Philadelphia Wage Tax Petition Form

What is the Philadelphia Wage Tax Petition

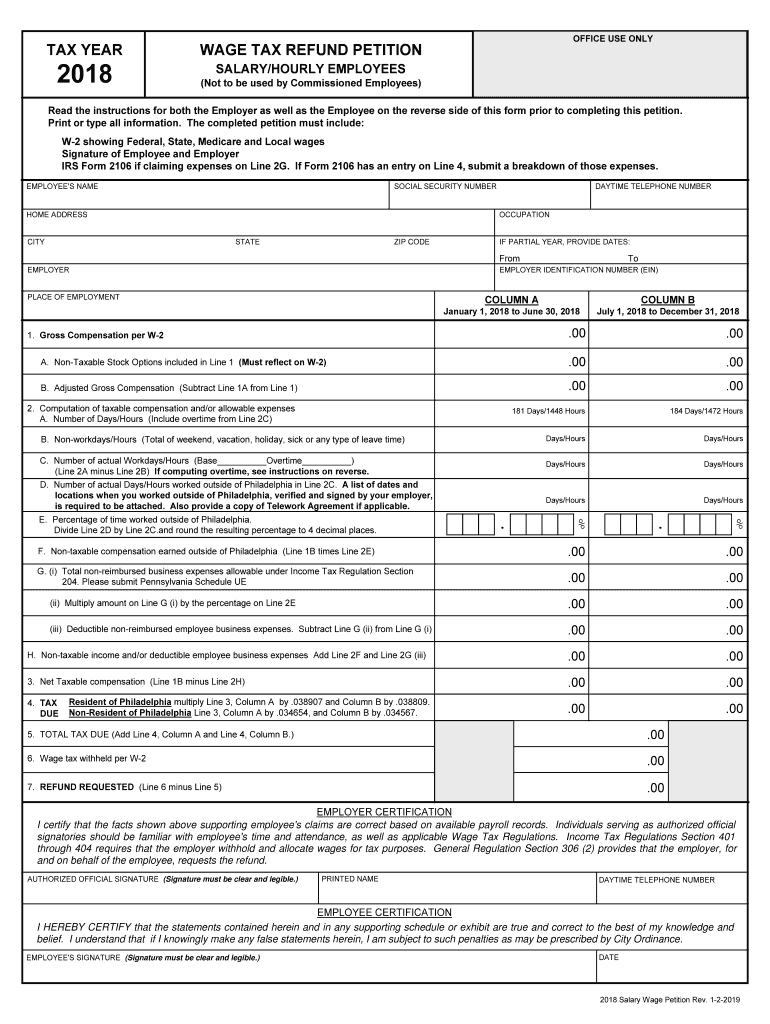

The Philadelphia Wage Tax Petition is a formal request submitted by individuals seeking a refund of wage taxes withheld by the City of Philadelphia. This petition is particularly relevant for employees who have overpaid their wage taxes or have been erroneously taxed. The petition allows taxpayers to reclaim funds that they are entitled to, ensuring that they are not paying more than their fair share of taxes. Understanding this petition is crucial for residents who work within the city limits and have experienced discrepancies in their wage tax withholdings.

Steps to complete the Philadelphia Wage Tax Petition

Completing the Philadelphia Wage Tax Petition involves several important steps to ensure that it is filled out correctly. First, gather all necessary documentation, including your W-2 forms and any other relevant tax documents. Next, download the appropriate form, typically the 83 A272A form, which is specific to wage tax refunds. Carefully fill out the form, ensuring that all information is accurate and matches your tax records. After completing the form, review it for any errors before submitting it. Finally, submit your petition either online or by mail to the City of Philadelphia Department of Revenue, depending on your preference.

Required Documents

To successfully file the Philadelphia Wage Tax Petition, certain documents are required. These typically include:

- Your W-2 forms for the relevant tax year.

- Proof of residency, if applicable.

- Any additional documentation that supports your claim for a refund.

Having these documents ready will facilitate a smoother filing process and help ensure that your petition is processed without delays.

Form Submission Methods (Online / Mail / In-Person)

The Philadelphia Wage Tax Petition can be submitted through various methods. Taxpayers have the option to file online, which is often the quickest and most efficient method. Alternatively, you can choose to mail your completed petition to the appropriate department. For those who prefer a face-to-face interaction, in-person submissions are also accepted at designated city offices. Each method has its own processing times, so consider your urgency when selecting how to submit your petition.

Eligibility Criteria

Eligibility to file the Philadelphia Wage Tax Petition is generally based on your employment status and tax withholdings. To qualify, you must have been employed in Philadelphia during the tax year in question and have had wage taxes withheld from your paychecks. Additionally, if you believe that you have overpaid your wage taxes due to incorrect withholdings or if you were a non-resident working in Philadelphia, you may also be eligible for a refund. It is important to review the specific criteria outlined by the City of Philadelphia to ensure your eligibility.

Legal use of the Philadelphia Wage Tax Petition

The Philadelphia Wage Tax Petition is a legally recognized document that allows taxpayers to reclaim overpaid taxes. It is essential to ensure that the petition is completed in accordance with local tax laws and regulations. Filing this petition not only helps in recovering funds but also reinforces the taxpayer's rights within the legal framework of the city's tax system. Understanding the legal implications of your petition can help you navigate the process more effectively and ensure compliance with all relevant laws.

Quick guide on how to complete filing taxes on artist commissions turbotax support get help

Effortlessly prepare Philadelphia Wage Tax Petition on any device

Digital document management has gained traction among companies and individuals alike. It offers a perfect eco-friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without obstacles. Handle Philadelphia Wage Tax Petition on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to alter and eSign Philadelphia Wage Tax Petition with ease

- Locate Philadelphia Wage Tax Petition and then click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose your preferred method to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device of your choice. Modify and eSign Philadelphia Wage Tax Petition and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the filing taxes on artist commissions turbotax support get help

How to create an eSignature for the Filing Taxes On Artist Commissions Turbotax Support Get Help online

How to create an eSignature for your Filing Taxes On Artist Commissions Turbotax Support Get Help in Chrome

How to generate an electronic signature for signing the Filing Taxes On Artist Commissions Turbotax Support Get Help in Gmail

How to make an eSignature for the Filing Taxes On Artist Commissions Turbotax Support Get Help from your smart phone

How to make an eSignature for the Filing Taxes On Artist Commissions Turbotax Support Get Help on iOS devices

How to generate an electronic signature for the Filing Taxes On Artist Commissions Turbotax Support Get Help on Android

People also ask

-

What is the Philadelphia Wage Tax Petition?

The Philadelphia Wage Tax Petition is a formal request submitted by individuals or businesses to contest or appeal wage tax assessments made by the city of Philadelphia. By utilizing this petition, taxpayers can seek a reduction or refund of excess wages taxed. This process can be streamlined with airSlate SignNow's easy-to-use eSignature solution.

-

How can airSlate SignNow help with my Philadelphia Wage Tax Petition?

airSlate SignNow provides a user-friendly platform that allows you to prepare, send, and eSign your Philadelphia Wage Tax Petition quickly and efficiently. Our solution eliminates the hassle of paper documents, enabling you to manage your tax petitions digitally while ensuring compliance with legal requirements.

-

What are the costs associated with filing a Philadelphia Wage Tax Petition using airSlate SignNow?

Using airSlate SignNow to file your Philadelphia Wage Tax Petition is cost-effective and offers a range of pricing plans to fit your needs. Depending on the features you require, you can choose a plan that suits your budget while still accessing powerful tools for document management and eSigning.

-

Are there any integrations available for the Philadelphia Wage Tax Petition process?

Yes, airSlate SignNow seamlessly integrates with various applications and software that can assist you in the Philadelphia Wage Tax Petition process. Whether you use accounting software or cloud storage services, our platform enhances your workflow and ensures all necessary documents are easily accessible.

-

What benefits does airSlate SignNow provide when submitting a Philadelphia Wage Tax Petition?

With airSlate SignNow, the benefits of submitting a Philadelphia Wage Tax Petition include enhanced efficiency, security, and compliance. Our platform allows for quick document preparation, tracking of signatures, and ensures that your petition is submitted accurately and on time.

-

Is airSlate SignNow secure for handling my Philadelphia Wage Tax Petition?

Absolutely! airSlate SignNow employs top-notch security measures to protect your sensitive information while processing your Philadelphia Wage Tax Petition. Our platform utilizes encryption and secure cloud storage to ensure that your documents are safe from unauthorized access.

-

How does the eSignature process work for my Philadelphia Wage Tax Petition?

The eSignature process with airSlate SignNow for your Philadelphia Wage Tax Petition is straightforward. Once your document is prepared, you can invite signers via email, and they can eSign the petition from any device, ensuring a smooth and efficient submission process.

Get more for Philadelphia Wage Tax Petition

Find out other Philadelphia Wage Tax Petition

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself