Minnesota Form M8

What is the Minnesota Form M8

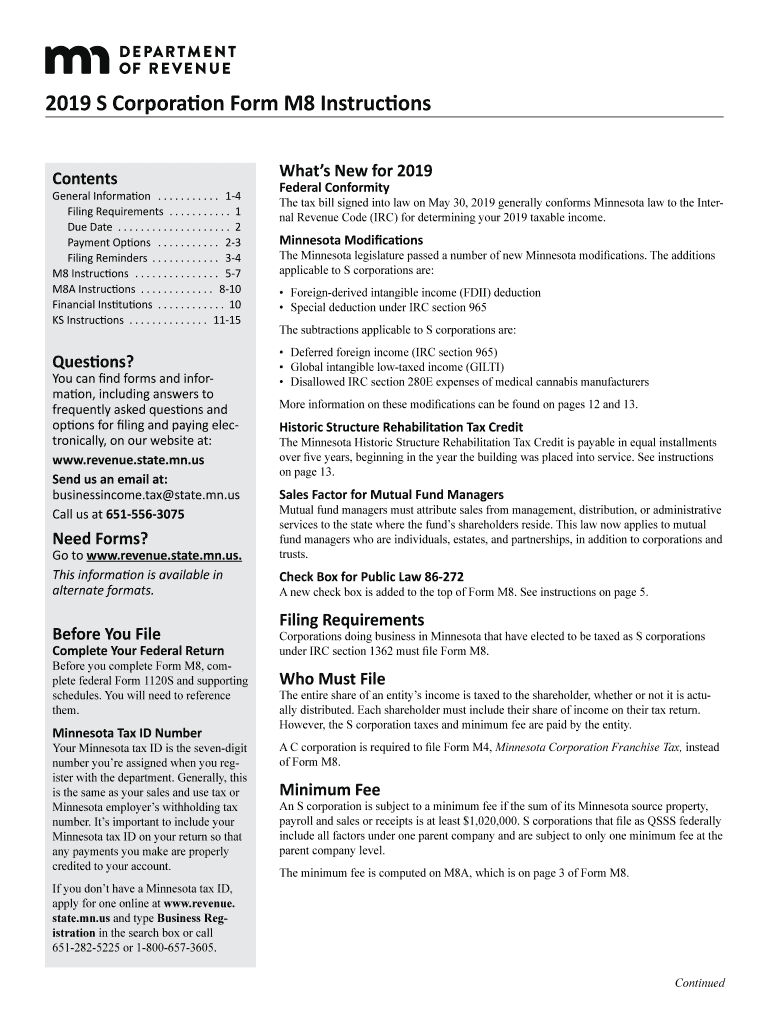

The Minnesota Form M8 is a specific tax document used by individuals and businesses in Minnesota to report certain financial information. This form is essential for various tax-related purposes, including income reporting and eligibility for specific tax credits. Understanding the purpose and requirements of the Form M8 is crucial for compliance with state tax laws.

How to use the Minnesota Form M8

Using the Minnesota Form M8 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents that pertain to your income and deductions. Next, fill out the form carefully, ensuring that all information is accurate and complete. Once the form is filled out, review it for any errors before submission. It can be submitted electronically or via mail, depending on your preference and the requirements set by the state.

Steps to complete the Minnesota Form M8

Completing the Minnesota Form M8 requires a systematic approach:

- Gather necessary documents, including W-2s, 1099s, and other income statements.

- Fill in personal identification information, such as your name, address, and Social Security number.

- Report your total income accurately, including wages, interest, and other sources.

- Calculate deductions and credits you may be eligible for, ensuring to follow the guidelines provided.

- Review the completed form for accuracy before submitting it.

Legal use of the Minnesota Form M8

The Minnesota Form M8 is legally binding when filled out correctly and submitted according to state regulations. It is important to comply with all legal requirements to avoid penalties. The form must be signed and dated by the taxpayer, indicating that the information provided is true and accurate. Misrepresentation or failure to submit the form can lead to legal repercussions, including fines or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Minnesota Form M8 are critical to avoid penalties. Typically, the form must be submitted by April fifteenth of the tax year. If the deadline falls on a weekend or holiday, it may be extended to the next business day. It is advisable to check for any updates or changes in deadlines annually to ensure compliance.

Required Documents

To complete the Minnesota Form M8, several documents are required:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any additional income, such as rental income or investment earnings.

- Documentation for deductions and credits, including receipts and tax statements.

Form Submission Methods (Online / Mail / In-Person)

The Minnesota Form M8 can be submitted through various methods:

- Online submission via the Minnesota Department of Revenue website.

- Mailing a printed copy of the form to the appropriate state address.

- In-person submission at designated tax offices, if applicable.

Quick guide on how to complete 2019 s corporation form m8 instructions

Accomplish Minnesota Form M8 seamlessly on any gadget

Online document administration has gained traction among companies and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed paperwork, allowing you to obtain the correct format and securely save it online. airSlate SignNow equips you with all the tools necessary to create, amend, and electronically sign your documents swiftly without delays. Manage Minnesota Form M8 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to amend and electronically sign Minnesota Form M8 effortlessly

- Locate Minnesota Form M8 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight essential sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Alter and electronically sign Minnesota Form M8 while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 s corporation form m8 instructions

How to create an electronic signature for your 2019 S Corporation Form M8 Instructions online

How to create an eSignature for the 2019 S Corporation Form M8 Instructions in Chrome

How to generate an eSignature for signing the 2019 S Corporation Form M8 Instructions in Gmail

How to create an electronic signature for the 2019 S Corporation Form M8 Instructions straight from your smartphone

How to make an electronic signature for the 2019 S Corporation Form M8 Instructions on iOS

How to create an electronic signature for the 2019 S Corporation Form M8 Instructions on Android devices

People also ask

-

What are the key features of airSlate SignNow that align with the 2019 s instructions?

airSlate SignNow offers a range of features that comply with the 2019 s instructions, including customizable templates, in-person signing options, and advanced document tracking. These features ensure that users can manage their documents efficiently while adhering to the latest standards. Additionally, the user-friendly interface simplifies the eSigning process for both businesses and clients.

-

How does airSlate SignNow pricing structure align with budget-friendly 2019 s instructions?

The pricing structure of airSlate SignNow is designed to be cost-effective, which resonates with the budget-conscious nature of the 2019 s instructions. With multiple pricing tiers and a range of features included in each plan, businesses can select an option that best fits their needs without overspending. This ensures companies can comply with requirements while managing costs.

-

Can airSlate SignNow integrate with other software as per the 2019 s instructions?

Yes, airSlate SignNow can seamlessly integrate with various software solutions that adhere to the 2019 s instructions. Popular integrations include platforms like Salesforce, Google Drive, and Zapier, allowing users to streamline their workflows without disruption. This enhances options for businesses looking to comply with document management standards.

-

What benefits does airSlate SignNow provide in relation to the 2019 s instructions?

By using airSlate SignNow, businesses can ensure compliance with the 2019 s instructions, which facilitates secure and efficient document handling. Key benefits include reduced turnaround times for documents, increased security through encryption, and the convenience of mobile signing. This keeps operations running smoothly while maintaining compliance.

-

How does airSlate SignNow support mobile signing in accordance with the 2019 s instructions?

airSlate SignNow’s mobile app offers a robust solution for signing documents on-the-go, aligning perfectly with the 2019 s instructions. Users can easily access their documents, sign, and send them directly from their mobile devices. This flexibility ensures that businesses can remain compliant, regardless of where their team and clients are located.

-

What kind of customer support does airSlate SignNow provide related to the 2019 s instructions?

airSlate SignNow offers extensive customer support to assist users in navigating the requirements of the 2019 s instructions. Support channels include live chat, email, and a comprehensive knowledge base filled with articles and guides. This ensures that companies can easily find help whenever they encounter challenges.

-

How can I get started with airSlate SignNow while following the 2019 s instructions?

Getting started with airSlate SignNow is simple and compliant with the 2019 s instructions. Prospective users can sign up for a free trial to explore the features, ensuring they meet their document management needs. After the trial, businesses can choose a subscription that aligns with their workflow requirements.

Get more for Minnesota Form M8

- Families guide to benefits gov benefits form

- Membership application black forest fire rescue form

- Faa form 3120 25 atctartcc ojt instructionevaluation report faa form 3120 25 atctartcc ojt instructionevaluation report

- Lego club registration form st monica school

- Parent teenager contract template form

- Park contract template form

- Park space contract template form

- Park spot contract template form

Find out other Minnesota Form M8

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online