Fgr 615 Form

What is the Fgr 615?

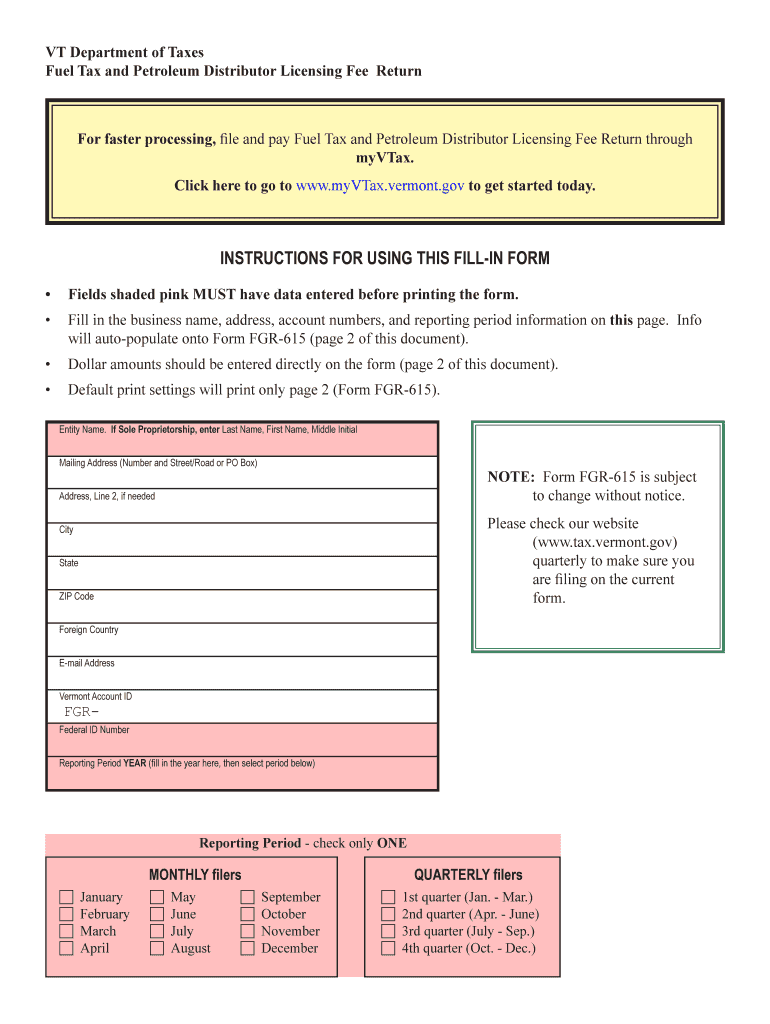

The Fgr 615, also known as the Vermont Fuel Distributor Return, is a tax form used by businesses that distribute fuel in Vermont. This form is essential for reporting fuel sales and ensuring compliance with state tax regulations. It captures information regarding the amount of fuel distributed, the type of fuel, and the corresponding taxes owed to the state. Understanding the Fgr 615 is crucial for fuel distributors to maintain accurate records and fulfill their tax obligations.

How to Use the Fgr 615

To effectively use the Fgr 615, businesses must first gather all relevant data regarding their fuel distribution activities. This includes sales records, inventory levels, and any applicable tax rates. Once this information is compiled, it can be entered into the form accurately. It is important to follow the specific instructions provided with the form to ensure all required fields are completed. After filling out the Fgr 615, the form must be submitted to the Vermont Department of Taxes by the established deadlines to avoid penalties.

Steps to Complete the Fgr 615

Completing the Fgr 615 involves several key steps:

- Gather necessary documentation, including sales records and tax rate information.

- Access the Fgr 615 form through the Vermont Department of Taxes website or obtain a physical copy.

- Fill in the required fields, ensuring accuracy in reporting the volume and type of fuel distributed.

- Calculate the total taxes owed based on the fuel sales reported.

- Review the completed form for any errors or omissions.

- Submit the form by mail or electronically, depending on the preferred submission method.

Legal Use of the Fgr 615

The Fgr 615 is legally binding when filled out correctly and submitted on time. Compliance with state tax laws is critical, as failure to file the form can result in penalties or fines. The form must be completed in accordance with Vermont tax regulations, ensuring that all information is accurate and truthful. Utilizing digital tools, such as eSignature solutions, can enhance the legal standing of the submission by providing a secure and verifiable method of signing and submitting the form.

Filing Deadlines / Important Dates

Filing deadlines for the Fgr 615 are typically set by the Vermont Department of Taxes. It is essential for businesses to be aware of these dates to avoid late fees. Generally, the Fgr 615 must be filed quarterly, with specific due dates for each quarter. Keeping a calendar of these important dates can help ensure timely compliance and prevent any disruptions in business operations.

Form Submission Methods

The Fgr 615 can be submitted through various methods, allowing flexibility for businesses. Options include:

- Online submission through the Vermont Department of Taxes portal.

- Mailing a physical copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if applicable.

Choosing the right submission method can depend on the business's preferences and the urgency of the filing.

Quick guide on how to complete fuel tax and petroleum distributor licensing fee return

Complete Fgr 615 seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can obtain the necessary form and safely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without delays. Manage Fgr 615 on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Fgr 615 effortlessly

- Locate Fgr 615 and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Emphasize key sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Produce your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you prefer to send your form—by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Fgr 615 while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fuel tax and petroleum distributor licensing fee return

How to make an eSignature for your Fuel Tax And Petroleum Distributor Licensing Fee Return in the online mode

How to generate an eSignature for your Fuel Tax And Petroleum Distributor Licensing Fee Return in Google Chrome

How to make an eSignature for putting it on the Fuel Tax And Petroleum Distributor Licensing Fee Return in Gmail

How to make an electronic signature for the Fuel Tax And Petroleum Distributor Licensing Fee Return from your smart phone

How to create an electronic signature for the Fuel Tax And Petroleum Distributor Licensing Fee Return on iOS devices

How to make an electronic signature for the Fuel Tax And Petroleum Distributor Licensing Fee Return on Android devices

People also ask

-

What features are included in the fgr 615 vt plan?

The fgr 615 vt plan includes a range of features such as customizable templates, advanced eSignature options, and real-time tracking of document status. With this plan, you can streamline your document workflows and improve efficiency for your business. Additionally, integration with various third-party applications adds to the versatility of the fgr 615 vt.

-

How much does the fgr 615 vt plan cost?

The pricing for the fgr 615 vt plan is structured to be affordable for businesses of all sizes. You can choose between monthly or yearly subscriptions, with discounts available for annual commitments. Contact our sales team for detailed pricing options and to find the best fit for your needs.

-

What are the benefits of using fgr 615 vt for eSigning documents?

Utilizing fgr 615 vt offers numerous benefits, including enhanced security features, compliance with legal standards, and the ability to sign documents from anywhere. This solution saves time and reduces paperwork, allowing businesses to focus on what matters most. The user-friendly interface makes it easy for any team member to get started quickly.

-

Can fgr 615 vt integrate with other software applications?

Yes, fgr 615 vt is designed to seamlessly integrate with various software applications commonly used in business environments. This includes CRM systems, project management tools, and cloud storage services. These integrations help to create a cohesive workflow and further enhance productivity.

-

Is there a mobile app for managing the fgr 615 vt documents?

Absolutely! The fgr 615 vt includes a mobile app that allows users to manage documents and eSign on the go. This flexibility is ideal for businesses that require mobility and quick access to important documents. The mobile app maintains the same user-friendly experience as the desktop version.

-

How secure is the fgr 615 vt platform?

Security is a top priority for fgr 615 vt, featuring industry-standard encryption, secure storage, and compliance with regulations such as GDPR and eIDAS. Our platform ensures that all document transactions are protected against unauthorized access. Users can feel confident that their sensitive information is safe.

-

What types of documents can I send with fgr 615 vt?

With fgr 615 vt, you can send a wide array of documents suitable for eSigning, including contracts, agreements, forms, and invoices. The platform supports various file formats, making it versatile for different business needs. This allows you to digitize and streamline your document management processes.

Get more for Fgr 615

- West virginia application employment form

- Application for employment neale marine transportation form

- Tx employment application city form

- Texas employment application form

- Exit interviews independent school form

- Labor order form inform or request labor from iatse

- Oklahoma wage claim form

- Terry neese form

Find out other Fgr 615

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors