Kansas Form K 59

What is the Kansas Form K-59

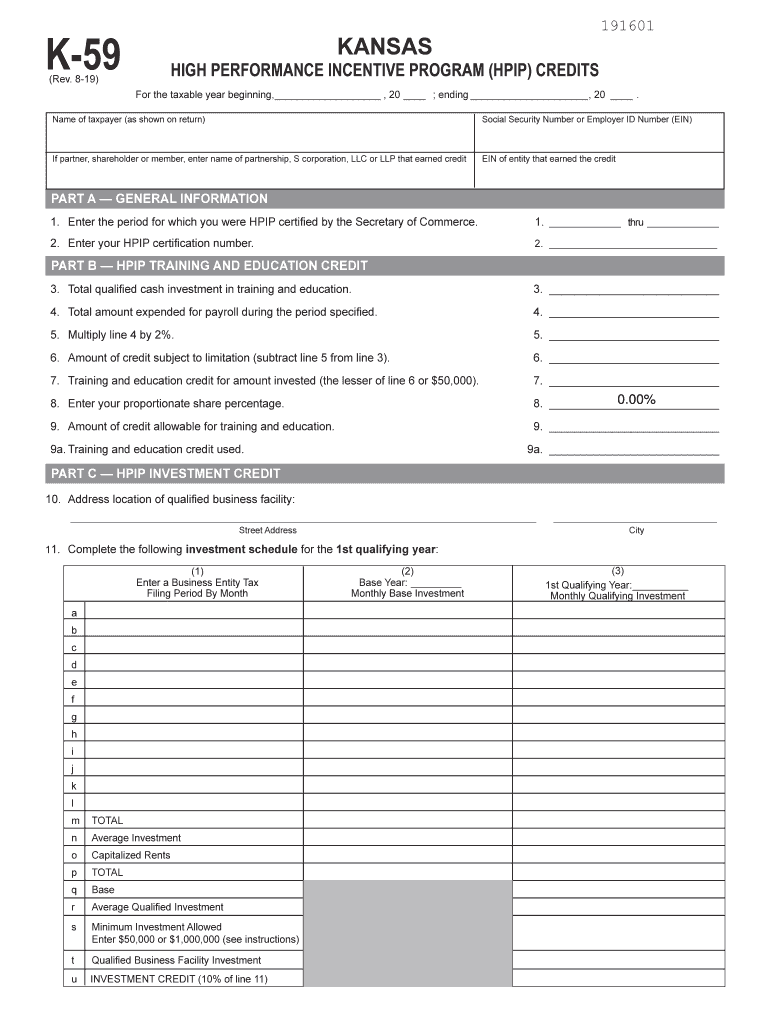

The Kansas Form K-59 is a state-specific tax form used primarily for reporting income from certain sources, such as partnerships, S corporations, and other pass-through entities. This form allows individuals and businesses to accurately report their share of income, deductions, and credits from these entities on their Kansas state tax returns. Understanding the purpose of Form K-59 is crucial for ensuring compliance with state tax regulations and for maximizing potential tax benefits.

How to use the Kansas Form K-59

Using the Kansas Form K-59 involves several steps to ensure accurate reporting of income and deductions. Taxpayers must first obtain the form, which can typically be found on the Kansas Department of Revenue website or through tax preparation software. After obtaining the form, individuals should fill it out with their income information from partnerships or S corporations, including any applicable deductions and credits. Once completed, the form must be submitted along with the taxpayer's Kansas individual income tax return.

Steps to complete the Kansas Form K-59

Completing the Kansas Form K-59 requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents, including K-1 forms from partnerships or S corporations.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your share of income, deductions, and credits as indicated on the K-1 forms.

- Double-check all entries for accuracy to avoid errors that could lead to penalties.

- Sign and date the form before submission.

Key elements of the Kansas Form K-59

The Kansas Form K-59 includes several key elements that are essential for proper tax reporting. These elements consist of:

- Taxpayer Information: Personal details such as name, address, and Social Security number.

- Income Reporting: Sections to report income from partnerships and S corporations.

- Deductions and Credits: Areas to claim any applicable deductions and credits associated with the reported income.

- Signature Line: A section for the taxpayer to sign, confirming the accuracy of the information provided.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Kansas Form K-59 to avoid penalties. Typically, the form must be filed by April 15 of the tax year, coinciding with the federal income tax deadline. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Taxpayers should also keep track of any changes in deadlines that may arise due to state-specific regulations or extensions.

Form Submission Methods

The Kansas Form K-59 can be submitted through various methods to accommodate different taxpayer preferences. Options include:

- Online Submission: Many taxpayers choose to file electronically through approved tax preparation software, which often includes e-filing options for state forms.

- Mail: Taxpayers can print the completed form and send it via postal mail to the Kansas Department of Revenue.

- In-Person: Some individuals may prefer to deliver their forms in person at local tax offices or the state revenue department.

Quick guide on how to complete high performance incentive program kansas department of

Complete Kansas Form K 59 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents swiftly without delays. Handle Kansas Form K 59 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

The easiest way to modify and eSign Kansas Form K 59 without effort

- Find Kansas Form K 59 and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Kansas Form K 59 and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the high performance incentive program kansas department of

How to generate an electronic signature for your High Performance Incentive Program Kansas Department Of online

How to make an electronic signature for your High Performance Incentive Program Kansas Department Of in Google Chrome

How to create an electronic signature for putting it on the High Performance Incentive Program Kansas Department Of in Gmail

How to create an electronic signature for the High Performance Incentive Program Kansas Department Of from your mobile device

How to generate an electronic signature for the High Performance Incentive Program Kansas Department Of on iOS

How to create an electronic signature for the High Performance Incentive Program Kansas Department Of on Android OS

People also ask

-

What is the kansas form k 59?

The Kansas Form K 59 is a document used for various tax-related processes in the state of Kansas. This form is essential for businesses and individuals who need to report their activities for compliance purposes. Using airSlate SignNow helps streamline the filling and signing process of the Kansas Form K 59 efficiently.

-

How does airSlate SignNow simplify the process of completing the kansas form k 59?

AirSlate SignNow offers easy-to-use features that allow users to complete the Kansas Form K 59 online. With templates and pre-built fields, it minimizes the time required for filling the form, ensuring that all necessary information is captured accurately. This convenience is especially beneficial during tax season.

-

Is there a cost associated with using airSlate SignNow for the kansas form k 59?

AirSlate SignNow offers competitive pricing plans that cater to different business needs. You can get started with a free trial, allowing you to explore the features related to completing the Kansas Form K 59 without upfront costs. Paid plans offer enhanced features for larger organizations and more frequent users.

-

Can I integrate airSlate SignNow with other software for processing the kansas form k 59?

Yes, airSlate SignNow supports integrations with various popular software applications. This means you can seamlessly transfer data from other platforms into your Kansas Form K 59 and vice versa, increasing efficiency and reducing manual data entry. Check the integration section for a list of compatible software.

-

How secure is the submission of the kansas form k 59 using airSlate SignNow?

AirSlate SignNow prioritizes security, employing advanced encryption methods to protect your documents, including the Kansas Form K 59. All data is stored in secure servers, and users can also utilize features like two-factor authentication to enhance security. You can confidently submit your sensitive documents knowing they are safeguarded.

-

What are the benefits of using airSlate SignNow for the kansas form k 59?

Using airSlate SignNow not only streamlines the completion and signing of the Kansas Form K 59 but also saves time and resources for your business. It allows for easy tracking of document status and sends reminders for signing. The overall efficiency improves workflow and helps ensure compliance with state requirements.

-

Are there templates available for the kansas form k 59 in airSlate SignNow?

Yes, airSlate SignNow provides templates specifically designed for the Kansas Form K 59, making it easier to start the document preparation process. These templates are pre-configured with fields that are relevant to the form, allowing for quick edits and updates. Utilizing templates can signNowly speed up the eSigning process.

Get more for Kansas Form K 59

- Cdatamy documentsnda reviewsexuberaexubera efficacy2 rev fda form

- Alzoubi et al the university of texas at dallas utdallas form

- Payment plan car installment payment contract template form

- Payment contract template form

- Payment plan installment payment contract template form

- Payment plan contract template form

- Payment takeover contract template form

- Payment plan owner financ contract template form

Find out other Kansas Form K 59

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast