Rew 1 1040 Form

What is the REW 1 1040 Form?

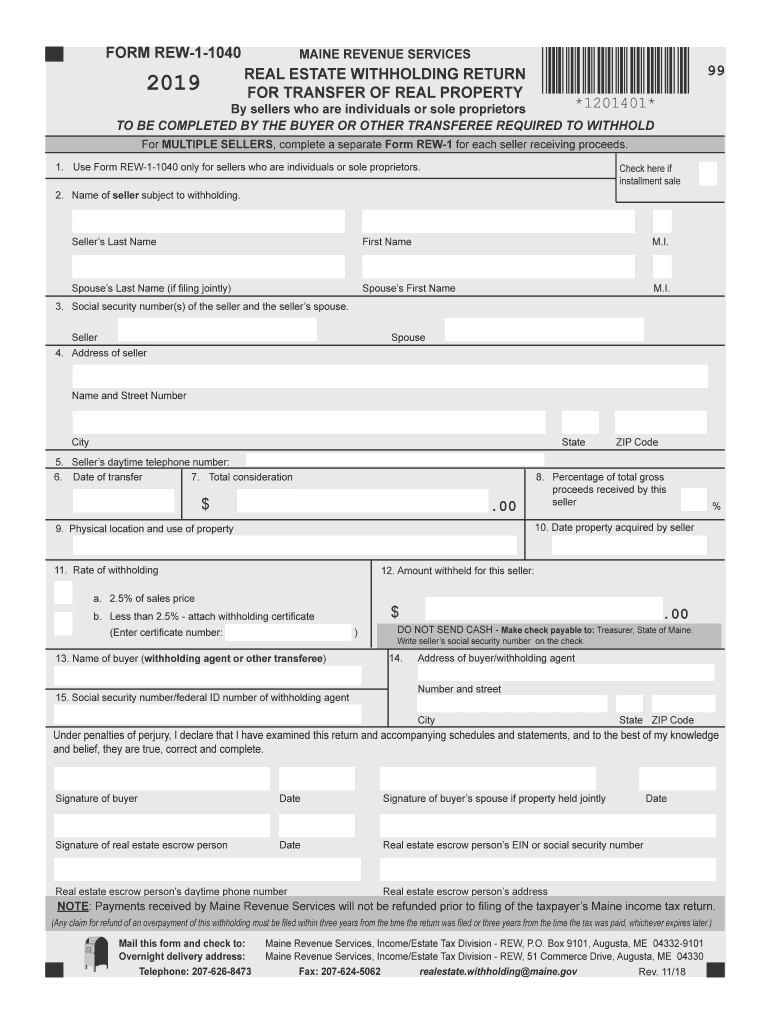

The REW 1 1040 form is a tax document used in Maine for reporting estate withholding. This form is essential for individuals or entities that are responsible for withholding taxes on certain payments made to non-residents. It serves as a declaration of the amount withheld and ensures compliance with state tax regulations. Understanding the purpose of the REW 1 1040 form is crucial for accurate tax reporting and avoiding penalties.

How to Use the REW 1 1040 Form

Using the REW 1 1040 form involves several steps to ensure proper completion and submission. First, gather all necessary information, including details about the payment recipient and the amount withheld. Next, accurately fill out the form, ensuring all sections are completed. After completing the form, review it for accuracy before submission. This form can be filed online or mailed to the appropriate Maine tax authority, depending on your preference.

Steps to Complete the REW 1 1040 Form

Completing the REW 1 1040 form requires attention to detail. Follow these steps:

- Gather required information, including the recipient's name, address, and taxpayer identification number.

- Enter the total amount of the payment and the amount withheld.

- Provide your contact information as the withholding agent.

- Review the form for any errors or omissions.

- Submit the completed form either electronically or by mail.

Legal Use of the REW 1 1040 Form

The legal use of the REW 1 1040 form is governed by Maine tax laws. This form must be used when withholding taxes on payments to non-residents, ensuring compliance with state regulations. Proper completion and timely submission of the form help avoid legal issues and potential penalties. It is essential for individuals and businesses to understand their obligations regarding this form to maintain compliance.

Filing Deadlines / Important Dates

Filing deadlines for the REW 1 1040 form are critical for compliance. Typically, the form must be submitted within a specified timeframe after the payment is made. It is important to check the Maine Revenue Services website or consult with a tax professional for the most current deadlines. Missing these deadlines can result in penalties and interest on unpaid taxes.

Required Documents

To complete the REW 1 1040 form, certain documents may be required. These typically include:

- Payment records detailing the amounts paid to non-residents.

- Identification documents for both the withholding agent and the recipient.

- Any prior correspondence with Maine tax authorities regarding withholding.

Having these documents ready can streamline the completion of the form and ensure accuracy.

Quick guide on how to complete social security numbers of the seller and the sellers spouse

Effortlessly Prepare Rew 1 1040 Form on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed paperwork, enabling you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and digitally sign your documents swiftly without unnecessary delays. Handle Rew 1 1040 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and digitally sign Rew 1 1040 Form effortlessly

- Locate Rew 1 1040 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with the features that airSlate SignNow offers specifically for this purpose.

- Create your digital signature using the Sign tool, which takes just a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the stress of lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and digitally sign Rew 1 1040 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the social security numbers of the seller and the sellers spouse

How to create an eSignature for the Social Security Numbers Of The Seller And The Sellers Spouse in the online mode

How to make an eSignature for your Social Security Numbers Of The Seller And The Sellers Spouse in Google Chrome

How to generate an eSignature for signing the Social Security Numbers Of The Seller And The Sellers Spouse in Gmail

How to create an electronic signature for the Social Security Numbers Of The Seller And The Sellers Spouse right from your smart phone

How to generate an electronic signature for the Social Security Numbers Of The Seller And The Sellers Spouse on iOS

How to generate an electronic signature for the Social Security Numbers Of The Seller And The Sellers Spouse on Android

People also ask

-

What is the rew 1 form individual used for?

The rew 1 form individual is primarily used for documenting personal information and assessing individual tax credits and liabilities. By utilizing the airSlate SignNow platform, you can easily eSign and submit the rew 1 form individual, ensuring compliance and accuracy.

-

How does airSlate SignNow simplify the signing of the rew 1 form individual?

airSlate SignNow provides a user-friendly interface that allows individuals to quickly upload, fill out, and eSign the rew 1 form individual. This eliminates the need for printing and scanning, streamlining the entire process and saving valuable time.

-

Is there a pricing plan for using airSlate SignNow for the rew 1 form individual?

Yes, airSlate SignNow offers various pricing plans that accommodate different needs and budgets. Each plan provides access to essential features for managing documents like the rew 1 form individual, ensuring that you get the most cost-effective solution.

-

What features does airSlate SignNow offer for the rew 1 form individual?

With airSlate SignNow, you can enjoy features such as document templates, secure eSigning, and mobile accessibility specifically for the rew 1 form individual. These tools enhance your workflow, making it easier to manage and sign your documents from anywhere.

-

Can I integrate airSlate SignNow with other applications for handling the rew 1 form individual?

Absolutely! airSlate SignNow supports integrations with various applications such as Google Drive, Dropbox, and CRM systems. This means you can seamlessly manage the rew 1 form individual alongside your other digital tools, ensuring a smooth workflow.

-

What are the benefits of using airSlate SignNow for the rew 1 form individual?

Using airSlate SignNow for the rew 1 form individual allows for quick processing, enhanced security, and easy access to your documents. Its intuitive design means you can eSign documents without hassle, ensuring that your submissions are both fast and compliant.

-

Is the rew 1 form individual compliant with local regulations when signed via airSlate SignNow?

Yes, the rew 1 form individual signed through airSlate SignNow adheres to legal standards and electronic signature laws. This compliance ensures that your eSigned documents hold the same legal weight as traditional signatures.

Get more for Rew 1 1040 Form

- Www dos pa govprofessionallicensingonline endorsement combined instructions pa department of state form

- Www northpolealaska com sites defaultvolunteer application packet form

- Office jobs employment in city of kenai akindeed com form

- Emergency home page alaska department of labor and form

- Homer volunteer fire department application form

- Job application avcp regional housing authority avcphousing form

- Pechonpersonal information sheet pdf application for

- Application for full time and part time employment city of kirksville form

Find out other Rew 1 1040 Form

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF