Mn Form

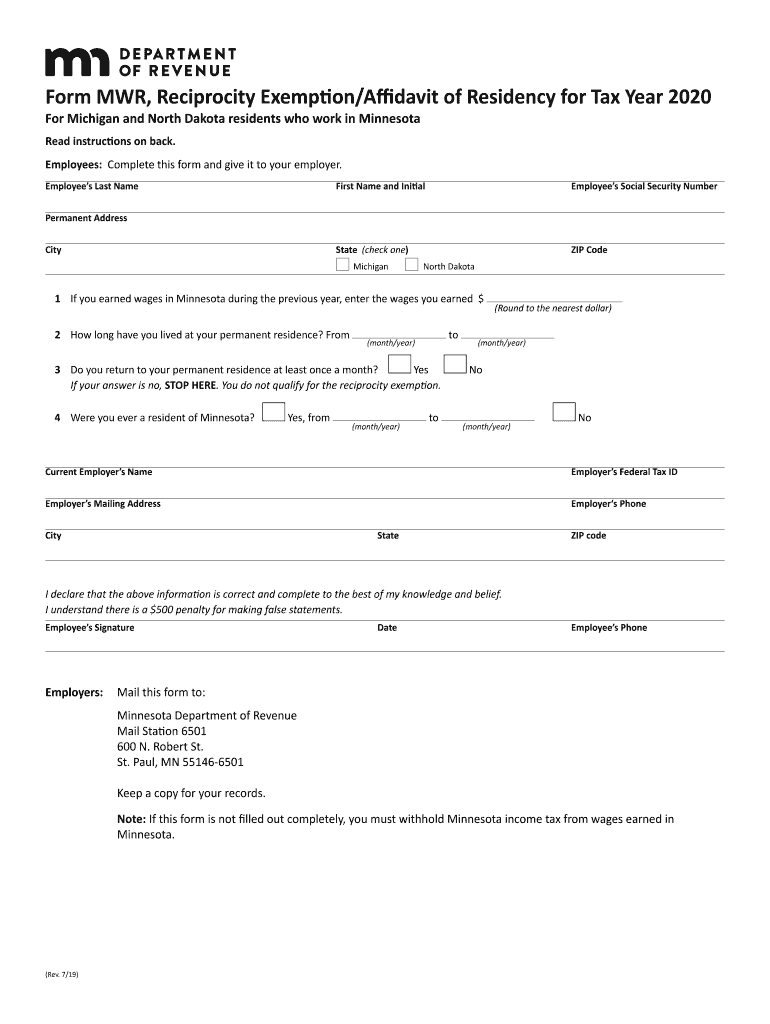

What is the 2020 reciprocity exemption?

The 2020 reciprocity exemption is a specific tax provision that allows residents of certain states to claim exemptions on their income tax returns based on their residency status. This exemption is particularly relevant for individuals who have income sourced from states that have reciprocal agreements with their home state. Understanding this exemption is essential for ensuring compliance with state tax laws and optimizing tax liabilities.

Steps to complete the 2020 reciprocity exemption form

Completing the 2020 reciprocity exemption form involves several key steps:

- Gather necessary personal information, including your Social Security number and details about your income sources.

- Identify the states involved in your residency and income sources to determine eligibility for the exemption.

- Fill out the form accurately, ensuring all required fields are completed to avoid delays.

- Review the form for accuracy, checking that all calculations and entries are correct.

- Submit the form according to your state’s guidelines, which may include online submission, mailing, or in-person delivery.

Legal use of the 2020 reciprocity exemption

The legal use of the 2020 reciprocity exemption is governed by state tax laws, which outline eligibility criteria and compliance requirements. To ensure that the exemption is applied correctly, it is important to understand the specific regulations of both your home state and the state from which you are receiving income. Adhering to these laws not only protects your tax status but also ensures that you avoid potential penalties for non-compliance.

Eligibility criteria for the 2020 reciprocity exemption

To qualify for the 2020 reciprocity exemption, you must meet certain eligibility criteria, which typically include:

- Being a resident of a state that has a reciprocity agreement with the state where your income is sourced.

- Filing your tax return in your home state and reporting all income earned, regardless of where it was generated.

- Meeting any specific income thresholds or conditions set by your home state’s tax authority.

Required documents for the 2020 reciprocity exemption

When applying for the 2020 reciprocity exemption, you may need to provide several documents to support your claim. Commonly required documents include:

- Your completed 2020 reciprocity exemption form.

- Proof of residency, such as a driver’s license or utility bill.

- W-2 forms or other income statements from employers in the state where you earned income.

- Any additional documentation requested by your state’s tax authority.

Form submission methods for the 2020 reciprocity exemption

Submitting the 2020 reciprocity exemption form can be done through various methods, depending on state regulations. Common submission methods include:

- Online submission through your state’s tax authority website, which may offer a streamlined process.

- Mailing a printed copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, which may provide immediate confirmation of receipt.

Quick guide on how to complete form mwr reciprocity exemptionaffidavit of residency

Prepare Mn Form easily on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the proper form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage Mn Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Mn Form effortlessly

- Obtain Mn Form and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, either by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Edit and eSign Mn Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form mwr reciprocity exemptionaffidavit of residency

How to make an eSignature for the Form Mwr Reciprocity Exemptionaffidavit Of Residency online

How to generate an eSignature for the Form Mwr Reciprocity Exemptionaffidavit Of Residency in Chrome

How to make an eSignature for putting it on the Form Mwr Reciprocity Exemptionaffidavit Of Residency in Gmail

How to make an eSignature for the Form Mwr Reciprocity Exemptionaffidavit Of Residency from your smartphone

How to make an electronic signature for the Form Mwr Reciprocity Exemptionaffidavit Of Residency on iOS

How to generate an electronic signature for the Form Mwr Reciprocity Exemptionaffidavit Of Residency on Android devices

People also ask

-

What is the 2020 reciprocity exemption in relation to eSigning documents?

The 2020 reciprocity exemption refers to specific legal provisions that allow for the acceptance of electronic signatures across jurisdictions without the need for traditional notarization. This is particularly beneficial for businesses using airSlate SignNow, as it simplifies the signing process and enhances transaction efficiency.

-

How does airSlate SignNow support the 2020 reciprocity exemption?

airSlate SignNow is designed to comply with the 2020 reciprocity exemption by enabling secure electronic signatures that are legally recognized across multiple states. Our platform ensures that all eSigned documents meet regulatory standards, making it a reliable choice for businesses needing compliance.

-

What are the pricing options for businesses interested in the 2020 reciprocity exemption features?

airSlate SignNow offers flexible pricing plans that cater to businesses of various sizes looking to utilize the 2020 reciprocity exemption features. Our cost-effective solutions allow companies to manage document signing seamlessly without incurring hefty fees associated with traditional signing methods.

-

What key features does airSlate SignNow offer for users looking to leverage the 2020 reciprocity exemption?

Key features of airSlate SignNow include customizable templates, secure document storage, and real-time tracking, all designed to enhance the eSigning experience under the 2020 reciprocity exemption. These tools streamline the signing process and increase productivity across your organization.

-

How can I integrate airSlate SignNow with other applications while adhering to the 2020 reciprocity exemption?

airSlate SignNow provides seamless integration options with various applications such as CRM tools, project management software, and cloud storage services. This ensures that your document signing processes align with the 2020 reciprocity exemption while maintaining workflow efficiency.

-

Are there any limitations when using eSignatures under the 2020 reciprocity exemption with airSlate SignNow?

While the 2020 reciprocity exemption allows for electronic signatures in many circumstances, certain legal documents may still require traditional signatures in some jurisdictions. airSlate SignNow provides guidance on compliance to ensure your documents are valid and enforceable.

-

What benefits do I gain from using airSlate SignNow in the context of the 2020 reciprocity exemption?

By using airSlate SignNow to take advantage of the 2020 reciprocity exemption, businesses can signNowly reduce turnaround times for document signing. Enhanced security features also provide confidence that your agreements are legally binding and tamper-proof.

Get more for Mn Form

- Coeus nih grants gov proposal review checklist form

- Fet consent forms dallas ivf

- Instructions for form nyc 210 claim for new york city school tax credit tax year 772083191

- Event management contract template form

- Event host contract template form

- Parent teacher contract template form

- Parent teen behavior contract template form

- Parent teen driv contract template form

Find out other Mn Form

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template