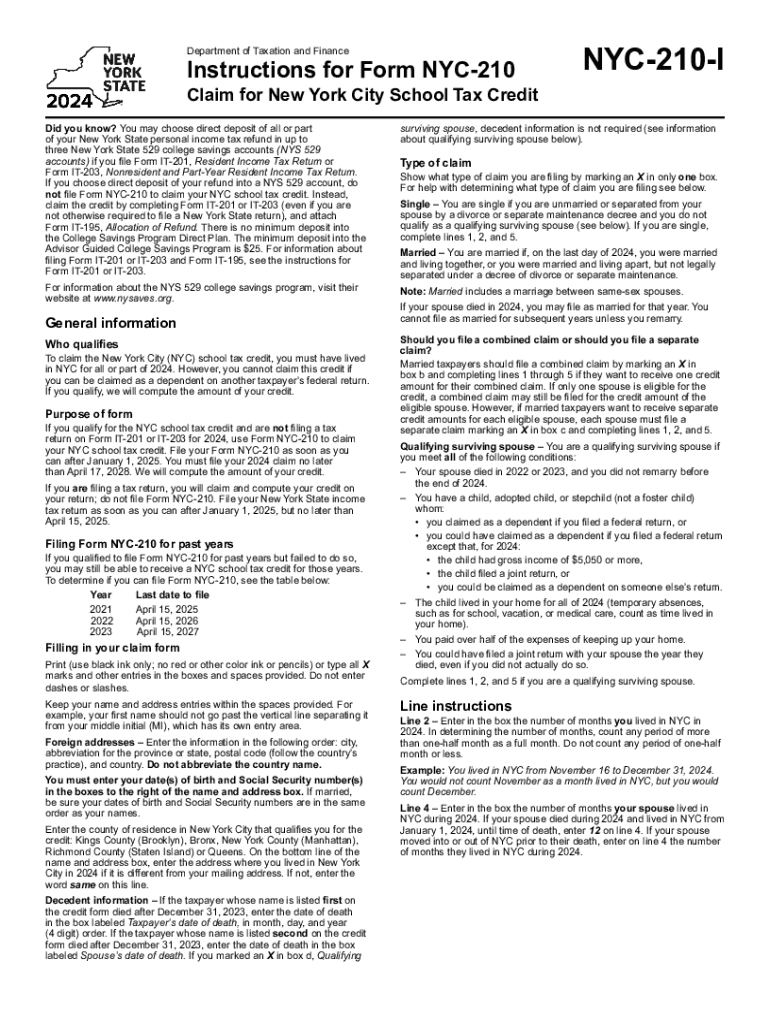

Instructions for Form NYC 210 Claim for New York City School Tax Credit Tax Year

Understanding Form NYC 210 for New York City School Tax Credit

Form NYC 210 is specifically designed for residents of New York City who are claiming the School Tax Credit. This form allows eligible taxpayers to receive a credit against their property taxes, which can significantly reduce their financial burden. The credit is available to homeowners who meet specific income and residency requirements. Understanding the nuances of this form is essential for ensuring that you receive the benefits you are entitled to.

Steps to Complete Form NYC 210

Completing Form NYC 210 involves several key steps that ensure accuracy and compliance. Start by gathering all necessary documentation, including proof of residency and income statements. Next, fill out the personal information section accurately, including your name, address, and Social Security number. Then, provide details about your property, such as the address and property tax identification number. Finally, calculate the credit amount based on the instructions provided and review the form for any errors before submission.

Eligibility Criteria for Form NYC 210

To qualify for the School Tax Credit using Form NYC 210, applicants must meet certain eligibility criteria. Primarily, you must be a resident of New York City and own the property for which you are claiming the credit. Additionally, your income must fall within specified limits set by the city. It is important to review these criteria carefully to ensure that you qualify before submitting your claim.

Required Documents for Form NYC 210

Submitting Form NYC 210 requires specific documentation to support your claim. Essential documents include proof of ownership, such as a deed or mortgage statement, and income verification, which may include W-2 forms or tax returns. Additionally, you may need to provide identification, such as a driver's license or state ID. Having these documents ready will streamline the application process and help avoid delays.

Filing Deadlines for Form NYC 210

Being aware of the filing deadlines for Form NYC 210 is crucial for timely submission. Typically, the deadline aligns with the annual tax filing date, which is April fifteenth for most taxpayers. However, it is advisable to check for any updates or changes to deadlines each tax year, as local regulations may vary. Submitting your form on time ensures that you do not miss out on potential credits.

Form Submission Methods for NYC 210

Form NYC 210 can be submitted through various methods, offering flexibility to taxpayers. You can file the form online through the city’s tax portal, which provides a straightforward process for electronic submissions. Alternatively, you may print the form and mail it to the designated address provided in the instructions. In-person submissions at local tax offices are also an option for those who prefer direct assistance.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form nyc 210 claim for new york city school tax credit tax year 772083191

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nyc 210 i and how does it work?

The nyc 210 i is a powerful tool offered by airSlate SignNow that allows businesses to streamline their document signing process. It enables users to send, sign, and manage documents electronically, ensuring a quick and efficient workflow. With its user-friendly interface, the nyc 210 i simplifies the eSigning experience for both senders and recipients.

-

What are the pricing options for the nyc 210 i?

airSlate SignNow offers competitive pricing for the nyc 210 i, catering to businesses of all sizes. You can choose from various subscription plans that fit your budget and needs, including monthly and annual options. Each plan provides access to essential features that enhance your document management capabilities.

-

What features does the nyc 210 i include?

The nyc 210 i comes packed with features designed to optimize your document workflow. Key features include customizable templates, real-time tracking of document status, and secure cloud storage. These functionalities help ensure that your documents are managed efficiently and securely.

-

How can the nyc 210 i benefit my business?

Implementing the nyc 210 i can signNowly enhance your business operations by reducing the time spent on document processing. It allows for faster turnaround times on contracts and agreements, improving overall productivity. Additionally, the cost-effective nature of the nyc 210 i helps businesses save on printing and mailing expenses.

-

Is the nyc 210 i easy to integrate with other software?

Yes, the nyc 210 i is designed to seamlessly integrate with various software applications, enhancing its functionality. Whether you use CRM systems, project management tools, or other business applications, the nyc 210 i can connect effortlessly. This integration capability ensures a smooth transition and improved workflow across your business tools.

-

What security measures are in place for the nyc 210 i?

The nyc 210 i prioritizes the security of your documents with advanced encryption and compliance with industry standards. airSlate SignNow employs robust security protocols to protect sensitive information during transmission and storage. You can trust that your documents are safe and secure when using the nyc 210 i.

-

Can I customize the nyc 210 i to fit my branding?

Absolutely! The nyc 210 i allows for extensive customization options to align with your brand identity. You can personalize templates, add your logo, and adjust colors to create a cohesive look that reflects your business. This feature helps enhance brand recognition and professionalism in your document communications.

Get more for Instructions For Form NYC 210 Claim For New York City School Tax Credit Tax Year

Find out other Instructions For Form NYC 210 Claim For New York City School Tax Credit Tax Year

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word