Irs Form 8949

What is the IRS Form 8949?

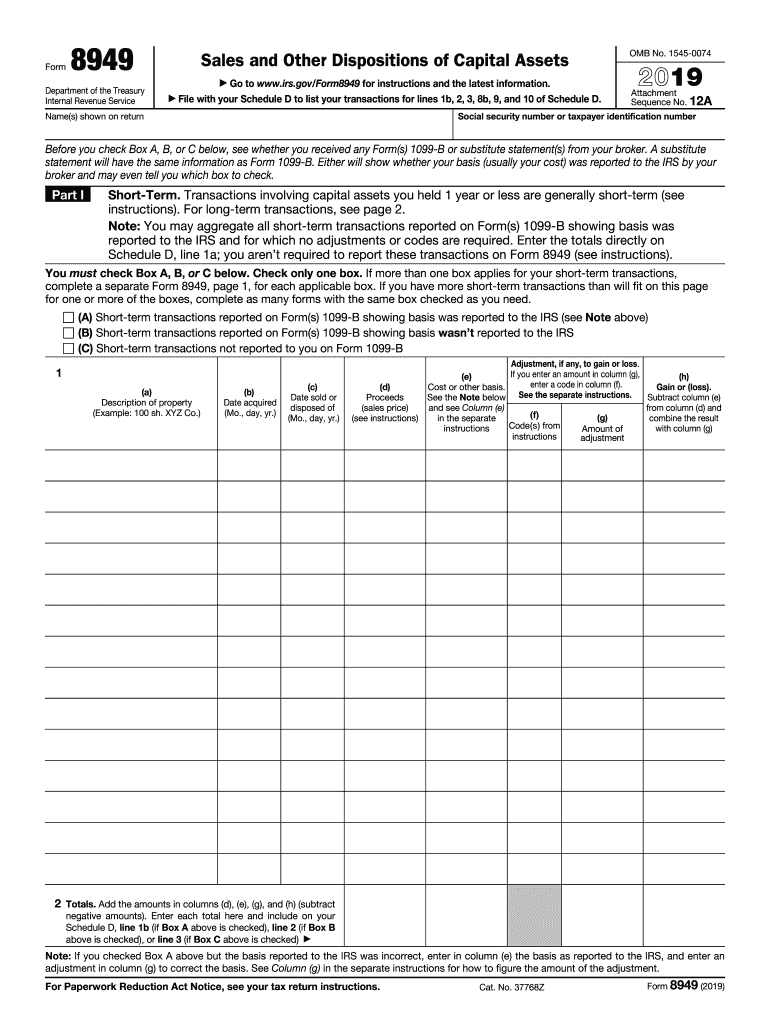

The IRS Form 8949 is a tax form used by individuals and businesses to report capital gains and losses from the sale of assets. This form is essential for accurately calculating taxable income and ensuring compliance with federal tax regulations. The 8949 for 2019 specifically pertains to transactions that occurred during that tax year. It requires detailed information about each transaction, including the date of acquisition, date of sale, proceeds, cost basis, and the resulting gain or loss.

How to Use the IRS Form 8949

Using the IRS Form 8949 involves several steps to ensure accurate reporting of capital gains and losses. Taxpayers must first gather all relevant transaction data, including purchase and sale information for each asset. Next, they will categorize transactions into short-term and long-term sections based on the holding period. After entering the required details for each transaction, the totals will be transferred to Schedule D of the 1040 tax form, which summarizes the overall capital gains and losses for the tax year.

Steps to Complete the IRS Form 8949

Completing the IRS Form 8949 involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather transaction records, including purchase and sale documents.

- Determine whether each transaction is short-term (held for one year or less) or long-term (held for more than one year).

- Fill in the details for each transaction in the appropriate section, including dates, proceeds, cost basis, and gain or loss.

- Calculate the totals for short-term and long-term transactions separately.

- Transfer the totals to Schedule D of your 1040 tax form.

Legal Use of the IRS Form 8949

The IRS Form 8949 is legally binding when completed accurately and submitted on time. It must comply with IRS regulations regarding capital gains and losses. Using electronic tools, such as signNow, can facilitate the completion and submission process while ensuring that the form is executed in accordance with legal standards. Compliance with eSignature laws further enhances the legal standing of the form, making it a valid document for tax purposes.

Filing Deadlines / Important Dates

For the 2019 tax year, the IRS Form 8949 must be filed by the tax deadline, which is typically April fifteenth of the following year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may file, which can provide additional time to submit the form, but any taxes owed must still be paid by the original deadline to avoid penalties.

Examples of Using the IRS Form 8949

Examples of transactions that require the IRS Form 8949 include the sale of stocks, bonds, real estate, or personal property. For instance, if an individual sells shares of stock for a profit, they must report the sale on Form 8949, detailing the acquisition date, sale date, proceeds, and cost basis. Similarly, if a property is sold at a loss, that transaction must also be reported to accurately reflect the taxpayer's financial situation and comply with tax regulations.

Quick guide on how to complete form 8949 form 8949 department of the treasury internal

Complete Irs Form 8949 seamlessly on any device

Online document management has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Irs Form 8949 on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to modify and eSign Irs Form 8949 effortlessly

- Locate Irs Form 8949 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Irs Form 8949 to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8949 form 8949 department of the treasury internal

How to generate an eSignature for your Form 8949 Form 8949 Department Of The Treasury Internal in the online mode

How to create an eSignature for your Form 8949 Form 8949 Department Of The Treasury Internal in Chrome

How to generate an eSignature for signing the Form 8949 Form 8949 Department Of The Treasury Internal in Gmail

How to generate an electronic signature for the Form 8949 Form 8949 Department Of The Treasury Internal straight from your smartphone

How to create an electronic signature for the Form 8949 Form 8949 Department Of The Treasury Internal on iOS devices

How to make an electronic signature for the Form 8949 Form 8949 Department Of The Treasury Internal on Android OS

People also ask

-

What is the importance of the 8949 for 2019?

The 8949 for 2019 is crucial for reporting capital gains and losses on your tax return. Properly documenting your transactions using the 8949 helps ensure compliance with IRS regulations and can maximize your deductions. Understanding this form can signNowly impact your overall tax liabilities.

-

How can airSlate SignNow assist with the 8949 for 2019?

airSlate SignNow simplifies the process of signing and sending the 8949 for 2019. With our platform, you can easily create, eSign, and send the document securely, ensuring that all signatures are legally binding. This saves you time and enhances your productivity when managing tax documents.

-

Are there any costs associated with using airSlate SignNow for the 8949 for 2019?

AirSlate SignNow offers competitive pricing plans tailored for various business needs. You can start with a free trial to assess whether our platform is suitable for managing your 8949 for 2019. Our plans are designed to provide value while being cost-effective.

-

What features does airSlate SignNow offer for handling the 8949 for 2019?

airSlate SignNow includes features such as templates for the 8949 for 2019, customizable workflows, and secure storage. These features enable you to efficiently manage your documents, ensuring that everything is organized and easily accessible. Plus, you'll benefit from an intuitive interface that streamlines the signing process.

-

How does airSlate SignNow ensure the security of the 8949 for 2019 documentation?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods and robust compliance protocols to protect your sensitive 8949 for 2019 documents. Our platform guarantees that all signed documents are securely stored and only accessible by authorized individuals.

-

Can I integrate airSlate SignNow with other tools for managing the 8949 for 2019?

Absolutely! airSlate SignNow integrates seamlessly with various popular applications like Google Drive, Salesforce, and more. This integration capability allows you to streamline your workflow by connecting your 8949 for 2019 tasks with existing tools and systems.

-

Is there customer support available for using airSlate SignNow with the 8949 for 2019?

Yes, airSlate SignNow provides comprehensive customer support to assist you with any inquiries regarding the 8949 for 2019. Our dedicated support team can help troubleshoot issues or offer guidance on using our features effectively. We aim to ensure that your experience is smooth and efficient.

Get more for Irs Form 8949

- Gcsd substitute teacher application geneva city schools form

- Cfwb 026 work search record cfwb 026 work search record form

- Nh fire application employment form

- Application for employment tnfd org form

- Www wahoo ne usvimagessharedcity of wahoo form

- Rpd permit application initial and renewal 1 dotx form

- Dc va client renweb comoaindexdominion christian school admissions online facts management form

- Adm application for adams construction company form

Find out other Irs Form 8949

- Sign Hawaii Rental Invoice Template Simple

- Sign California Commercial Lease Agreement Template Free

- Sign New Jersey Rental Invoice Template Online

- Sign Wisconsin Rental Invoice Template Online

- Can I Sign Massachusetts Commercial Lease Agreement Template

- Sign Nebraska Facility Rental Agreement Online

- Sign Arizona Sublease Agreement Template Fast

- How To Sign Florida Sublease Agreement Template

- Sign Wyoming Roommate Contract Safe

- Sign Arizona Roommate Rental Agreement Template Later

- How Do I Sign New York Sublease Agreement Template

- How To Sign Florida Roommate Rental Agreement Template

- Can I Sign Tennessee Sublease Agreement Template

- Sign Texas Sublease Agreement Template Secure

- How Do I Sign Texas Sublease Agreement Template

- Sign Iowa Roommate Rental Agreement Template Now

- How Do I Sign Louisiana Roommate Rental Agreement Template

- Sign Maine Lodger Agreement Template Computer

- Can I Sign New Jersey Lodger Agreement Template

- Sign New York Lodger Agreement Template Later