INSTRUCTIONS for PIT ES , ESTIMATED TAX PAYMENT Tax Newmexico Form

What is the PIT ES Estimated Tax Payment Instructions for New Mexico?

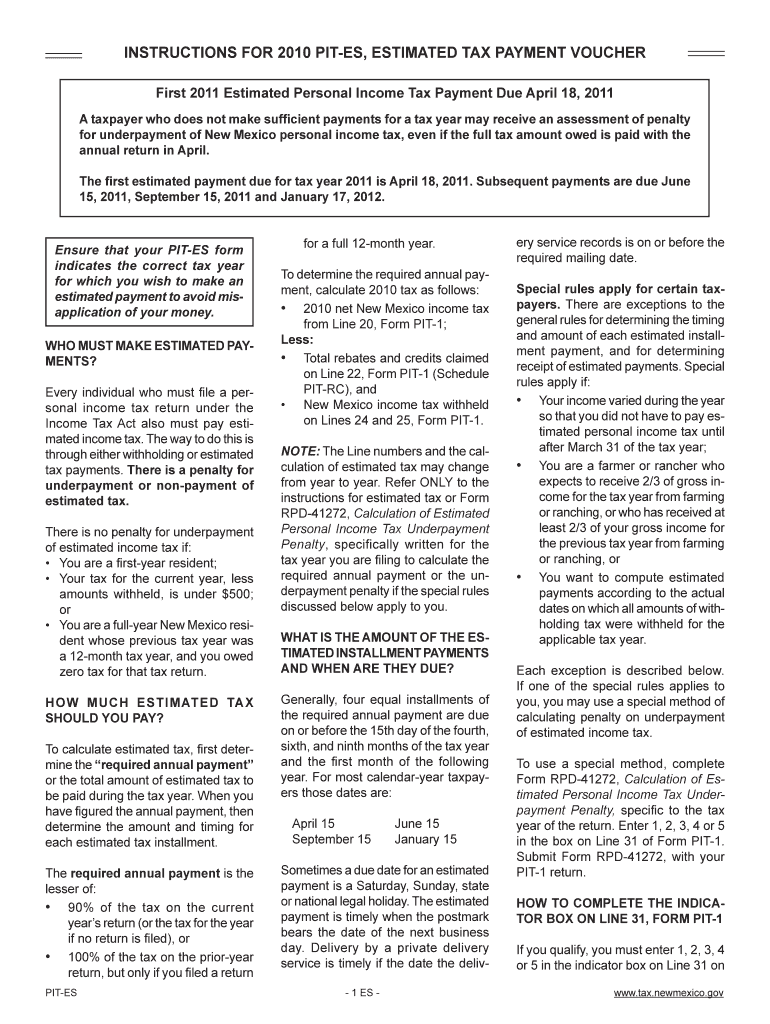

The PIT ES, or Personal Income Tax Estimated Payment Instructions for New Mexico, provide essential guidance for individuals who need to make estimated tax payments. This form is particularly important for self-employed individuals, freelancers, and those with income not subject to withholding. Understanding these instructions helps ensure compliance with state tax laws and prevents penalties associated with underpayment.

Steps to Complete the PIT ES Estimated Tax Payment Instructions for New Mexico

Completing the PIT ES involves several key steps:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Calculate your estimated tax liability based on your expected income for the year.

- Determine the amount of estimated payment due, which is typically a percentage of your expected income.

- Fill out the PIT ES form accurately, ensuring all required fields are completed.

- Choose your payment method, whether online, by mail, or in person.

Legal Use of the PIT ES Estimated Tax Payment Instructions for New Mexico

The legal validity of the PIT ES instructions is supported by compliance with New Mexico tax regulations. To ensure that your estimated payments are recognized by the state, it is crucial to follow the guidelines outlined in the instructions. This includes using the correct form, meeting payment deadlines, and maintaining accurate records of your payments.

Filing Deadlines and Important Dates for the PIT ES Estimated Tax Payment

Staying informed about filing deadlines is vital for avoiding penalties. In New Mexico, estimated tax payments are typically due on the 15th of April, June, September, and January of the following year. Mark these dates on your calendar to ensure timely submissions and compliance with state tax requirements.

Required Documents for the PIT ES Estimated Tax Payment

To complete the PIT ES form, you will need specific documents, including:

- Your previous year’s tax return for reference.

- Income statements, such as W-2s or 1099s, to estimate your current income.

- Records of any deductions or credits you plan to claim.

Who Issues the PIT ES Estimated Tax Payment Instructions for New Mexico?

The New Mexico Taxation and Revenue Department is responsible for issuing the PIT ES instructions. They provide the necessary forms and guidance to help taxpayers understand their obligations regarding estimated tax payments. For the most accurate and up-to-date information, refer to official communications from this department.

Quick guide on how to complete instructions for 2010 pit es estimated tax payment tax newmexico

Complete INSTRUCTIONS FOR PIT ES , ESTIMATED TAX PAYMENT Tax Newmexico seamlessly on any gadget

Digital document management has become favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed files, as you can access the correct template and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly without any holdups. Manage INSTRUCTIONS FOR PIT ES , ESTIMATED TAX PAYMENT Tax Newmexico on any gadget using airSlate SignNow applications for Android or iOS and enhance any document-driven procedure today.

How to modify and electronically sign INSTRUCTIONS FOR PIT ES , ESTIMATED TAX PAYMENT Tax Newmexico effortlessly

- Locate INSTRUCTIONS FOR PIT ES , ESTIMATED TAX PAYMENT Tax Newmexico and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign INSTRUCTIONS FOR PIT ES , ESTIMATED TAX PAYMENT Tax Newmexico while ensuring excellent communication at any step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

Assuming I collect sales tax from residents of all 50 states as an online seller, & send a check to each state annually, how do I avoid fines/penalties for technical bsignNowes (didn’t make estimated payments, use correct form, file quarterly etc.)?

Great question!To begin, you will only want to register for a sales tax permit in states where you have nexus. For states in which you have nexus, the best way to avoid fines/penalties due to technical bsignNowes is to either 1) pay early or 2) use a third party tool to automate your sales tax filings.That’s where a company like TaxJar comes in. TaxJar can automate your sales tax filings in every state so you never need to worry about deadlines, payments, fines, or forms again. TaxJar is able to do this by connecting with the places you sell via one-click integrations. Whether it’s a marketplace like Amazon, eBay, and Etsy or an eCommerce platform like Shopify, Magento, and Squarespace, TaxJar can get you set up in minutes.If you’re new to sales tax, I recommend reading TaxJar’s free guide to getting sales tax compliant in 2018. Whether you choose to use a third party tool or do it yourself, TaxJar’s free guide will get you moving in the right direction.

Create this form in 5 minutes!

How to create an eSignature for the instructions for 2010 pit es estimated tax payment tax newmexico

How to generate an electronic signature for the Instructions For 2010 Pit Es Estimated Tax Payment Tax Newmexico in the online mode

How to create an eSignature for your Instructions For 2010 Pit Es Estimated Tax Payment Tax Newmexico in Google Chrome

How to create an eSignature for signing the Instructions For 2010 Pit Es Estimated Tax Payment Tax Newmexico in Gmail

How to create an electronic signature for the Instructions For 2010 Pit Es Estimated Tax Payment Tax Newmexico right from your smartphone

How to create an eSignature for the Instructions For 2010 Pit Es Estimated Tax Payment Tax Newmexico on iOS

How to make an electronic signature for the Instructions For 2010 Pit Es Estimated Tax Payment Tax Newmexico on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to pit es?

airSlate SignNow is a comprehensive eSignature solution designed to streamline document signing workflows. With pit es functionalities such as customizable templates and automated workflows, it enables businesses to execute contracts efficiently and securely.

-

How much does airSlate SignNow cost for users looking into pit es?

Pricing for airSlate SignNow starts at an affordable tier, making it accessible for various business sizes. Each plan includes pit es features that enhance user experience, ensuring even small companies can leverage powerful document signing capabilities.

-

What features does airSlate SignNow offer that benefit pit es users?

airSlate SignNow provides a range of features tailored for pit es users, including advanced templates, real-time collaboration, and mobile compatibility. These tools help enhance productivity and streamline document management processes.

-

Can airSlate SignNow integrate with other applications commonly used in pit es?

Absolutely! airSlate SignNow offers seamless integrations with various applications frequently used in pit es, such as CRMs and project management tools. This facilitates a smoother workflow, allowing users to manage documents efficiently across platforms.

-

How does airSlate SignNow enhance the signing experience for pit es?

With airSlate SignNow, users can enjoy a simple and intuitive signing experience specifically designed for pit es. This includes features like personalized signing links and multi-party signing, which promote faster turnaround times for important documents.

-

What are the security measures in place for pit es users of airSlate SignNow?

Security is paramount at airSlate SignNow, especially for pit es users who handle sensitive information. The platform employs advanced encryption methods and compliance with industry standards, ensuring that all transactions and documents remain secure.

-

Is customer support available for pit es users of airSlate SignNow?

Yes, airSlate SignNow offers robust customer support for all users, including those utilizing pit es. You can access help via live chat, email, or phone, ensuring any queries or issues are promptly addressed.

Get more for INSTRUCTIONS FOR PIT ES , ESTIMATED TAX PAYMENT Tax Newmexico

- Southwestern washington synod of the elca remittance form lutheranssw

- Dv 520 info get ready for your restraining order court hearing domestic violence prevention judicial council forms

- Af form 357

- Patch testing patient test resultspatient name form

- Low income home energy assistance program liheap application for assistance form

- Voorbeeld getuigenverklaring download hier gratis form

- Customizable employee handbook template new empire group form

- Maneb form 2 examinations mathematics

Find out other INSTRUCTIONS FOR PIT ES , ESTIMATED TAX PAYMENT Tax Newmexico

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe