M1nr Form

What is the M1nr

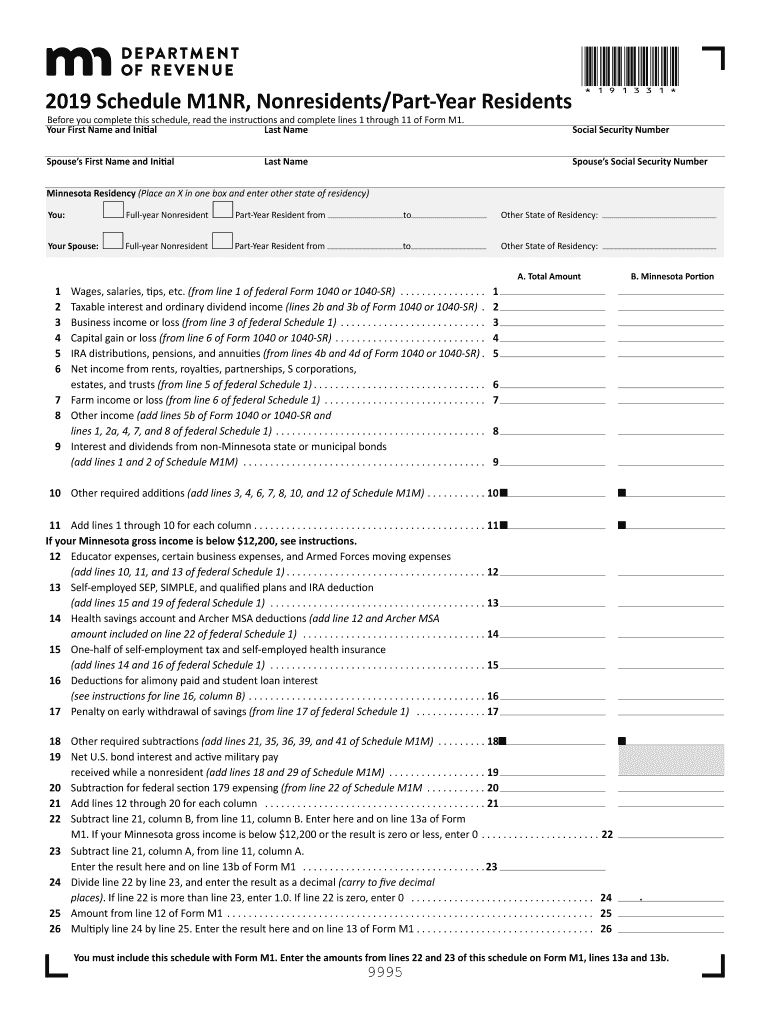

The M1nr is a Minnesota income tax return form specifically designed for nonresidents and part-year residents. It is used to report income earned in Minnesota while allowing individuals who do not reside in the state to comply with state tax obligations. This form is essential for ensuring that nonresidents accurately report their Minnesota-sourced income and calculate the appropriate tax liability.

How to use the M1nr

Using the M1nr involves several steps to ensure accurate reporting of income. Nonresidents must first gather all relevant financial documents, including W-2s and 1099s, that detail income earned within Minnesota. After compiling this information, individuals should fill out the M1nr form, detailing their income, deductions, and credits applicable to their situation. It is crucial to follow the instructions provided with the form carefully to ensure compliance with state tax laws.

Steps to complete the M1nr

Completing the M1nr involves a systematic approach:

- Gather all necessary income documents, such as W-2s and 1099s.

- Fill out personal information, including name, address, and Social Security number.

- Report all Minnesota-sourced income in the designated sections.

- Claim any applicable deductions and credits available to nonresidents.

- Calculate the total tax due based on the provided instructions.

- Review the completed form for accuracy before submission.

Legal use of the M1nr

The M1nr is legally recognized as a valid tax return form for nonresidents of Minnesota. To ensure legal compliance, it is important that all information reported on the form is accurate and complete. Nonresidents must adhere to Minnesota tax laws, which require the reporting of all income earned within the state, regardless of residency status. Failure to use the M1nr correctly may result in penalties or additional tax liabilities.

Filing Deadlines / Important Dates

Nonresidents must be aware of specific deadlines when filing the M1nr. Typically, the filing deadline for the M1nr coincides with the federal tax deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential for taxpayers to verify the exact dates each year to ensure timely submission and avoid penalties.

Required Documents

To complete the M1nr, several documents are necessary:

- W-2 forms that report wages earned in Minnesota.

- 1099 forms for any additional income sources.

- Records of any deductions or credits claimed.

- Identification documents, such as a Social Security number.

Form Submission Methods

The M1nr can be submitted through various methods, including:

- Online submission through the Minnesota Department of Revenue's e-filing system.

- Mailing a paper copy of the completed form to the appropriate state address.

- In-person submission at designated state tax offices.

Quick guide on how to complete minnesota residency place an x in one box and enter other state of residency

Prepare M1nr seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents promptly and without delays. Manage M1nr on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to edit and electronically sign M1nr with ease

- Obtain M1nr and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact confidential information using the tools specifically offered by airSlate SignNow.

- Generate your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method to share your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, time-consuming form searches, or mistakes that necessitate printing additional copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign M1nr to ensure effective communication at every stage of your form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the minnesota residency place an x in one box and enter other state of residency

How to make an electronic signature for your Minnesota Residency Place An X In One Box And Enter Other State Of Residency in the online mode

How to make an eSignature for the Minnesota Residency Place An X In One Box And Enter Other State Of Residency in Chrome

How to generate an eSignature for putting it on the Minnesota Residency Place An X In One Box And Enter Other State Of Residency in Gmail

How to create an electronic signature for the Minnesota Residency Place An X In One Box And Enter Other State Of Residency right from your smartphone

How to create an electronic signature for the Minnesota Residency Place An X In One Box And Enter Other State Of Residency on iOS

How to create an eSignature for the Minnesota Residency Place An X In One Box And Enter Other State Of Residency on Android devices

People also ask

-

What are the benefits of using airSlate SignNow for 2020 MN nonresidents?

Using airSlate SignNow offers several benefits for 2020 MN nonresidents, including a user-friendly interface and secure document signing. This platform ensures compliance with local laws, making it ideal for nonresidents who need to manage important documents efficiently. Plus, it enhances collaboration by allowing multiple parties to sign documents seamlessly.

-

How does airSlate SignNow ensure compliance for 2020 MN nonresidents?

airSlate SignNow is designed to ensure compliance with legal standards for 2020 MN nonresidents. The platform adheres to industry regulations and provides audit trails for all signed documents. This level of compliance is crucial for businesses that need reliable documentation for nonresident transactions.

-

What are the pricing options for airSlate SignNow for 2020 MN nonresidents?

airSlate SignNow offers competitive pricing plans suitable for 2020 MN nonresidents, ensuring cost-effectiveness. Whether you are a small business or a larger enterprise, there are flexible options to align with your budget. This allows nonresidents to leverage advanced eSigning features without breaking the bank.

-

Can airSlate SignNow integrate with other applications for 2020 MN nonresidents?

Yes, airSlate SignNow can easily integrate with various applications, making it ideal for 2020 MN nonresidents who use different software. These integrations allow for a seamless workflow, helping users manage documents across platforms efficiently. This flexibility enhances productivity and simplifies the signing process.

-

What features does airSlate SignNow offer specifically for 2020 MN nonresidents?

airSlate SignNow provides features like customizable templates and secure cloud storage for 2020 MN nonresidents. These features streamline the signing process and ensure that documents are easily accessible whenever needed. This added convenience supports nonresidents in managing their important documentation with ease.

-

Is customer support available for 2020 MN nonresidents using airSlate SignNow?

Absolutely! airSlate SignNow offers robust customer support for 2020 MN nonresidents, ensuring that users have assistance when needed. The support team is knowledgeable about the platform and can help resolve any issues efficiently. This commitment to customer service enhances the overall user experience.

-

How secure is airSlate SignNow for 2020 MN nonresidents?

Security is a top priority for airSlate SignNow, especially for 2020 MN nonresidents managing sensitive documents. The platform employs advanced encryption and security measures to protect user data. With compliance to various security standards, users can trust that their documents are safe.

Get more for M1nr

Find out other M1nr

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy