1040me Form

What is the 1040me

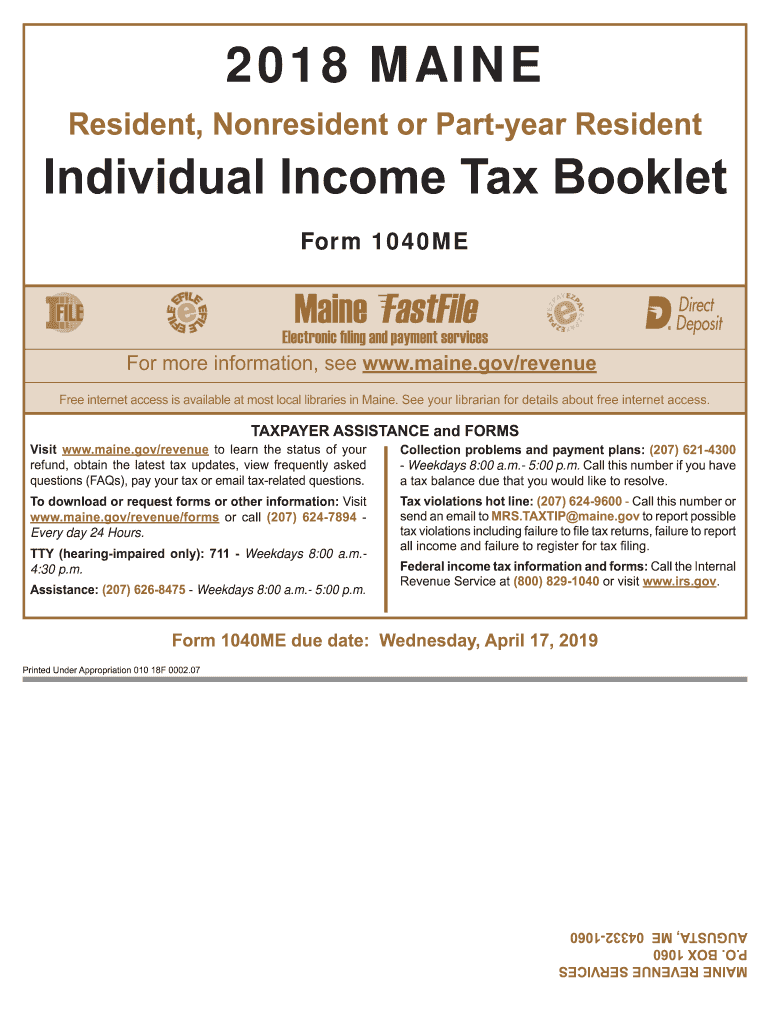

The 1040me is a specific tax form used by residents of Maine to report their income and calculate their state tax liability. It is designed to accommodate various income types, deductions, and credits applicable to Maine taxpayers. This form is essential for ensuring compliance with state tax laws and is part of the broader federal tax filing process.

How to use the 1040me

Using the 1040me involves several steps to accurately report your income and claim any deductions or credits. Taxpayers should first gather all necessary documentation, including W-2s, 1099s, and records of other income. Next, follow the instructions on the form carefully, ensuring that all sections are completed accurately. It is advisable to review the form for any errors before submission, as mistakes can lead to delays or penalties.

Steps to complete the 1040me

Completing the 1040me requires a systematic approach:

- Gather all relevant income documents, such as W-2s and 1099s.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income in the designated sections.

- Claim any deductions or credits you are eligible for, following the guidelines provided.

- Calculate your total tax liability and any payments made throughout the year.

- Sign and date the form before submitting it.

Filing Deadlines / Important Dates

Taxpayers should be aware of the important deadlines associated with the 1040me. Typically, the filing deadline for state income tax returns in Maine is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to file on time to avoid penalties and interest on any unpaid taxes.

Legal use of the 1040me

The 1040me is legally recognized as a valid document for reporting income and calculating state taxes in Maine. To ensure its legal standing, taxpayers must complete the form accurately and submit it by the designated deadline. Additionally, using a reliable electronic signature solution can enhance the legitimacy of the submission process, ensuring compliance with state regulations.

Required Documents

To complete the 1040me, taxpayers need to gather several essential documents:

- W-2 forms from employers, detailing wages earned.

- 1099 forms for any freelance or contract work.

- Documentation of any other income sources, such as rental income or dividends.

- Records of deductible expenses, including medical expenses and mortgage interest.

Who Issues the Form

The 1040me form is issued by the Maine Revenue Services, which is the state agency responsible for tax administration in Maine. This agency provides guidelines and resources to assist taxpayers in understanding their obligations and completing the form accurately.

Quick guide on how to complete 99 16941p0 form 941p me 01 01 2018 12 31 mainegov

Effortlessly Prepare 1040me on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, alter, and electronically sign your documents swiftly and without delays. Manage 1040me on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The Easiest Method to Alter and Electronically Sign 1040me with Ease

- Locate 1040me and click Get Form to start.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow has specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes only a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any chosen device. Edit and electronically sign 1040me and guarantee seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 99 16941p0 form 941p me 01 01 2018 12 31 mainegov

How to create an eSignature for your 99 16941p0 Form 941p Me 01 01 2018 12 31 Mainegov in the online mode

How to make an electronic signature for your 99 16941p0 Form 941p Me 01 01 2018 12 31 Mainegov in Chrome

How to make an electronic signature for putting it on the 99 16941p0 Form 941p Me 01 01 2018 12 31 Mainegov in Gmail

How to make an eSignature for the 99 16941p0 Form 941p Me 01 01 2018 12 31 Mainegov straight from your smart phone

How to create an eSignature for the 99 16941p0 Form 941p Me 01 01 2018 12 31 Mainegov on iOS devices

How to make an eSignature for the 99 16941p0 Form 941p Me 01 01 2018 12 31 Mainegov on Android OS

People also ask

-

What documents are necessary for filing the 2018 Maine tax?

To file the 2018 Maine tax, you'll need your W-2 forms, any 1099 forms you received, and documentation for other income. It's also advisable to have your previous year's tax return for reference. Ensuring you have all relevant documents will simplify the eSigning process using airSlate SignNow.

-

How can airSlate SignNow help with my 2018 Maine tax preparation?

airSlate SignNow streamlines the document signing process, making it easier to prepare for your 2018 Maine tax. You can send forms for eSignature, track document status, and securely store your signed files. This efficiency enhances your overall tax filing experience.

-

What features does airSlate SignNow offer for tax documents?

airSlate SignNow offers a simple-to-use electronic signature platform that allows you to sign tax documents remotely. Features include customizable templates, automatic reminders, and secure document storage. These tools are especially beneficial for managing the 2018 Maine tax submissions.

-

Is airSlate SignNow cost-effective for tax filing?

Yes, airSlate SignNow provides a cost-effective solution for managing your tax documents, including the 2018 Maine tax. With flexible pricing plans, you can choose one that fits your business needs without overspending. It ensures you get the best value for your eSignature and document management requirements.

-

Can I integrate airSlate SignNow with other accounting software for my 2018 Maine tax?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software that can help streamline your 2018 Maine tax process. By syncing your documents, you can easily manage and sign all necessary paperwork from one platform, enhancing productivity.

-

What benefits does eSigning bring to my 2018 Maine tax forms?

eSigning your 2018 Maine tax forms with airSlate SignNow provides convenience and security. It allows you to sign documents from anywhere, reducing turnaround time and increasing efficiency. Plus, your signed documents are securely stored, ensuring easy access whenever needed.

-

How secure is my information when using airSlate SignNow for tax purposes?

airSlate SignNow prioritizes the security of your information, especially for sensitive tasks like filing the 2018 Maine tax. The platform employs robust encryption and security measures to protect your documents. You can confidently manage your tax forms knowing your data is safe.

Get more for 1040me

- Www alpinefire org files 4a4835c93invites applications for firefighteremt application period form

- City services and departments city of piedmont form

- Sonoma valley 630 2 street west fire ampamp rescue authority form

- Application for employment pala band of mission indians form

- Personnel office schell vista fire protection district use form

- Contact us tiburon fire protection district form

- Flsa exempt and nonexempt defined office of human resources form

- State of california division of workers compensation workers compensation appeals board stipulations with request for award form

Find out other 1040me

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter