Sworn Statement in Proof of Loss 2015

What is the sworn statement in proof of loss

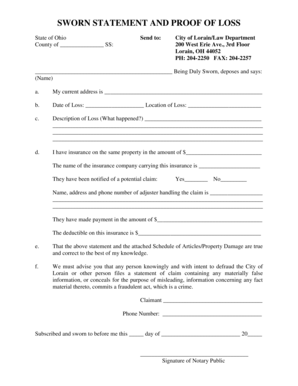

A sworn statement in proof of loss is a formal document used in insurance claims to provide a detailed account of the loss or damage incurred. This statement is typically required by insurance companies to assess the validity of a claim. It includes information such as the date of the loss, a description of the incident, the value of the lost or damaged property, and any relevant supporting documentation. The individual submitting the statement must sign it under oath, affirming that the information provided is accurate and truthful.

How to use the sworn statement in proof of loss

To effectively use a sworn statement in proof of loss, start by gathering all necessary documentation related to the loss, including photographs, receipts, and police reports if applicable. Next, complete the sworn statement by accurately detailing the circumstances of the loss and the estimated value of the property affected. Once the statement is filled out, sign it in the presence of a notary public to ensure its validity. Finally, submit the completed sworn statement along with any supporting documents to your insurance company as part of your claim process.

Key elements of the sworn statement in proof of loss

The key elements of a sworn statement in proof of loss include:

- Date of loss: The specific date when the loss occurred.

- Description of the loss: A detailed account of what was lost or damaged.

- Value of the loss: An estimate of the monetary value of the lost or damaged property.

- Supporting documentation: Any evidence that substantiates the claim, such as receipts or photographs.

- Signature: The statement must be signed by the claimant, typically in front of a notary.

Steps to complete the sworn statement in proof of loss

Completing a sworn statement in proof of loss involves several important steps:

- Gather all relevant information regarding the loss, including dates, descriptions, and values.

- Obtain any necessary supporting documents, such as receipts, estimates, or photographs.

- Fill out the sworn statement form accurately, ensuring all information is complete.

- Sign the document in the presence of a notary public to verify its authenticity.

- Submit the sworn statement along with supporting documents to your insurance provider.

Legal use of the sworn statement in proof of loss

The sworn statement in proof of loss serves a critical legal function in the insurance claims process. By signing this document, the claimant attests to the truthfulness of the information provided, which can be used as evidence in potential disputes. Insurance companies rely on these statements to evaluate claims and determine the appropriate compensation. Failure to provide an accurate sworn statement may result in delays, denial of the claim, or even legal repercussions for fraud.

Filing deadlines and important dates

When submitting a sworn statement in proof of loss, it is crucial to be aware of any filing deadlines set by your insurance policy. Typically, insurers require this statement to be submitted within a specific timeframe following the loss, often ranging from 30 to 90 days. Check your policy for exact dates to ensure compliance and avoid complications with your claim. Missing these deadlines can jeopardize your ability to receive compensation for your loss.

Quick guide on how to complete sworn statement in proof of loss 205783811

Effortlessly Prepare Sworn Statement In Proof Of Loss on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without delay. Manage Sworn Statement In Proof Of Loss on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The Easiest Way to Edit and eSign Sworn Statement In Proof Of Loss with Ease

- Obtain Sworn Statement In Proof Of Loss and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and eSign Sworn Statement In Proof Of Loss to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sworn statement in proof of loss 205783811

Create this form in 5 minutes!

How to create an eSignature for the sworn statement in proof of loss 205783811

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a sworn statement in proof of loss?

A sworn statement in proof of loss is a formal document that an insured party submits to an insurance company to claim compensation for a loss. This statement typically includes details about the loss, supporting evidence, and is signed under oath. Understanding this document is crucial for ensuring a smooth claims process.

-

How can airSlate SignNow help with sworn statements in proof of loss?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning sworn statements in proof of loss. With its user-friendly interface, you can easily customize your documents and ensure they are legally binding. This streamlines the claims process and enhances communication with your insurance provider.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including a free trial for new users. The plans are designed to be cost-effective, allowing you to manage sworn statements in proof of loss without breaking the bank. You can choose a plan that best fits your volume of document management.

-

Is airSlate SignNow secure for handling sensitive documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your sworn statements in proof of loss are protected. The platform uses advanced encryption and secure storage solutions to safeguard your data. You can confidently manage sensitive documents knowing they are in safe hands.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow offers seamless integrations with various applications, enhancing your workflow. Whether you need to connect with CRM systems or document management tools, you can easily incorporate sworn statements in proof of loss into your existing processes.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time tracking for your documents. These tools make it easier to manage sworn statements in proof of loss efficiently. You can also collaborate with team members and clients directly within the platform.

-

How long does it take to get a sworn statement in proof of loss signed?

With airSlate SignNow, getting a sworn statement in proof of loss signed can be done in minutes. The platform allows for quick sending and receiving of documents, reducing turnaround time signNowly. This efficiency helps expedite the claims process with your insurance provider.

Get more for Sworn Statement In Proof Of Loss

- Cpt20 fill 21e pdf clear data protected b when completed form

- Form dc 5 hawaii gov

- Form ow 8 es oklahoma individual estimated tax year worksheet for individuals

- Form 538 s claim for credit refund of sales tax

- Form 13 9 application for credit or refund of state and local sales or use tax 699489787

- Investmentnew jobs credit oklahoma digital prairie form

- Khsaa form ge04 high school parental permission and

- Business incentivesoklahoma department of commerce form

Find out other Sworn Statement In Proof Of Loss

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement