Form 8959

What is the Form 8959

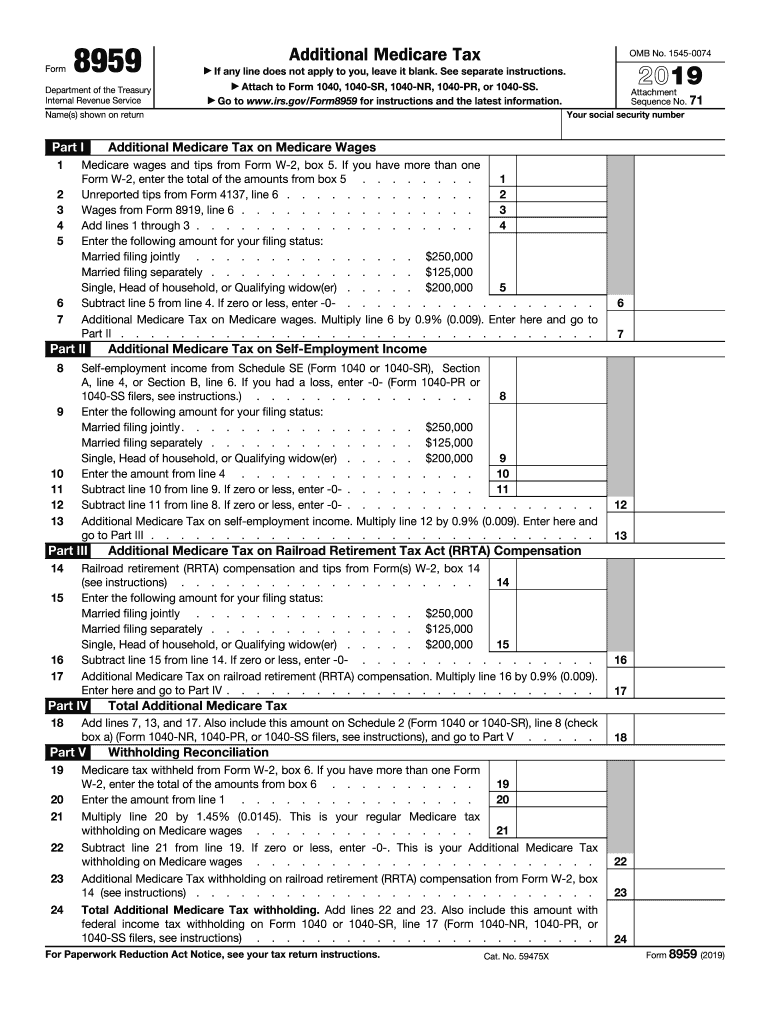

The Form 8959 is a tax form used by the Internal Revenue Service (IRS) to calculate the Additional Medicare Tax. This tax applies to individuals with high income levels, specifically those earning above certain thresholds. The form is essential for reporting the Additional Medicare Tax owed on wages, self-employment income, and other compensation. Understanding this form is crucial for taxpayers who may be subject to the tax, as it helps ensure compliance with federal tax regulations.

How to use the Form 8959

Using the Form 8959 involves several steps to accurately report the Additional Medicare Tax. Taxpayers must first determine if their income exceeds the applicable thresholds, which are based on filing status. Once eligibility is established, the next step is to gather all relevant income information. The form requires detailed reporting of wages, compensation, and self-employment income. After completing the form, it should be submitted along with the annual tax return to the IRS.

Steps to complete the Form 8959

Completing the Form 8959 involves a systematic approach:

- Determine your filing status and the corresponding income thresholds.

- Gather all income documentation, including W-2s and 1099s.

- Calculate total wages and self-employment income to see if they exceed the threshold.

- Fill out the form by entering the necessary figures in the designated fields.

- Review the completed form for accuracy before submission.

Legal use of the Form 8959

The legal use of the Form 8959 is governed by IRS regulations. Taxpayers are required to file this form if their income exceeds the specified thresholds for the Additional Medicare Tax. Failure to file or inaccurately reporting income can lead to penalties. It is important to ensure that the form is completed truthfully and submitted on time to avoid complications with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8959 align with the annual tax return due date. Typically, this means that the form must be submitted by April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any changes in tax law that may affect filing dates or requirements.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Form 8959. The form can be filed electronically through tax preparation software, which often simplifies the process and ensures accuracy. Alternatively, it can be printed and mailed to the IRS. In-person submission is generally not an option for tax forms, as the IRS does not accept walk-in filings. It is essential to choose a submission method that aligns with personal preferences and compliance requirements.

Quick guide on how to complete 2019 form 8959 additional medicare tax

Complete Form 8959 effortlessly on any device

Online document management has become highly favored among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage Form 8959 on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to edit and electronically sign Form 8959 without hassle

- Find Form 8959 and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight important sections of the documents or obscure sensitive details with the tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and then click the Done button to preserve your changes.

- Select your preferred method to deliver your form—via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors necessitating new document prints. airSlate SignNow addresses all your document management needs in just a few clicks from the device of your choice. Edit and electronically sign Form 8959 and ensure effective communication at each step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 8959 additional medicare tax

How to generate an eSignature for the 2019 Form 8959 Additional Medicare Tax online

How to make an eSignature for your 2019 Form 8959 Additional Medicare Tax in Chrome

How to generate an eSignature for signing the 2019 Form 8959 Additional Medicare Tax in Gmail

How to make an eSignature for the 2019 Form 8959 Additional Medicare Tax straight from your smart phone

How to make an eSignature for the 2019 Form 8959 Additional Medicare Tax on iOS

How to create an electronic signature for the 2019 Form 8959 Additional Medicare Tax on Android devices

People also ask

-

What is Form 8959 and why is it important for businesses?

Form 8959 is used to calculate the Additional Medicare Tax for high-income earners. Understanding and accurately completing Form 8959 is crucial for businesses to ensure compliance with tax regulations. By using airSlate SignNow, you can easily eSign and manage Form 8959 efficiently, minimizing errors and streamlining your tax filing process.

-

How can airSlate SignNow help with completing Form 8959?

airSlate SignNow simplifies the process of completing Form 8959 by allowing users to fill out, sign, and send the form electronically. With our user-friendly interface, you can easily upload your Form 8959, add necessary signatures, and send it securely to recipients. This saves time and reduces the hassle of paperwork.

-

Is there a cost associated with using airSlate SignNow for Form 8959?

Yes, airSlate SignNow offers various pricing plans that cater to different business sizes and needs. Our plans are designed to provide cost-effective solutions for managing documents like Form 8959, ensuring that you get the best value for your investment. Explore our pricing options to find the best fit for your organization.

-

What features does airSlate SignNow offer for managing Form 8959?

airSlate SignNow provides features such as document templates, in-app signing, and real-time tracking for Form 8959. These tools enhance your workflow by ensuring that all parties can access and sign the document quickly and securely. Additionally, you can integrate Form 8959 into your existing processes seamlessly.

-

Can I integrate airSlate SignNow with other software for Form 8959?

Absolutely! airSlate SignNow offers integrations with various software solutions to help streamline the management of Form 8959. Whether you use CRM systems or cloud storage platforms, our integrations allow you to manage documents seamlessly, making it easier to handle compliance tasks.

-

How secure is airSlate SignNow when handling Form 8959?

Security is a top priority at airSlate SignNow. When you use our platform to manage Form 8959, you benefit from advanced security features such as data encryption and secure access controls. We ensure that your sensitive tax documents are protected at all times.

-

Can I track the status of Form 8959 sent through airSlate SignNow?

Yes! One of the key benefits of using airSlate SignNow for Form 8959 is the ability to track its status in real-time. You will receive notifications when the form is viewed and signed, allowing you to stay updated on your document's progress without any hassle.

Get more for Form 8959

- Auto fill slashes for date fields on a form

- 42 005 ia 1120s instructions iowa department of revenue form

- Forms fiduciary tax

- Ohio it 4738 electing pass through entity income tax return form

- Pass through entity and fiduciary income tax form

- Form or 40 n oregon individual income tax return

- Indiana state tax information support

- Oregon corporation excise tax return form

Find out other Form 8959

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online