing process.

Get more for K 99CSV Information Returns Specifications For Electronic Filing Comma Separated Value CSV Format Rev 10 19 Electronic

- Program evaluation report city of stockton san joaquin county epa form

- British journal of ncbi nlm nih form

- Page 1 page 2 i introduction as does the majority opinion courts ca form

- A i k i k a i at l a n ta form

- Va form 21 0960c 7 veterans benefits administration va gov vba va

- Performance based contract template

- Performance contract template

- Performance based service contract template

Find out other K 99CSV Information Returns Specifications For Electronic Filing Comma Separated Value CSV Format Rev 10 19 Electronic

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement