Rev 1500 Form

What is the Rev 1500?

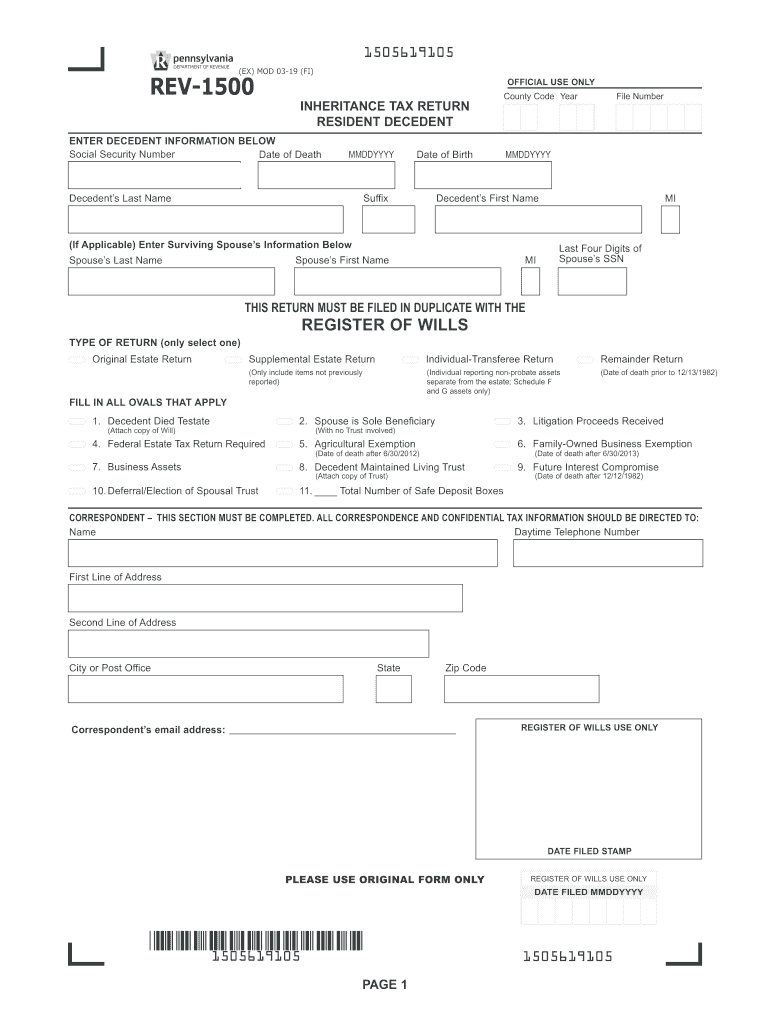

The Pennsylvania Rev 1500 is an official form used for reporting inheritance tax in the state of Pennsylvania. This form is essential for individuals who are responsible for filing the inheritance tax return for a decedent's estate. The Rev 1500 outlines the value of the estate and calculates the amount of tax owed based on the relationship of the heirs to the deceased. It is critical for ensuring compliance with Pennsylvania's inheritance tax laws.

Steps to complete the Rev 1500

Completing the Pennsylvania inheritance return form requires careful attention to detail. Here are the essential steps to ensure accurate submission:

- Gather all necessary documentation, including the decedent's will, property deeds, and any relevant financial statements.

- Determine the value of the estate by appraising all assets, including real estate, personal property, and financial accounts.

- Identify the beneficiaries and their relationship to the decedent, as this affects the tax rate applied.

- Fill out the Rev 1500 form, ensuring that all information is accurate and complete.

- Calculate the total inheritance tax owed based on the values reported and the applicable rates.

- Submit the completed form along with any required payment to the Pennsylvania Department of Revenue.

Legal use of the Rev 1500

The Rev 1500 must be completed and submitted in accordance with Pennsylvania law to be considered legally binding. This form serves as a declaration of the estate's value and the tax owed. Failure to file the Rev 1500 accurately or on time can result in penalties and interest charges. It is advisable to consult with a legal professional or tax advisor to ensure compliance with all legal requirements.

Required Documents

To complete the Pennsylvania inheritance tax return form, several documents are typically required:

- The decedent's will, if applicable.

- Death certificate of the decedent.

- Documentation of all assets, including appraisals of real estate and personal property.

- Financial statements for bank accounts, investments, and other assets.

- Information regarding any debts or liabilities of the estate.

Form Submission Methods

The Rev 1500 can be submitted through various methods, ensuring flexibility for filers. Options include:

- Online submission through the Pennsylvania Department of Revenue's e-filing system.

- Mailing the completed form to the appropriate address provided by the state.

- In-person submission at designated state offices, if preferred.

Filing Deadlines / Important Dates

Timely submission of the Rev 1500 is crucial to avoid penalties. The standard deadline for filing the Pennsylvania inheritance tax return is nine months from the date of the decedent's death. Extensions may be available, but they must be formally requested. It is important to stay informed about any changes to deadlines or regulations that may affect the filing process.

Quick guide on how to complete ex mod 03 19 fi

Complete Rev 1500 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents promptly without any delays. Manage Rev 1500 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and electronically sign Rev 1500 without hassle

- Locate Rev 1500 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Modify and electronically sign Rev 1500 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ex mod 03 19 fi

How to make an eSignature for the Ex Mod 03 19 Fi in the online mode

How to create an eSignature for your Ex Mod 03 19 Fi in Google Chrome

How to make an electronic signature for signing the Ex Mod 03 19 Fi in Gmail

How to generate an eSignature for the Ex Mod 03 19 Fi right from your mobile device

How to generate an eSignature for the Ex Mod 03 19 Fi on iOS

How to create an eSignature for the Ex Mod 03 19 Fi on Android devices

People also ask

-

What is the Pennsylvania REV 1500 tax form?

The Pennsylvania REV 1500 tax form is a state-specific document used for filing personal income taxes in Pennsylvania. It captures essential financial information and is essential for individual taxpayers who want to ensure compliance with state tax laws.

-

How can airSlate SignNow assist with the Pennsylvania REV 1500 tax form?

airSlate SignNow provides an intuitive platform to easily eSign and send the Pennsylvania REV 1500 tax form. Our solution simplifies the document signing process, ensuring all parties can complete and submit their tax documents quickly and securely.

-

What are the pricing options for using airSlate SignNow for the Pennsylvania REV 1500 tax form?

airSlate SignNow offers various pricing plans that cater to different business needs, starting from a basic tier for individuals to more comprehensive plans for businesses. With competitive pricing, it remains a cost-effective choice for managing your Pennsylvania REV 1500 tax form.

-

Are there any specific features in airSlate SignNow to support the Pennsylvania REV 1500 tax form?

Yes, airSlate SignNow includes features such as template creation, advanced sharing options, and secure cloud storage, which are particularly beneficial for managing the Pennsylvania REV 1500 tax form. These features help streamline the signing process and enhance document security.

-

Can I track the status of my Pennsylvania REV 1500 tax form with airSlate SignNow?

Absolutely! airSlate SignNow enables users to track the status of their Pennsylvania REV 1500 tax form in real time. You can see who has viewed or signed the document, ensuring that the entire process remains transparent and accountable.

-

Is airSlate SignNow secure for sending the Pennsylvania REV 1500 tax form?

Yes, airSlate SignNow prioritizes security and utilizes advanced encryption protocols to protect your documents. When sending the Pennsylvania REV 1500 tax form, you can trust that your sensitive information is safe and secure.

-

Can I integrate airSlate SignNow with other software for the Pennsylvania REV 1500 tax form?

Yes, airSlate SignNow offers integrations with various software and platforms, which can help in managing your Pennsylvania REV 1500 tax form seamlessly. This allows for efficient data transfer and improved workflow across different applications.

Get more for Rev 1500

- Coalition formation in simple games the semistrict core gtcenter

- Computability of simple games a complete investigation of mpra mpra ub uni muenchen form

- Wo of the most important challenges confronting the nephrology form

- Paint contract template form

- Paint job contract template form

- Paint proposal contract template form

- Paint service contract template form

- Paralegal contract template form

Find out other Rev 1500

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document